Ocean Freight Comments

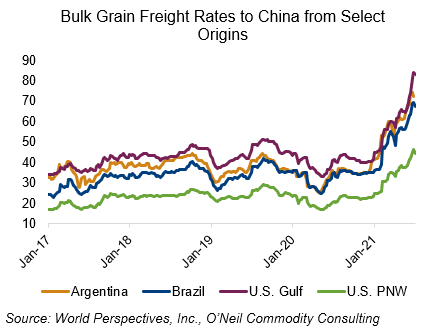

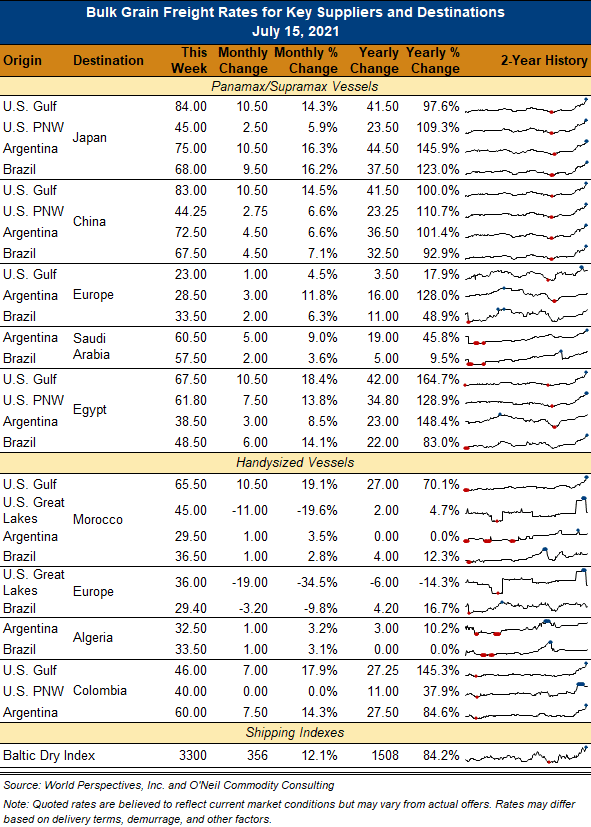

Transportation and Export Report: Jay O’Neil, O’Neil Commodity Consulting: Dry-bulk markets seem to be taking their que from the corn and soybean futures; one day is all bids and the next is all offers. Volatility has become the norm and even Black Sea rates have been crazy. Rates for wheat to Egypt have more than doubled since January and there was a $6.00/MT (18 percent) range in freight offers in this week’s GASC tender. The spread between bids and offers is widening around the globe. Things may have moved up a bit too fast and paper traders in the FFA markets are doing the smart thing by taking profits, but the market is not likely to see a big drop off.

Aside from the continued stories about higher rates and poor logistics, the biggest news in containerized grain markets came from the railroads this week. The Union Pacific railroad announced that Chicago is overly congested, and the railroad will stop hauling ocean containers out of U.S. West Coast ports to the UP’s Joliet, Illinois facility from July 18-24. The move comes as the railroad estimates there are 2,000-3,000 containers without chassis in Joliet. This will be a big disruption in service.