Ocean Freight Comments

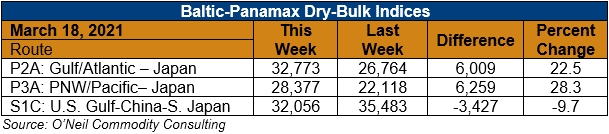

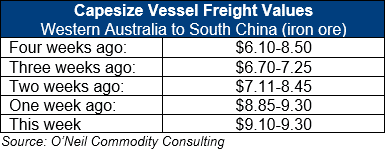

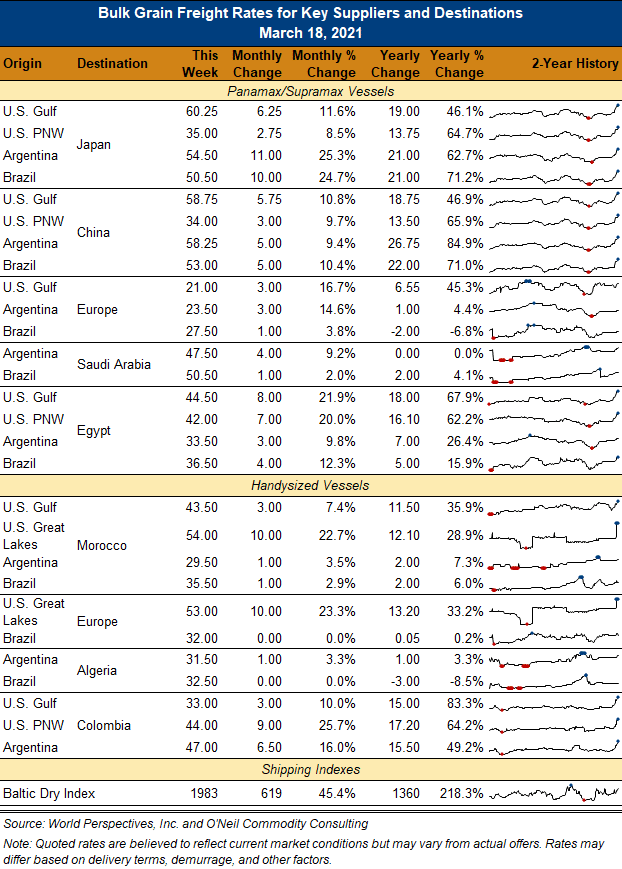

Transportation and Export Report: Jay O’Neil, O’Neil Commodity Consulting: Dry-bulk paper traders are maintaining both their enthusiasm and hold on freight markets this week. The theory of the markets entering a commodity super-cycle still circles is still in their heads and driving price action. Physical markets continue to cautiously follow their lead. April Panamax daily hire rates hit a new high of $25,500/day while Q2 traded at $24,000/day and while CAL.2022 traded at $13,250/day. This clearly shows all the market excitement is in the front end of the curve and the rest of the market is severely inverted. Once again, Panamax markets outpaced Capesize values on the upside.

The arrival line for container vessels at ports of Los Angeles/Long Beach has diminished and logistics have improved for now. There is talk, however, that this is a temporary ebb and flow situation which will eventually return to large backups and strained logistics. Grain shippers and receivers still need to be careful. It is, however, encouraging to see U.S. containerized grain export volumes increase this week.