Chicago Board of Trade Market News

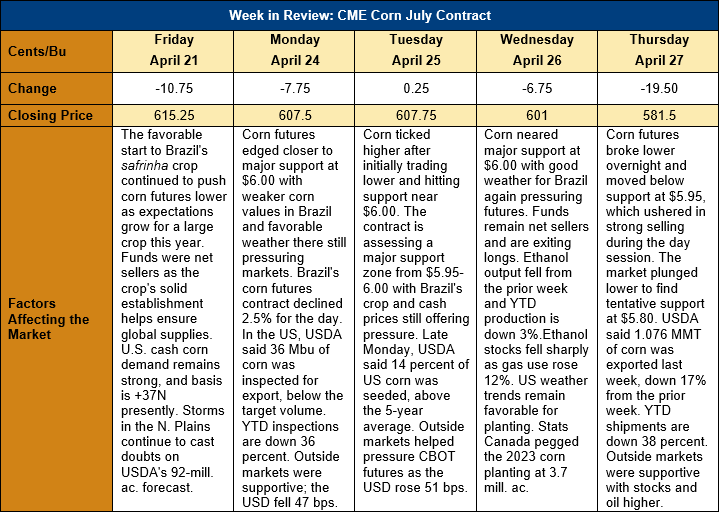

Outlook: July corn futures are 33 ¾ cents (5.5 percent) lower this week with 19 ½ cents of that loss coming from Thursday’s technically driven selloff. The market was previously hovering near support at $6.00 but an overnight break below that point triggered more aggressive selling in the day session. Fundamentally, there is little fresh news beyond favorable weather conditions for the Brazilian safrinha crop and the U.S. 2023 planting effort, but this weather has exerted a mildly bearish influence.

Brazil’s weather has been kind to the safrinha crop so far and allowed it to largely recover from a late planting. This helped put pressure on futures earlier this week, but recent model runs show the introduction of above-average heat and below-normal precipitation in the next 1-2 weeks. If this trend continues longer than a few weeks, the markets will likely add back a “weather premium” to values.

In the U.S., the 2023 corn planting effort is progressing well and USDA said Monday that 14 percent of fields were seeded. That is above the five-year average of 11 percent and strong progress was noted in Illinois, Indiana, and Iowa. The current weather forecasts offer little concern for planting in the south and Corn Belt, but rain and cool temperatures may continue to delay fieldwork in the Northern Plains. Additionally, recent rains and snowmelt have created flooding in the Dakotas and Minnesota that is hampering planting.

U.S. corn export sales continue to follow their seasonal pattern and fell from last week’s volume as gross sales totaled 0.585 MMT. Exports are heading into their seasonal peak but fell 17 percent from the prior week to 1.076 MMT. YTD exports now total 23.671 MMT (down 38 percent) while YTD bookings (exports plus unshipped sales) total 38.451 MMT (down 33 percent). YTD bookings account for 82 percent of USDA’s projected exports with roughly four and a half months left in the marketing year.

July corn futures may have posted a bearish day on Thursday but are now very close to major technical support levels. Thursday’s lows were formed a half-cent above psychological support at $5.80 and key support lies a few cents below that at the 22 July 2022 low of $5.74 ¼. International buyers have been active on recent breaks in the market and that suggests more business is likely to get done with futures at eight-month lows.