U.S. Corn Use and Ending Stocks

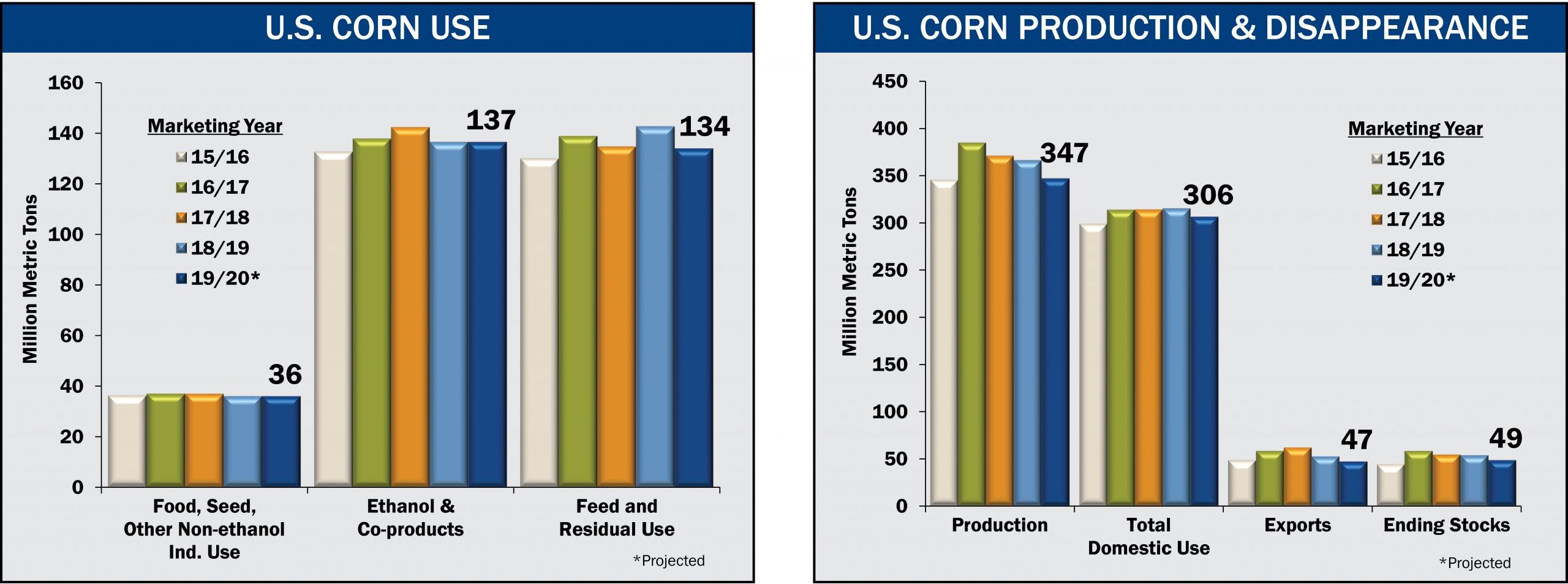

U.S. corn use for food, seed and other non-ethanol industrial purposes has remained consistent over the past four completed marketing years.

The amount of corn used for domestic ethanol production is largely dependent on U.S. consumption of finished gasoline. With domestic gasoline consumption stagnating from marketing year 15/16 through marketing year 17/18, annual increases in ethanol exports contributed to increases in corn consumption for ethanol production. However, the effects of a slight decrease in U.S. gasoline consumption and an increase in the proportion of sorghum used for ethanol production outweighed increasing ethanol exports in marketing year 18/19, leading to a 4.1% decline in the amount of corn used for ethanol in marketing year 18/19 compared to marketing year 17/18.

With ample corn supplies and competitive corn prices relative to other feed ingredients, direct consumption of corn as a feed ingredient in domestic livestock and poultry rations has remained strong.

