Chicago Board of Trade Market News

Outlook

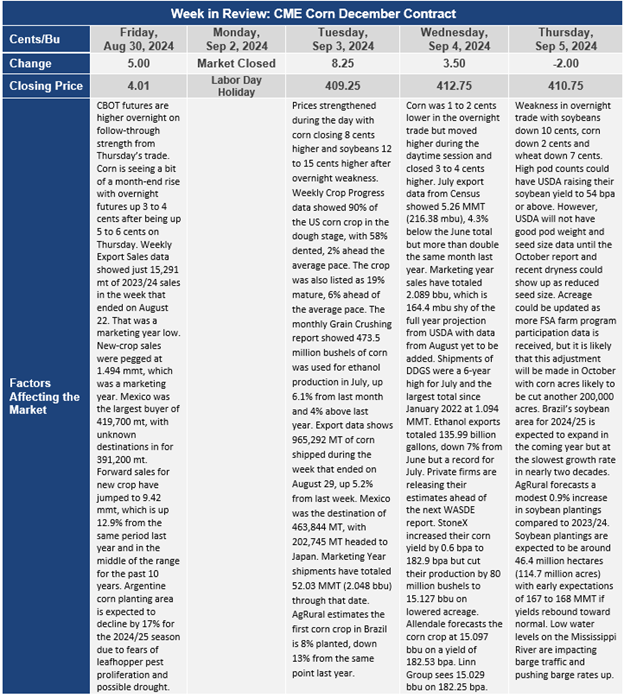

Private firms are beginning to release their estimates of the U.S. corn crop ahead of the next USDA WASDE report that will be released next week. So far, the new estimates are all slightly below USDA’s August estimate of 183.1 bushels per acre and production of 15.147 billion bushels. The average of three estimates released this week is 15.084 billion bushels which would be 62 million bushels less than USDA’s August estimate.

Crop condition ratings for the U.S. corn crop have held relatively stable since the August WASDE. On August 12th, corn was rated 67% Good/Excellent. It is now rated 65% Good/Excellent. Crop condition ratings often drift lower even when the overall conditions are good as the crop moves toward maturity. Some localized areas of dryness are reappearing, especially in the Eastern cornbelt, in the Delta and the Southern Plains. The heart of the cornbelt remains blessed with relatively good conditions for final ear fill for corn and pod fill for soybeans.

China’s investigation into canola shipments from Canada to China appears to be part of China’s response to the imposition of tariffs on Chinese electric vehicles, steel, and aluminum. These actions led to overnight selling on the Chicago futures markets on Tuesday night, but these worries were short lived, and the market began focusing on other issues once the daytime session on Wednesday got underway. Malaysian palm oil futures extended losses to a third straight session on Wednesday, tracking a drop in prices of rival vegetable oils and a decline in India’s palm oil imports. Recent strength in the ringgit has made palm oil less competitive and with other vegetable oils and weakness in crude oil futures has not helped oils that are now used for biofuels. Malaysia’s palm oil inventories are expected to have climbed to their highest levels in six months at the end of August due to lackluster export demand. Oil prices fell slightly on Wednesday, hovering at their lowest levels since December after plunging more than 4% the previous day on signs of a weak global economy, perceived weakening of oil demand, and expectations of an end to a dispute halting Libyan oil exports.

Investors have become confident the U.S. Federal Reserve and other central banks will soon cut interest rates to stimulate consumer and business spending but that has not dispelled concerns about weak oil demand growth. Instead, forecasts of steep rate cuts over the rest of 2024 and through 2025 have been seen as confirming fears that the major economies are set to slow significantly, keeping demand growth moderate. Traders also remained concerned about pending output increases by Saudi Arabia and its OPEC⁺ allies from the start of October which, if carried out, might boost inventories and further depress prices. All of this matters for the price of corn since corn use for ethanol is the number one domestic use for U.S. corn and is a primary driver in setting overall demand for U.S. corn.

The South American weather pattern is stagnant for the next two weeks which should allow heavy rains to impact areas between Buenos Aires and Rio Grande do Sul. Otherwise, a stagnant pattern of heat and dryness is projected for Mato Grosso, Mato Grosso do Sul, Goias, and Minas Gerais with zero rain projected for those states through mid-September. Dryness in early September is not unusual for these areas, but if the dryness extends into late September, it could delay both first crop corn planting and soybean planting. So far, 8% of Brazil’s first crop corn is reported to be planted. Meanwhile, a push by India to make more corn-based ethanol has turned Asia’s top corn exporter into a net importer for the first time in decades.