Chicago Board of Trade Market News

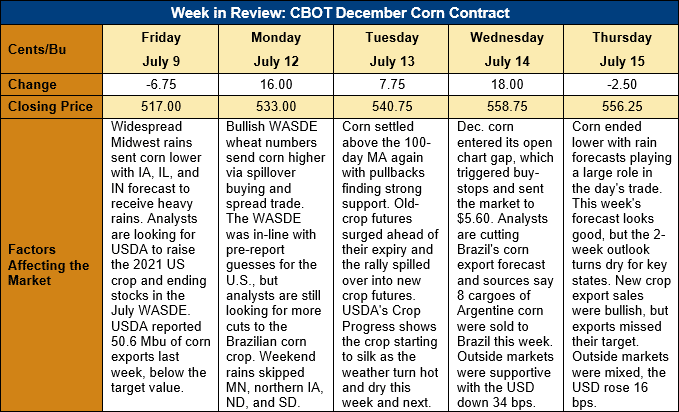

Outlook: December corn futures are 39 ¼ cents (7.6 percent) higher this week after the USDA surprised the market with bullish wheat numbers. The WASDE was neutral corn but spillover buying from wheat and spread trade has pulled corn futures higher. Production concerns still linger for Brazil and the U.S. weather is turning drier in the coming weeks, which is adding a premium back to futures.

The July WASDE was mostly neutral the U.S. corn market, but traders and analysts still see upside potential in USDA’s numbers. The headlines from the report were for tighter U.S. and world 2020/21 supplies with a modest increase in 2021/22. In the U.S., old crop feed use was revised 0.63 MMT (25 million bushels) higher and USDA cut ending stocks by an equal amount to 27.48 MMT (1.082 million bushels). The smaller ending stocks figure and recent increases in cash corn prices prompted USDA to increase its marketing-year average farm price by $0.05/bushel to $4.40.

Regarding the 2021/22 crop, USDA left its U.S. corn yield forecast unchanged but increased production due to higher planted area estimates. USDA’s 2021 production figure now totals 385.2 MMT (15.165 billion bushels), up 24.9 MMT (983 million bushels) from 2020. The only demand-side changes USDA made were a 0.63-MMT (25-million bushel) increase in feed and residual use and a 1.27-MMT (50-million bushel) increase in U.S. exports. The new crop export program should total 63.5 MMT (2.5 billion bushels), according to the latest WASDE.

USDA increased U.S. 2021/22 corn ending stocks 1.9 MMT (75 million bushels) to 36.375 MMT (1.432 billion bushels), up 32 percent from 2020/21. USDA’s 2021/22 ending stocks-to-use ratio forecast is 9.6 percent, up from 2020/21 but tighter than recent years. USDA estimated the new crop average marketing price will be $5.60/bushel in the coming year.

Internationally, UDSA cut its forecast of the Brazilian corn crop due to drought and untimely frost/freeze events in the country. USDA pegged the crop at 93 MMT (down from 98.5 MMT in the June WASDE), which is still on the high side of private analysts’ estimates. Argentina’s 2020/21 corn crop was revised 1.5 MMT higher to 48.5 MMT and exports were adjusted equally higher to 35.5 MMT. USDA made no changes to China’s 2020/21 or 2021/22 corn balance sheets, leaving 2021/22 production at 268 MMT and imports at 26 MMT.

USDA cut world 2020/21 corn production due to the Brazilian and Paraguayan droughts and cut ending stocks 0.74 MMT. For 2021/22, USDA expects larger exports from the U.S. and Russia while Mexico’s exports and EU imports both decline. USDA raised 2021/22 world ending stocks 1.7 MMT to 291.2 MMT.

The Brazilian crop is where many analysts see additional upside potential for the corn market. Most firms still forecast a sub-90 MMT Brazilian crop and expect the country will increase its imports. Industry sources say 8 cargoes of Argentine corn were recently sold to Brazil for delivery in the next few months. Drought also damaged Paraguay’s corn, making that country an unlikely supplier to Brazil. The 2020/21 South American drought(s) look like they will boost U.S. corn exports in the coming year.

The weekly Export Sales report showed a seasonally expected slowdown in old crop net sales, though exports were in-line with expectations at 1.06 MMT. YTD exports are up 66 percent at 59.75 MMT while YTD bookings (exports plus unshipped sales) are up 61 percent at 69.86 MMT. Sales for the 2021/22 marketing year were bullish with 133,000 MT of net sales that brought total outstanding sales to 16.08 MMT (up 274 percent).

Better weather for the central U.S. in recent weeks helped boost corn conditions ratings, with 65 percent of the crop rated good/excellent as of Monday evening’s USDA report. Barley conditions improved 2 percent to 24 percent good/excellent, though that rating is near historic lows. Sorghum conditions fell 2 percent last week to 70 percent good/excellent.

The weather forecasts continue to call for hot, dry conditions across the U.S. PNW and northern Plains in the coming weeks while the central Corn Belt should see more favorable conditions. Some models hold a drying trend for the western Corn Belt in the 6-14-day outlook, which could cause concerns as the crop reaches peak pollination during that time.

From a technical standpoint, December corn futures are rallying from trendline support and are working on filling a large, open chart gap, the top of which is at $5.73 ½. The market broke key support levels heading into the WASDE but has since rallied on a combination of short covering and end-user buying. How the market acts around the chart gap will be key for determining the next move. Filling the gap and settling above it will be a bullish signal that could take futures back near $6.00. Filling it and settling lower creates a bearish signal and trade down to $5.00. Given a drier U.S. weather forecast and the smaller Brazilian crop, however, it seems the fundamentals lean bullish.