Chicago Board of Trade Market News

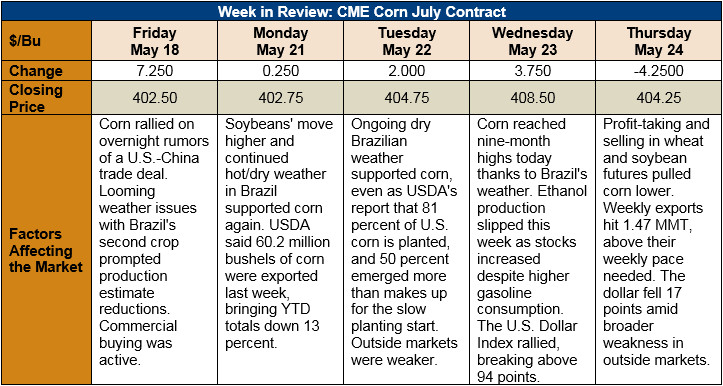

Outlook: July corn has gained 9 cents/bushel (2 percent) since last week’s report. Dry weather in Brazil threatening that country’s second corn crop is largely to blame for the higher futures. Despite the severe drought in the U.S. Southern Plains, major corn producing states are avoiding the threat of dryness so far, except for a modest drought in northern Missouri and southern Iowa. The U.S. crop looks to be in good shape, but the market will not rest easy until yield certainty is attained.

American farmers continue making good progress on spring field work. On Monday, USDA announced corn planting was 81 percent complete, equal to the five-year average for this time of year. Similarly, corn emergence hit 50 percent, up 3 percent from the average pace. The planting progress and emergence all but negate the slow start to planting this year.

This week’s Export Sales report from USDA showed 0.85 MMT of net corn sales for the 2017/18 marketing year with 1.47 MMT of exports. This week’s activity puts YTD bookings (sales plus shipments) equal with last year’s volumes while YTD exports are down. Sorghum exports hit 11,000 MT this week, keeping YTD shipments 28 percent above last year. Similarly, YTD barley exports are up 76 percent.

Cash corn prices continue to rise, reaching their highest levels since July 2017. The national average cash corn price hit $3.75/bushel this week, priced 30 cents under July futures. U.S. corn remains competitive on the export market, priced nearly equal to Brazilian corn and slightly under Argentina Upriver offers.

From a technical perspective, July and December corn futures remain in an uptrend. Commercial buying was active early this week and fund buying quickly followed. Thursday’s lower close is likely a short-term consolidation amid the long-term uptrend. With the dry weather in Brazil and the uncertainty about U.S. yields that will linger at least through July, there is little incentive for the market to remove any risk premium.