Distiller’s Dried Grains with Solubles (DDGS)

DDGS Comments: DDGS values are $5/MT lower this week amid pressure from weaker soymeal and corn futures and despite a pullback in ethanol output. This week’s weak futures performance has pared back DDGS values, but end-user demand remains active as buyers use the break to book product. The ethanol industry was thought to have been exiting the spring maintenance shutdown season two weeks ago, but the recent dip in output, according to the EIA data, suggests there is still work being done. That will continue to keep spot DDGS supplies tight and support values amid weaker outside markets.

The FOB ethanol plant DDGS/cash corn price ratio rose to 1.12 this week, up from 1.06 last week and above the three-year average of 1.06. The DDGS/Kansas City soymeal ratio also rose this week and hit 0.57, up from last week’s value of 0.56 and still above the five-year average of 0.50.

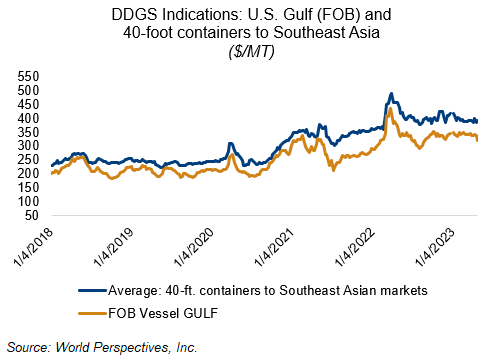

Barge rates continue to work their way lower and keep export offers competitive. Barge CIF NOLA offers are down $15/MT for May – July positions while FOB NOLA offers are down $22 for spot shipment compared to last week and are $18-20/MT lower for June and July. Container rates, however, are slightly higher with offers for 40-foot containers to Southeast Asia up $2/MT at $388/MT.