C. Outlook

1. U.S. Outlook

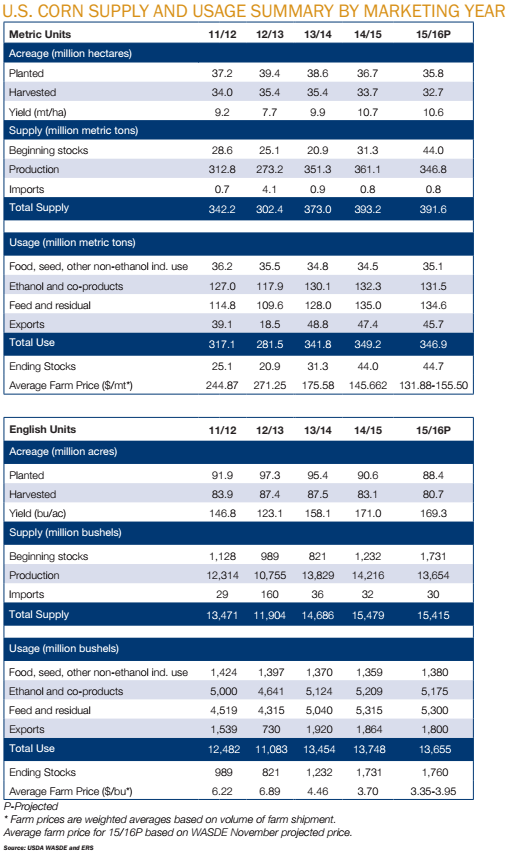

- While slightly less than the record-setting size of the 2014 U.S. corn crop, the 2015 crop has created an abundant supply of corn for MY15/16. This ample supply has kept downward pressure on corn prices. The ample supply and low prices are major factors driving the projected domestic use of corn in MY15/16 to be the second-highest on record, behind only MY14/15.

- Corn use for food, seed and non-ethanol industrial (FSI) purposes is expected to remain largely unchanged in MY15/16 compared to MY14/15, continuing the pattern of the previous four marketing years.

- Projected MY15/16 corn use for ethanol is about the same as the previous marketing year. Low gasoline prices have increased domestic gasoline demand, therefore expanding the domestic ethanol market. However, the ethanol blend wall (the maximum level of ethanol that can be blended into gasoline) continues to limit U.S. consumption of ethanol.

- Domestic corn use for livestock and poultry feeding and for residual use is expected remain about the same in MY15/16 as in MY14/15, which was the highest level since MY07/08. Feed demand for corn is expected to be supported by low corn prices, the rebuilding of livestock herds, and the practice of feeding livestock longer.

- U.S. corn exports during MY15/16 are projected to be about 3.5% lower than last year and 6.3% lower than 2013/14. A strong currency and projected domestic demand for corn are currently decreasing the price competitiveness of U.S. corn exports. However, an ample supply will likely push U.S. exports higher than in MY11/12 and MY12/13.

- MY15/16 corn ending stocks are projected to be 1.6% higher than the previous marketing year primarily due to large corn crops in consecutive years. This will increase the stocks-to-use ratio for the third year in a row.

2. International Outlook

Global Supply

- Global corn production during MY15/16 is expected to be slightly less than last year’s record-setting production, due to smaller crops in both the United States and other major corn-producing countries.

- Lower production for MY15/16 in Argentina, Brazil, the EU, Mexico, and Ukraine will offset greater production in Canada, China, Egypt, South Africa, and Southeast Asia.

- In addition to slightly lower U.S. exports, total non-U.S. exports are expected to be lower in MY15/16 than in MY14/15.

- Decreased exports are also expected from the key non-U.S. exporting countries–Argentina, Brazil, and Ukraine.

Global Demand

- Global corn use is expected to decrease very little in MY15/16 from MY14/15.

- Corn use is anticipated to be lower in MY15/16 in the EU, Ethiopia and Ukraine and higher in China, Brazil, Russia and Argentina compared to MY14/15.

- A slight increase in year-over-year imports is expected globally in MY15/16, with increases in EU imports, and slight increases in Egypt and Japan imports. These increased imports will be countered by China’s decrease in projected MY15/16 corn imports.