Chicago Board of Trade Market News

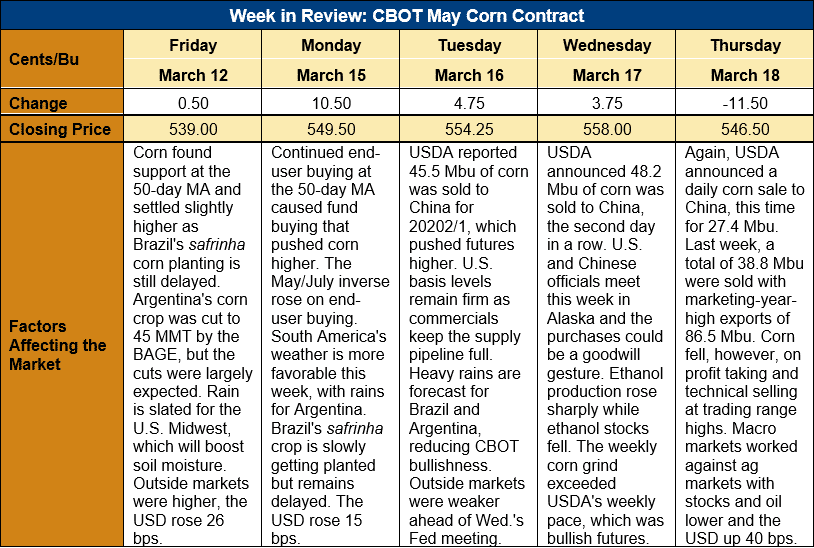

Outlook: May corn futures are 7 cents (1.4 percent) higher this week as early week strength found profit taking at trading range resistance that pared gains for the week. Three days of daily export sales news was supportive, but the market is cautious about moving above trading range highs ahead of two key USDA reports coming at the end of the month. On 31 March, USDA will issue its quarterly Grain Stocks report that will be key in determining old-crop futures’ trading direction and the Prospective Plantings report that will offer needed insight into the new-crop supply picture. Both reports are expected to be bullish, but the CBOT remains cautious so far.

The weekly Export Sales report saw international buyers book 985,900 MT of net export sales, up 149 percent from the prior week while exports rose 38 percent from last week to a new marketing-year-high of 2.119 MMT. YTD exports now total 29.962 MMT (up 85 percent) while YTD bookings (exports plus unshipped sales) stand at 60.504 MMT (up 109 percent). YTD bookings now account for 92 percent of USDA’s 66.04-MMT (2.60 billion bushel) 2020/21 export forecast.

Sorghum net export sales totaled 267,200 MT last week (up 343 percent) while exports jumped sharply higher to 353,300 MT. YTD exports total 3.447 MMT, up 198 percent while YTD bookings stand at 6.2 MMT (up 162 percent).

U.S. cash prices continue to firm with the May/July corn futures inverse rising and showing strong commercial demand. Basis levels remain steady at a five-year high of -12K, putting the average U.S. corn price at $214.87/MT ($5.46/bushel). The market is increasingly moving to incentivize farmers and commercial firms to keep the supply pipelines full, which will likely continue to support the May/July futures spread as well as basis levels.

Barge CIF NOLA offers are up 2 percent this week at $244.86/MT while FOB NOLA offers are up 3 percent amid an increase in export sales demand. April FOB Gulf positions are offered at $248.60/MT.

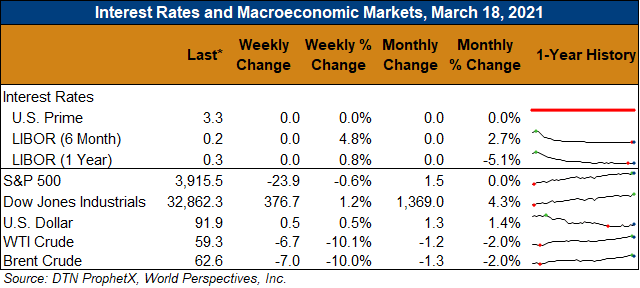

From a technical standpoint, May corn futures found strong support late last week/early Monday at the 50-day MA/$5.30, which helped spark buying early this week. The market is trying to carve out a trading range heading into the March planting and stocks reports and that range currently looks to be $5.30-5.59. Commercial buying has been notable and, as noted above, pushed the May/July spread to a new high this week at 16 ¼ cents. Funds have been modest net buyers but have been largely content to hold their existing long positions heading into the reports, despite the CBOT’s new, higher position limits. Momentum indicators are neutral, and the corn market seem destined to chop sideways heading into April.