Ocean Freight Comments

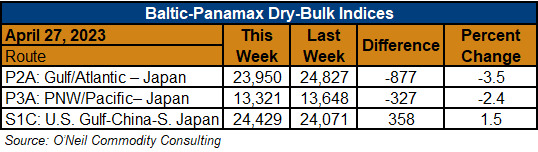

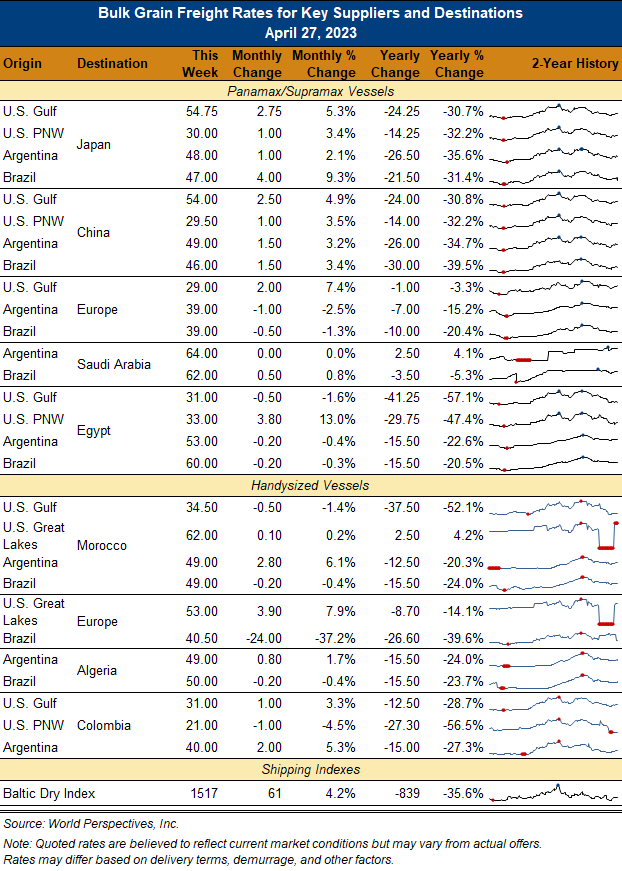

Transportation and Export Report: Jay O’Neil, O’Neil Commodity Consulting: The dull trend continues. Dry-bulk markets have not been very exciting over the last month, but that may be a good thing for grain buyers and vessel charters. Vessel owners and FFA paper traders have done their best to resist selling at lower levels but, on the other side of the coin, there is not sufficient demand growth to support a rally. It is already Q2 of 2023 and the anticipated bull market has not materialized. Buyers are happy but vessel owners are starting to cry. Operating costs have increased but revenues have not. Panamax FFA paper for Q2 was down $100 points to $14,700/day, Q3 slipped 800 points to $16,200/day.

U.S. Container Grain export volumes continue to slip back and are looking pitiful.

It is rumored that a labor deal in West Coast container ports has been mostly negotiated but there is no confirmation nor any details. Time will tell.