U.S. corn exports peaked in marketing year 17/18, following the largest two U.S. crops in history in 2016 and 2017. A small increase in domestic consumption and lower production in 2018 left less corn available for export in marketing year 18/19.

Ending stocks have decreased each year slightly since the record 2016 U.S. corn crop.

U.S. Outlook

The 2019 U.S. corn crop is projected to be smaller than each of the previous three crops, leaving a lower supply of corn available for export. However, it is important to note that the previous three crops were the largest and highest-yielding corn crops in U.S. history. Despite the challenges posed by inclement weather during the planting season, the 2019 U.S. crop is still projected to be the sixth-largest U.S. corn crop on record. The size of this crop will still leave an ample supply of corn available for domestic consumption and exports in marketing year 19/20 and will keep downward pressure on corn prices.

Additionally, the 2019 U.S. crop is still projected to be the sixth-largest U.S. corn crop on record despite the challenges posed by inclement weather during the planting season. This will leave an ample supply of corn available for domestic consumption and exports in marketing year 19/20 and will keep downward pressure on corn prices.

Corn use for food, seed and non-ethanol industrial purposes is expected to remain largely unchanged in marketing year 19/20 compared to marketing year 18/19, continuing the pattern of the previous four marketing years.

Projected marketing year 19/20 corn use for ethanol is the same as marketing year 18/19. Corn use for ethanol is influenced, in part, by domestic gasoline demand and ethanol exports. Increasing ethanol exports have been responsible for corn use for ethanol remaining steady in recent years as gasoline consumption has stalled. However, ethanol exports in marketing year 19/20 are anticipated to be slightly lower than in marketing year 18/19, counteracting a projected rebound in domestic gasoline consumption. Domestic corn use for feed and residual use is expected to be 8.71 million metric tons lower (6.1% decrease) in marketing year 19/20 compared to marketing year 18/19.

Lower U.S. corn exports are also projected for marketing year 19/20 as a result of the smaller corn crop anticipated. U.S. corn exports are projected to be 46.99 million metric tons in marketing year 19/20, which is a decrease of 5.46 million metric tons (10.4% decrease) from marketing year 18/19.

In addition to lower U.S. exports and feed and residual use, U.S. ending stocks are also projected to be lower in marketing year 19/20 to offset the reduced production, as a reduction of 5.19 million metric tons (9.7%) is anticipated compared to the previous marketing year. In terms of the stocks-to-use ratio, marketing year 19/20 is projected to have a ratio of 13.7%. This is slightly lower than the record 2016 crop’s stocks-to-use ratio of 15.7%, which was the highest since marketing year 05/06 (17.5%). However, the projected stocks-to-use ratio in marketing year 19/20 is still slightly above the average from the past ten completed marketing years (11.6%).

International Outlook

Global Supply

Global corn production during marketing year 19/20 is expected to be 1,108.62 million metric tons. This 15.87 million metric ton (1.4%) reduction from marketing year 18/19 production is mainly due to lower U.S. production.In addition to lower projected U.S. exports, total non-U.S. exports are also expected to be lower in marketing year 19/20 than in marketing year 18/19 by 8.29 million metric tons (6.5%).

Global Demand

Global corn use is expected to decrease from 1,146.67 million metric tons in marketing year 18/19 to 1,127.23 million metric tons in marketing year 19/20, a 1.7% annual decrease.

Of the major corn-consuming countries and areas, Argentina, China, and Southeast Asia are each anticipated to consume at least 1.0 million metric tons more corn in marketing year 19/20 than in marketing year 18/19; while the European Union and Canada are each anticipated to consume at least 1.0 million metric tons less corn in marketing year 19/20 than in the previous year. However, the largest change in domestic corn consumption compared to marketing year 18/19 is projected to occur in the U.S., with an anticipated decrease of 8.73 million metric tons (2.7%).

A slight increase in year-over-year imports is expected globally in marketing year 19/20.