Ocean Freight Comments

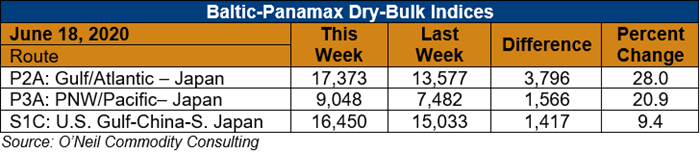

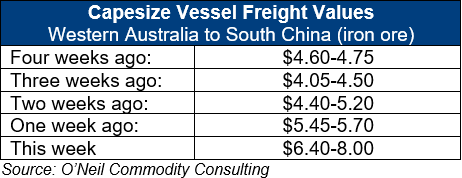

Transportation and Export Report: Jay O’Neil, O’Neil Commodity Consulting: It was a wild week as Baltic Dry Bulk indices soared like a rocket. The surge was led again by the Capesize market and FFA paper traders’ belief that the bull market has finally arrived. Paper shorts in the FFA market got stopped out and values rose in all sectors and oceans. Bold optimism is leading the parade.

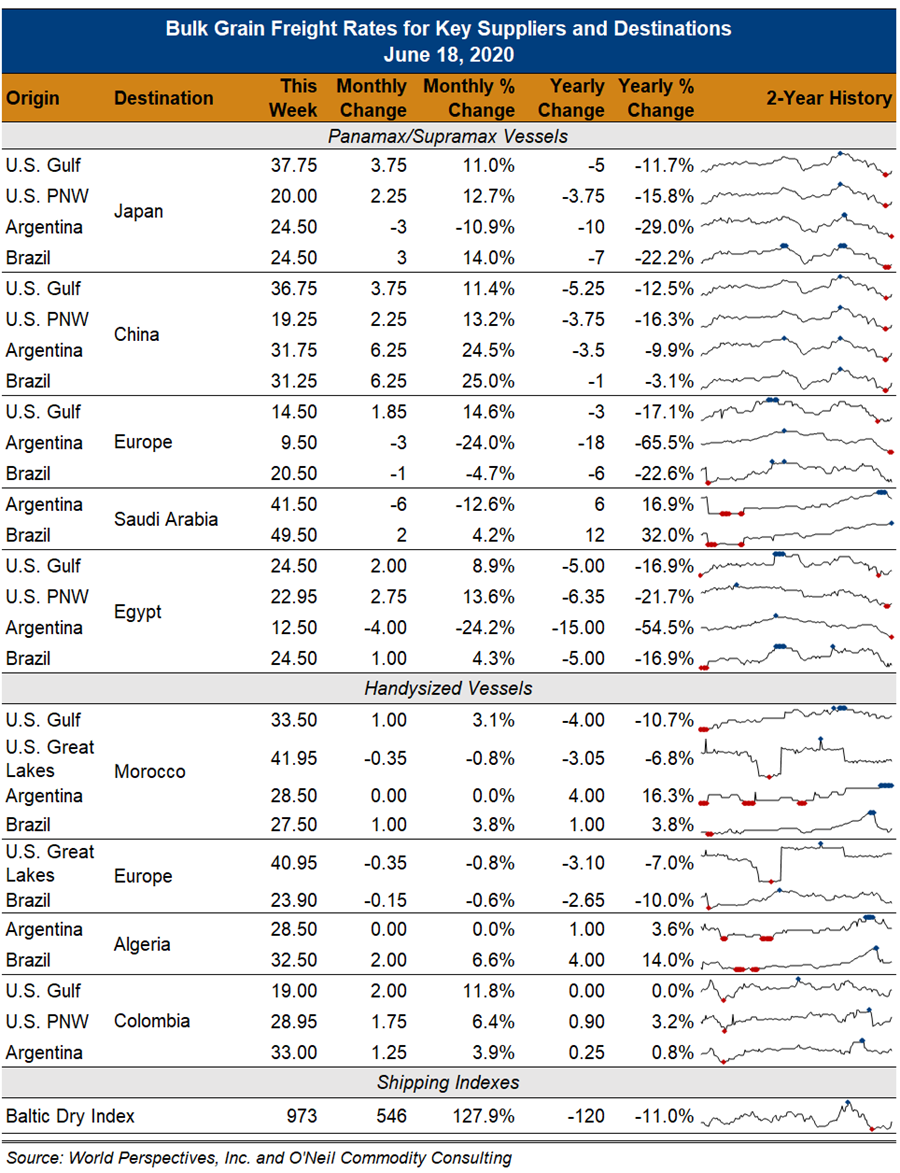

Physical markets had to follow the major move in the paper trading markets. Daily hire spot rates for Capes jumped from $13,000/day up to $25,250/day while Panamax vessels moved from $8,400/day to a new high of $11,600. Markets, however, are now inverted as the forward months re trading at a slight discount. Panamax rates for Q1 2021 are at $9,800-10,000/day.

This week’s market rally was obviously the biggest upward move of the year and the market will now have to see what kind of staying power it possesses. Is the global recovery really at hand? Keep in mind that it is only Thursday and there could be another end of week sell-off if paper traders want to take profits.