Chicago Board of Trade Market News

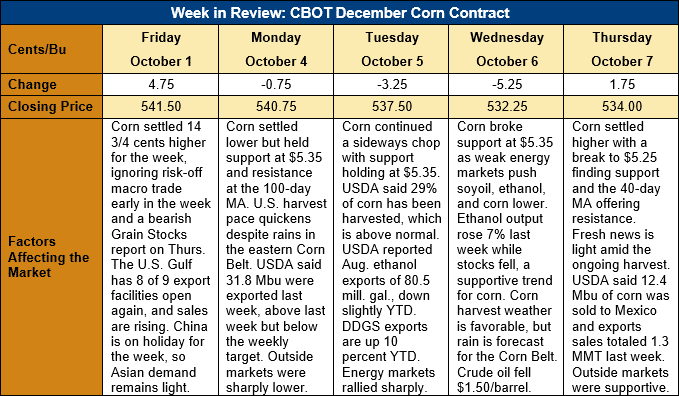

Outlook: December corn futures are 7.5 cents (1.4 percent) lower this week after the market consolidated in a sideways trading range. The market has still not traded outside range that occurred on 30 September, when the latest Grain Stocks report was released, meaning that day’s high and low still mark the immediate trading range. Fresh fundamental news has been light with the U.S. harvest progressing ahead of schedule and U.S. exports picking up as the Gulf finishes reopening. Eight of the nine Gulf grain export facilities are open again, which is allowing Gulf basis offers to slowly decline amid an uptick in interest for U.S. corn. Traders are already positioning for the October WASDE, to be issued Tuesday, 12 October, which is keeping keep the market contained to sideways trade.

The U.S. corn harvest was 29 percent complete as of 3 October, ahead of the average 22 percent completion rate for the first week of October. Notably, Illinois’ harvest is 41 percent finished, up 28 percent from last year and 15 percent ahead of normal. Iowa’s harvest is 19 percent completed, ahead of the 11 percent five-year average pace while Indiana’s harvest is 9 percent ahead of normal at 26 percent complete.

The early harvest pace has two notable implications for the U.S. corn market. The first is that the early harvest is minimizing possible crop losses from poor late-season weather, which will add to U.S. yields and supplies on the margin. The second is that yield estimates in the October WASDE will have a greater-than-normal volume of actual yield data as inputs into USDA’s estimate. Consequently, the October yield estimate maybe subject to fewer subsequent revisions this year.

Despite the early start to the corn harvest, U.S. farmers are making relatively few new crop sales. Farmers are focused on executing fieldwork and remain patient in their marketing strategy. This is keeping Midwest basis levels stronger than usual, with basis averaging -18Z (18 cents under December futures) this week, up from -19Z last week and -27Z this time last year. Interestingly, Ukrainian farmers have also been slow to market their crop and seem to be waiting for a price rally before making sales.

The reopening of the U.S. Gulf is, as expected, boosting U.S. export sales and shipments. USDA reported 1.265 MMT of net export sales last week, a figure that was up 242 percent from the prior week. Weekly exports were up 44 percent at 0.974 MMT, putting YTD exports down 32 percent at 2.496 MMT. The cumulative export figure is low due to the Hurricane Ida-induced Gulf shutdown, but, notably, YTD bookings (exports plus unshipped sales) are up 3 percent YTD.

From a technical standpoint, December corn futures are still trading within a $5.27 ¼ – 5.48 ½ range and have now turned sideways from their September trend higher. The 100-day moving average (at $5.48 ½) has been significant resistance and bulls have been unable to push the market above that level amid the ongoing harvest. A break below the lower end of this range could take the market to $5.20 or the 200-day moving average ($5.16) while an upside breakout should target the 30 August daily high at $5.58. Overall, December corn futures seem to be steadily trading sideways while waiting for harvest to end and create the seasonal slow trend higher into the new year.