Ocean Freight Markets and Spreads

Ocean Freight Comments

There were no reported attacks on vessels in the Red Sea and around the Arabian Peninsula by the Houthi terrorist organization this week. The U.S. led military alliance continues to destroy Houthi drones and missiles. Vessel owners and operators continue to avoid the region, choosing longer sailing routes around the Cape of Good Hope.

Russia continued attacking grain infrastructure and ocean vessels in Ukraine’s Port of Odesa this week. Its missile attack killed one and injured eight while damaging two ocean vessels and grain storage. Ukraine has requested the International Maritime Organization to send a mission team to monitor the situation. With increased attacks from Russia over the past few weeks, vessel insurers have increased premiums or cancelled bookings. Reportedly, over the past three months, Russia carried out 60 attacks that damaged hundreds of port facilities and 22 ocean vessels.

A record export pace of grain and soybeans, and products from the U.S. to Mexico is facing challenges crossing the border by rail into Mexico. Congestion has mounted with the high volumes of grain and other products and commodities. Moreover, the Mexican grain inspection agency is overwhelmed while inspecting agriculture products more closely.

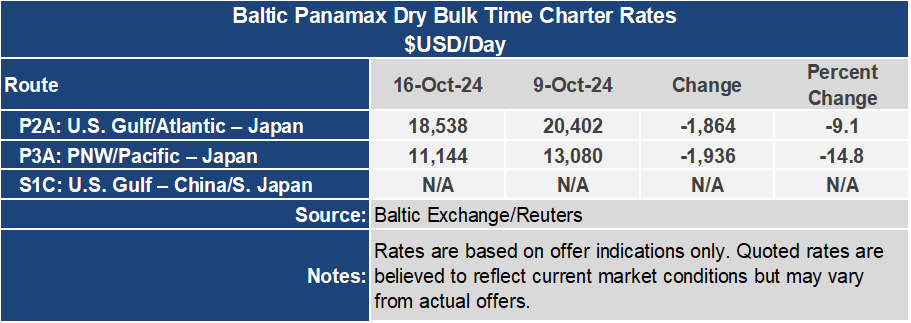

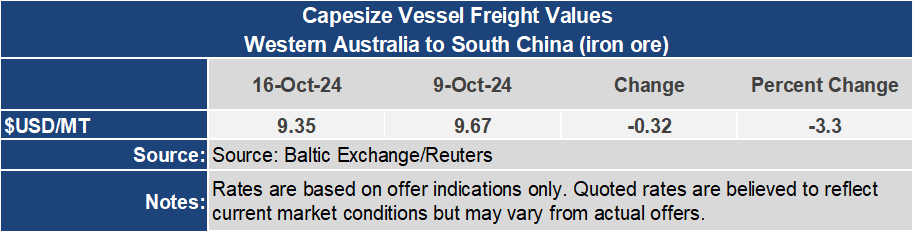

Demand for dry bulk ocean vessels of all class sizes has stalled. The Baltic Dry Index, the basket index of the health of the dry bulk sector, ended the week down 6.8% or 123 points to 1,676. The Capesize Baltic Index was down 8.4% or 234 points to an index of 2,552, the lowest level since mid-August. The Baltic Panamax Index was 10.2% or 148 points lower this week to an index of 1,309 while the Baltic Supramax Index was down 1% to 1,257.

