Chicago Board of Trade Market News

Outlook

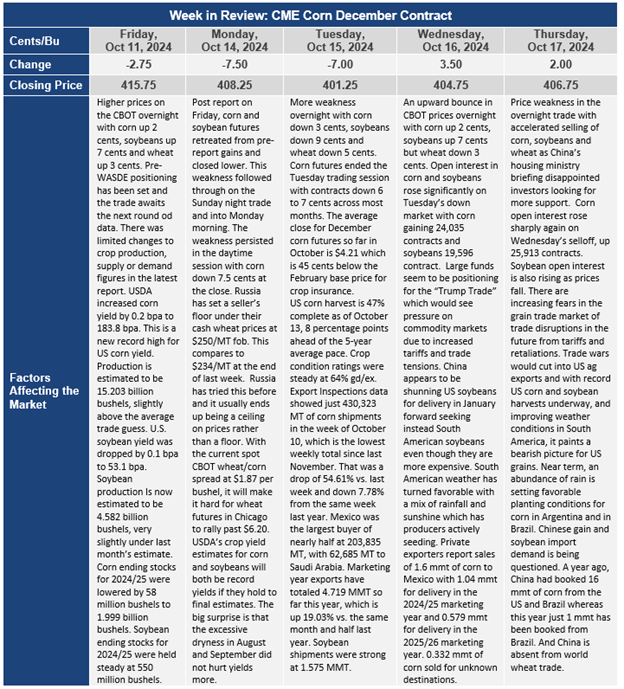

The immediate reaction to the October crop production reports saw prices dropping 5 cents on corn and about 10 cents on soybeans, the price action in the following days has been more negative. USDA’s estimate for corn production is 15.203 billion bushels on a national yield of 183.8 bushels per acre. This was slightly above the average analyst estimates but well within the range of their estimates. If the anecdotal producer reports of better than expected yields is borne out through harvest, then the old adage of “big crops get bigger” could play out this year. An additional 1 bushel per acre could be added to final yields. However, digging into the supporting data in the crop production report shows that ear count dropped from the September report and given the yield reported, this implies that ear weight went up sharply and would be record high. The last time implied ear weights were record high in the October report, ear weights actually declined in the final report and national yield was lowered accordingly.

For soybeans, USDA made just very minor changes to yields and production, lowering yield by 0.1 bpa and production by 4 million bushels to 4.582 billion bushels. Pod counts rose in October compared to September and stand in the upper-third of recent ranges, but this leads to reduced implied pod weights.

Ending grain stocks for corn for the 2024/25 year at 1.999 billion bushels was higher than analysts’ estimates of 1.962 billion bushels but was down from September’s estimate which was 2.057 billion bushels. USDA increased their corn export expectations for 2024/25 by 25 million bushels. Soybean stocks are expected to be 550 million bushels, unchanged from last month.

World corn stocks are estimated to be 306.52 mmt, which compares to USDA’s latest estimate of 308.35 mmt. World soybean stocks are estimated to be 134.65 mmt, compared to 134.58 mmt in USDA’s September estimate.

Internationally, the USDA also left their old & new crop soybeans projections for South America unchanged like corn this month. Despite Brazil’s Amazon River Basin having two major tributaries shutdown because of low water levels, the forecast of seasonal rains beginning next weekend seems to be behind the USDA’s lack of changes in their South American 2024/25 crop sizes this month.

France’s farm ministry on Tuesday further cut its estimates for the country’s rain-hit soft wheat and barley crops, while raising its outlook for the maize harvest that is getting underway. Repeated heavy rain in France, the European Union’s largest grain producer, reduced planting and hampered development of wheat and barley, leading forecasters to predict a plunge in wheat exports this season. Soft wheat production in 2024 was revised down to 25.43 million metric tons from 25.78 million last month, nearly 28% below last year’s level and the smallest volume since 1986, the ministry’s data showed. The ministry cut its estimate for the barley crop to 9.80 million tons from 10.05 million tons last month. The reduction, which reflected cuts to both winter and spring barley yields, meant estimated barley output was 20% lower than in 2023 and 17% below the five-year average. In contrast, the ministry raised its projection of 2024 output of grain maize, including crop grown for seeds, to 14.47 million tons from 14.39 million last month. That was 11.4% above last year’s crop.