C. Outlook

1. U.S. Outlook

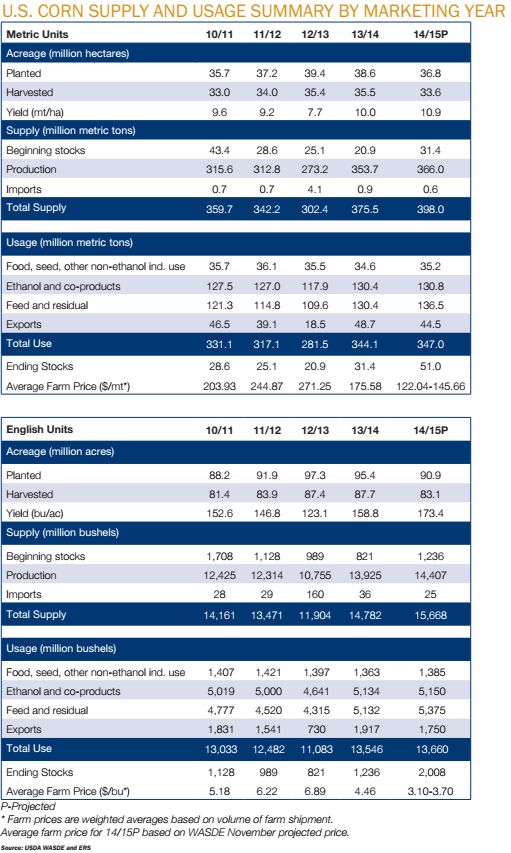

- The record-setting 2014 U.S. corn crop is creating an abundant supply of corn for MY14/15. The ample corn supply has put a downward pressure on corn prices, which has helped support corn use in the domestic market. As a result, domestic use is projected to increase 2.4% from MY13/14 to MY14/15.

- Corn use for food, seed and non-ethanol industrial (FSI) purposes is expected to remain largely unchanged in MY14/15 compared to MY13/14, continuing the pattern of the previous four marketing years.

- Projected MY14/15 corn use for ethanol is about the same as the previous marketing year, with corn expected to represent a larger share of the ethanol feedstock. U.S. ethanol disappearance will be impacted by lower crude oil and gasoline prices, possibly weakening domestic ethanol demand and net ethanol exports.

- Domestic corn use for livestock and poultry feeding and for residual use is expected to be about 4.5% higher in MY14/15 than in MY13/14 and at the highest level since MY07/08. Factors driving this demand include the continued decline in the relative price of corn to other feedstuffs and increasing demand due to feeding livestock longer and/or the rebuilding of livestock herds.

- U.S. corn exports during MY14/15 are projected to be about 9.5% lower than last year, yet higher than in MY11/12 and MY12/13. Lower corn prices and ample supply will help support U.S. exports.

- MY14/15 corn ending stocks are projected to be 38.4% higher than the previous marketing year primarily because of the large corn crop. This will increase the stocks-to-use ratio for the second year in a row.

2. International Outlook Global Supply

- Global corn production during MY14/15 is expected to be a record-setting year, primarily due to the large U.S. corn crop.

- Greater production for MY14/15 in the EU, Russia, Serbia and the Philippines will offset lower production in China, Brazil, Ukraine, India, Canada and Argentina.

- In addition to slightly lower U.S. exports, total non-U.S. exports are expected to be 11% lower in MY14/15 than in MY13/14.

- Increases in exports are expected in Serbia, South Africa and the EU. Global Demand Global corn use is expected to increase around 2% in MY14/15 from MY13/14.

- Corn use is anticipated to be higher in MY14/15 in China, Mexico, Brazil and Russia, but lower in Canada compared to MY13/14.

- An 11% decrease in year-over-year imports is expected globally in MY14/15, with decreases in the EU (64% decrease), Indonesia, Egypt and China.