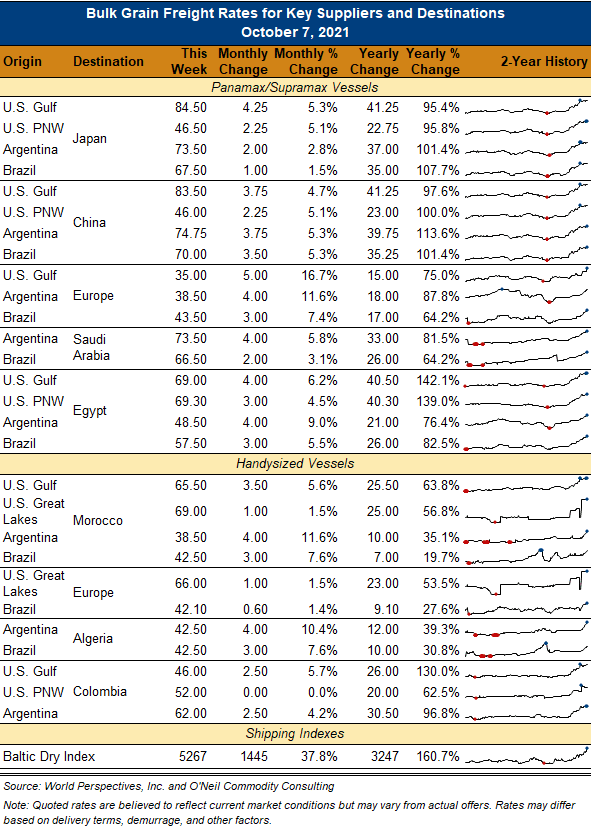

Ocean Freight Comments

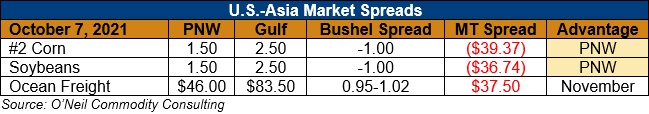

Transportation and Export Report: Jay O’Neil, O’Neil Commodity Consulting: One cannot talk about ocean freight without recognizing that 2/3 of all dry bulk demand depends on Chinese imports. Therefore, 100% of dry bulk freight is impacted by Chinese market conditions.

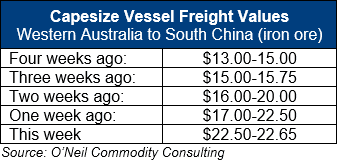

Currently 34% of the Capesize fleet is sitting at anchor due to congestion at Chinese ports. That figure is down from 38% but is still big and causing problems. A small change in Chinese government policy, or covid-19 conditions will cause big ripples in dry bulk markets. Vessel congestion is a major factor in current markets.

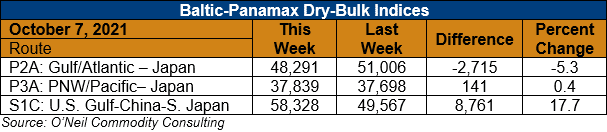

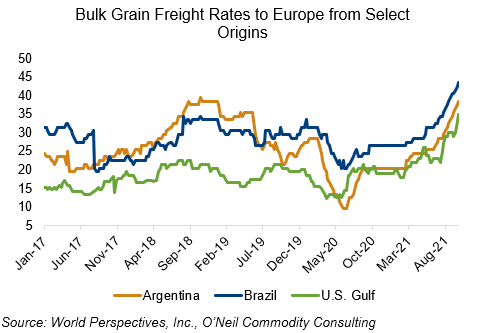

The Baltic Dry Bulk index has risen 907% from its low point on 13 May 2020, just 17 months ago. There is also a 70 percent inverse between the spot markets and Q1 2022. Markets remain volatile, but there is reason to be concerned about what could happen once global congestion softens. There are sufficient ships to cover cargo demand; they are just backed up and trying to get free.

China emerged early Thursday from its Golden Week holiday, which left market quiet and mostly unchanged for the past week. There are now 8 of the 9 previously operating New Orleans export grain facilities back online.