Distiller’s Dried Grains with Solubles (DDGS)

DDGS Comments: U.S. DDGS prices are up $5.00/MT this week as a modest decrease in barge freight is helping pull product from the domestic market to the Gulf. A strong summer export program (USDA reported DDGS exports are up 10 percent YTD) and early-fall reductions in ethanol run rates have helped tighten supplies. Kansas City soymeal prices are down $10/MT this week as the futures market has trended lower, putting the DDGS/Kansas City soymeal ratio at 0.60, up from last week and above the three year-average of 0.47. The DDGS/cash corn ratio is higher this week at 1.02, up from 0.98 last week but below the three-year average of 1.09.

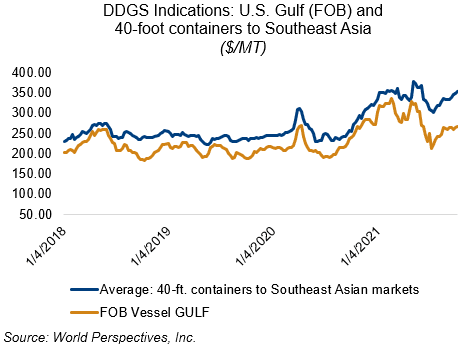

On the export market, DDGS values are mixed with barge CIF NOLA rates are down $6/MT for Q4 2021 shipment and down $2 for Q1 2022. FOB NOLA offers are up $1-2/MT for November – January shipment while U.S. rail rates are up $9-10/MT this week.

Brokers continue to report that the international market is seeing fewer offers for containerized DDGS due to high freight costs. Both buyers and sellers are eyeing the huge inverse in the freight market and proceeding somewhat cautiously. Some trade is still getting done, however, and prices for 40-foot containers to Southeast Asia are up $6/MT at $354/MT this week.

Please note that FOB Gulf markets will likely be more volatile than normal as the industry works to recover full capacity in New Orleans area export facilities. There are significant questions about elevation capacity and availability and the DDGS market will have to compete with other grains as the U.S. new crop harvest approaches. Consequently, both flat prices and spreads versus other markets may see greater than normal volatility.