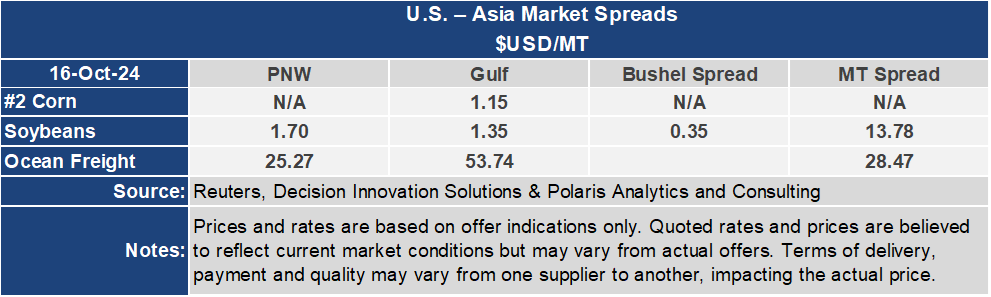

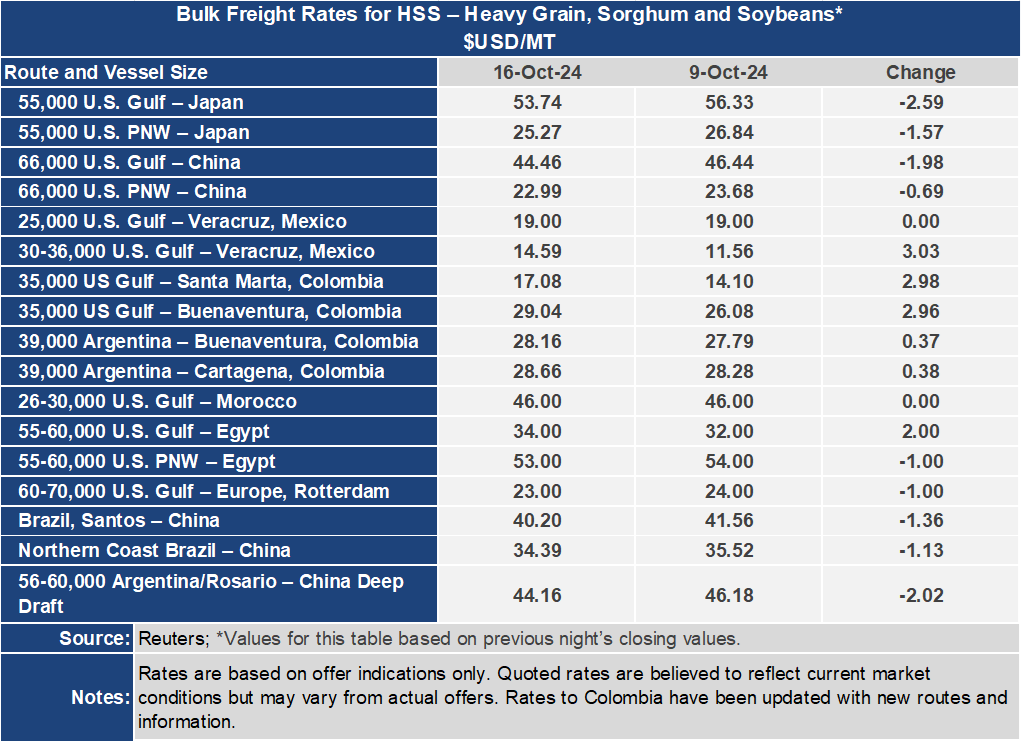

Voyage grain rates followed the Baltic indices lower this week. The U.S. Gulf to Japan freight rate was down $2.59 per metric ton or 4.6% for the week to $53.74 per metric ton. From the Pacific Northwest the rate lost 5.8% or $1.57 per metric ton to $25.27 per metric ton. The spread between these key grain routes narrowed 3.5% or $1.02 per metric ton to $28.47 per metric ton. Both routes are quoted using vessels loaded with 55,000 metric tons.

To China the rate from the U.S. Gulf was $44.46 per metric ton for the week, losing $1.98 per metric ton or 4.3%. From the PNW, the rate was down $0.69 per metric ton or 2.9% to $22.99 per metric ton this week. The spread on this route narrowed by 5.7% or $1.29 per metric ton to $21.47 per metric ton. Both routes to China are quoted using vessels loaded with 66,000 metric tons.

Ocean rates to Central and Latin America, and North Africa were firmer for the week, reflecting delays in freight rates being reported by various agencies and organizations.