Chicago Board of Trade Market News

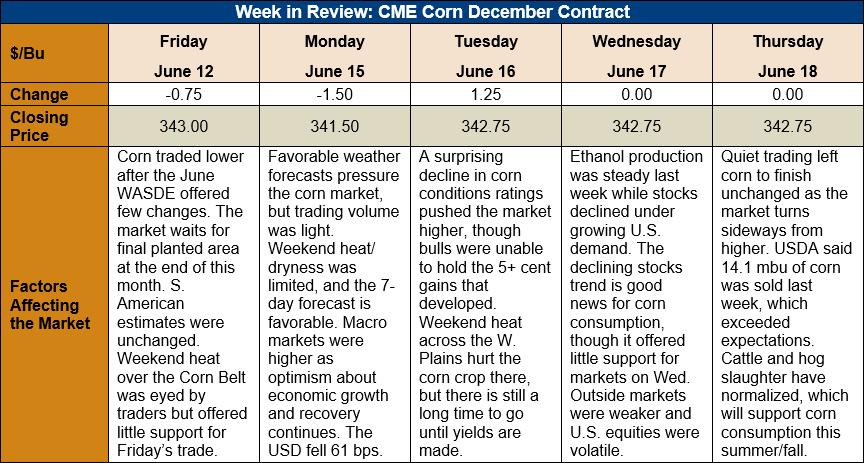

Outlook: December corn futures are ¼ cent (0.1 percent) lower this week as the market remains range-bound and closely watching the U.S. weather forecasts. Weekend heat over the western Plains and hot/dry weather early this week prompted CBOT strength early this week, but more favorable forecasts later in the week erased near-term weather risk concerns. Funds remain heavily short corn futures and have amassed a large short corn/long soybean spread position.

Planting for the 2020 U.S. corn crop is essentially complete, and USDA did not include that statistic in its latest report. Corn conditions turned slightly lower this week, with 71 percent of the crop rated goo/excellent – down 4 percent from the prior week. The reduction in ratings was a surprise to the market and put a bid under corn early Tuesday. That effect, however, was short-lived as crop analysts were quick to point out that early-season conditions ratings have poor correlations with final yields. The crop is far from made yet, and that brought comfort to the futures market.

Sorghum planting is progressing at a slightly better-than-average pace with 79 percent of the crop seeded as of 14 June. That is up slightly from the five-year average of 75 percent. Sorghum conditions ratings slipped slightly from last week as well, due to hot/dry conditions in the western Plains, and USDA said 48 percent of the crop was good/excellent condition as of Sunday night.

The weekly Export Sales report featured net corn sales of 569,000 MT and exports of 877,000 MT. Both figures were down from the prior week but above the market’s expectation. The recent shipments put YTD exports at 31.129 MMT (down 27 percent) while YTD bookings (exports plus unshipped sales) stand at 41.490 MMT (down 14 percent). The report also featured 215,000 MT of sorghum exports. YTD sorghum exports are up 168 percent as international demand has remained exceptionally strong.

From a technical standpoint, December corn futures have turned sideways within the confines of an upward-sloping channel. The market faces major psychological resistance at $3.50, which is only few cents below the upper end of the channel. Farm sales and hedge pressure have been aggressive when the market has approached this point in recent weeks. The market is neither overbought nor oversold and trend indicators suggest the current uptrend is weak. Looking forward, these factors indicate the December futures will likely continue to move mostly sideways with rallies seeing strong selling pressure at $3.50.