Chicago Board of Trade Market News

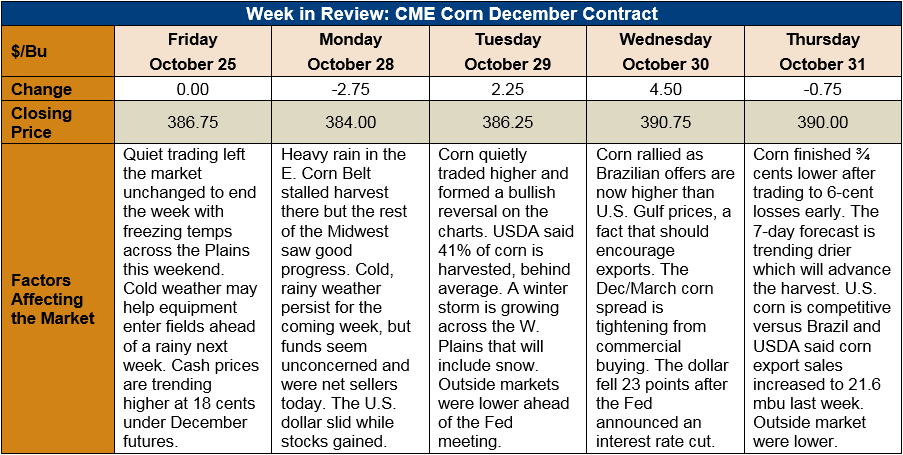

Outlook: December corn futures are 3 ¼ cents (0.8 percent) higher this week as inclement weather is delaying the U.S. corn harvest and supporting basis and cash values. On Monday, USDA said 93 percent of the U.S. corn crop was rated “mature”, slightly behind the five-year average progress but much improved over the prior week. At the same time, harvest progress lags the typical pace by 20 percent, having reached only 41 percent completion as of Monday’s report. This week’s rainy weather for the Eastern Corn Belt and winter storm over the Plains states has likely prevented much additional field work. Fortunately, the seven-day forecast includes dry and cold weather that should help facilitate harvest progress.

The weekly Export Sales report showed stronger corn export demand with net sales hitting 549,100 MT. Weekly exports increased 1 percent to 494,300 MT, putting YTD exports at 3.621 MMT (down 61 percent). USDA also reported 100 MT of sorghum exports and 600 MT of barley shipments. YTD bookings (exports plus unshipped sales) for sorghum and barley are up 43 and 3 percent, respectively.

Cash corn prices are firmer this week with the average price across the U.S. reaching $147.17/MT. Basis has been slightly firmer despite the slow move lower in futures prices, averaging 16 cents under December futures this week. Basis in the Eastern Corn Belt has shown a strong increase this week as some of the country’s latest-planted fields faced rainy weather. Barge CIF NOLA and FOB NOLA values are steady with last week’s values, with the latter moving to $172/MT this week.

From a technical standpoint, December corn is moving sideways from $3.80-3.90. These two psychological support and resistance points have largely defined the market’s movement this week. Funds were sellers at the beginning of the week but with the winter storm marching across the Midwest and Brazilian corn prices climbing higher, they have covered part of that short this week. Notably, the December/March futures spread is tightening, indicating commercial buying activity that may signal a tighter/stronger market is ahead.