Ocean Freight Markets and Spreads

Ocean Freight Comments

Attacks on vessels ply the Red Sea and around the Arabian Peninsula by the Houthi terrorist organization have slowed. The U.S. led alliance is destroying and eliminating Houthi missile and drone assets. Despite the lack of attacks, vessel owners and operators continue to avoid the Red Sea route while using the longer route around the Cape of Good Hope. The longer route has led to higher container utilization rates due to longer transit times. When vessel owners and operators return to the Red Sea, container utilization rates will fall, and those lower levels will bring freight rates down as well.

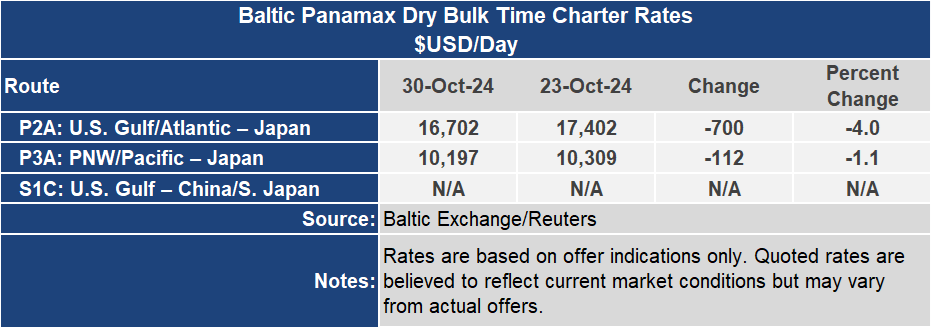

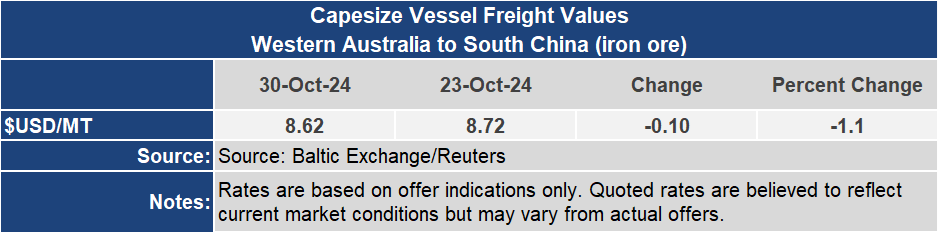

The Baltic indices were once again lower and are now below year ago levels. With weakened demand and a larger fleet of dry bulk vessels plying the oceans, rates are weakened. The Baltic Dry Index lost 3.5% or 50 points this week to 1,395. The BDI, a basket measurement for all dry bulk vessel sizes, is slightly below its level one year ago. The Baltic Capesize Index was down 3.9% or 75 points to 1,846 for this week while 2.8% or 53 points below its level one year ago. The Baltic Panamax Index was down 2.9% or 36 points to an index of 1,202 while 19.3% or 287 points below its level one year ago.

