Ocean Freight Markets and Spreads

Ocean Freight Comments

There is no letup in the attacks by the Houthi’s terrorist organization on vessels plying through the Red Sea. This week the Houthis attacked and hit two tankers in the Red Sea. One vessel was a Saudi Arabian owned vessel and the other a Greek managed one. Since November 2023 the terrorist group has attacked more than 70 vessels, sinking two and seizing another while killing at least three mariners. Vessel owners and operators continue to avoid the Red Sea and Arabian Peninsula as the situation intensifies and the return to “normal” remains uncertain.

The International Longshoremen’s Association that manages the labor contract of the U.S. East and Gulf Coasts has been meeting with its members to discuss their contract terms and plan for a possible strike. The ILA has said it will strike on October 1 after their contract with the United States Maritime Alliance expires September 30. The ILA is seeking a 77% wage increase and other concessions regarding safety, healthcare and retirement benefits, and automation. The two sides have not met in weeks. A strike will have a greater impact on containerized cargos but will have domino effects through the supply chain. Grain export elevator operators in the U.S. Gulf use non-union labor and should not be impacted.

Water levels in the Mississippi River have been falling. In Memphis, the gage reading has fallen fast and is approaching historical low levels experienced the previous two years. Barge rates have been firming as a result due to draft and tow restrictions. The gage reading near New Orleans has been falling as it does seasonally. As of now the pilot associations of the Lower Mississippi River have no restrictions in place. Water levels on the Madeira River in Brazil continue to fall impacting corn barge loadings that would be moved to export position. The low water in Brazil is making corn more expensive across the Northern Arch.

The Baltic Dry Index gained 147 points or 8.4% to an index of 1,902 this week. While it is higher, it peaked midweek and is retreating. However, the BDI is 75.9% higher than one year ago. The Baltic Capesize Index propelled the BDI together, gaining 341 points or 11.8% for the week to an index of 3,224. BCI is more than 211% higher than it was one year ago. The smaller vessel classes were lower for the week. The Baltic Panamax Index was down 3.7% for the week to an index of 1,300. The Baltic Supramax Index was down 3.4% to 1,271 for the week.

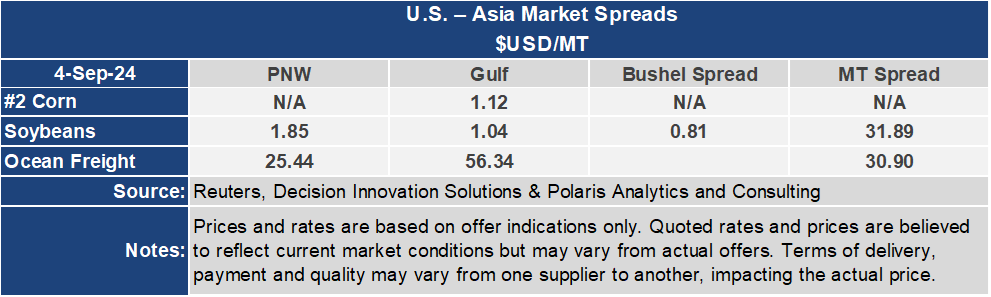

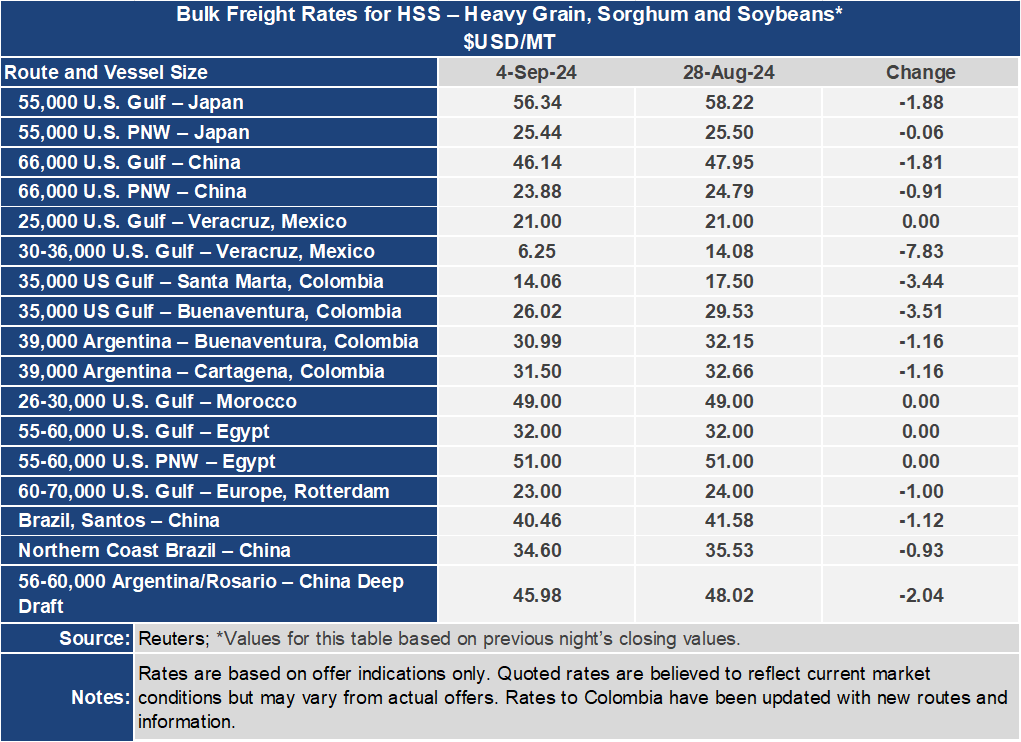

The U.S. Gulf to Japan ocean freight rate was down $1.88 per metric ton or 3.2% for the week to $56.34 per metric ton. From the Pacific Northwest the rate was nearly unchanged at $25.44 per metric ton. The spread between these key grain routes narrowed 5.6% or $1.82 per metric ton to $30.90 per metric ton. Both routes are quoted using vessels loaded with 55,000 metric tons.

To China the rate from the U.S. Gulf was $46.14 per metric ton for the week, down $1.81 per metric ton or 3.8%. From the PNW the rate was down $0.91 per metric ton or 3.7% lower to $23.88 per metric ton this week. The spread on this route narrowed by 3.9% or $0.90 per metric ton to $22.26 per metric ton. Both routes to China are quoted using vessels loaded with 66,000 metric tons.

Ocean freight rates from the U.S. Gulf to Central America reported as erratic this week. These rates swing widely from time to time and this week is one of those.