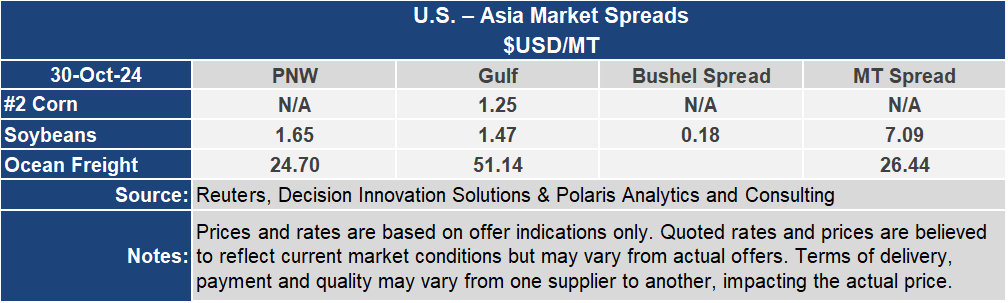

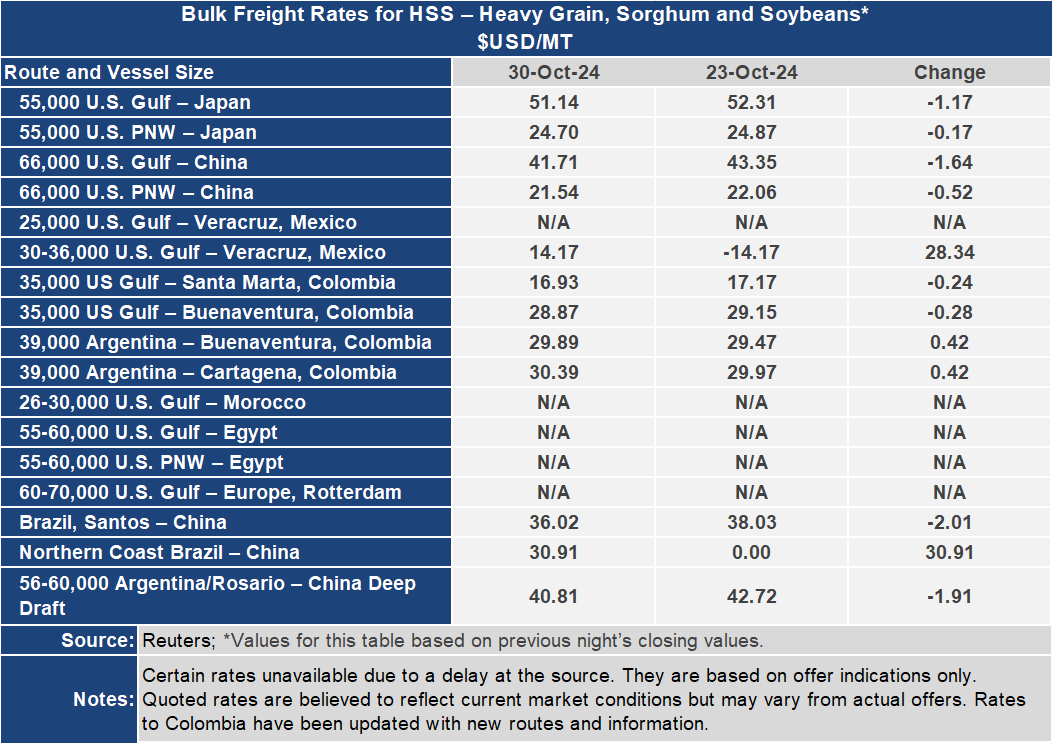

Most voyage rates have been restored, with a few still unavailable due to a glitch at the source. Voyage rates are following the Baltic indices lower and with crude oil prices off from recent peaks in September, bunker fuel pricing has been stable and should ease, adding further ocean freight rate relief to shippers. The U.S. Gulf to Japan grain freight rate was down $1.17 per metric ton or 2.2% for the week ending October 30 to $51.14 per metric ton. From the Pacific Northwest the rate was down 0.7% or $0.17 per metric ton to $24.70 per metric ton. The spread between these closely watched grain routes narrowed 3.6% or $1.00 per metric ton to $26.44 per metric ton. Both routes are quoted using vessels loaded with 55,000 metric tons.

To China the rate from the U.S. Gulf was $41.71 per metric ton for the week ending October 30, down $1.64 per metric ton or 3.8%. From the PNW, the rate was down $0.52 per metric ton or 2.4% to $21.54 per metric ton. The spread on these routes narrowed by 5.3% or $1.12 per metric ton to $20.17 per metric ton. Both routes to China are quoted using vessels loaded with 66,000 metric tons.

The International Longshore Association ended its three-day strike at ports along the U.S. East and Gulf Coasts on October 3. Since then, container freight rates for forty-foot containers from the Far East to the U.S. West Coast have dropped 347 points or 6% to an index of 5,195. The container rate index from North Europe to the U.S. East Coast lost 4% or 106 points to an index of 2,894 since October 3. For U.S. export loads, the forty-foot container rate since October 3 is down 1% or 4 points to an index of 701 from the U.S. West Coast to the Far East while from the U.S. East Coast to the Far East the index is down 2% or 9 points to an index of 561. The U.S. East Coast to Far East rate index jumped in June ahead of the anticipated ILA strike, essentially maintaining is present level. The ILA and U.S. Maritime Alliance are expected to resume negotiations on Friday. The negotiations are expected to focus on automation. The ILA is working on an extended contract that expires January 15, 2025.