Chicago Board of Trade Market News

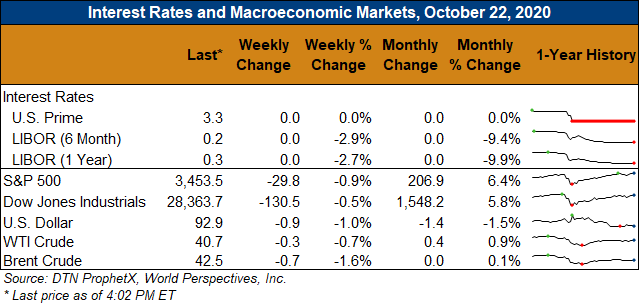

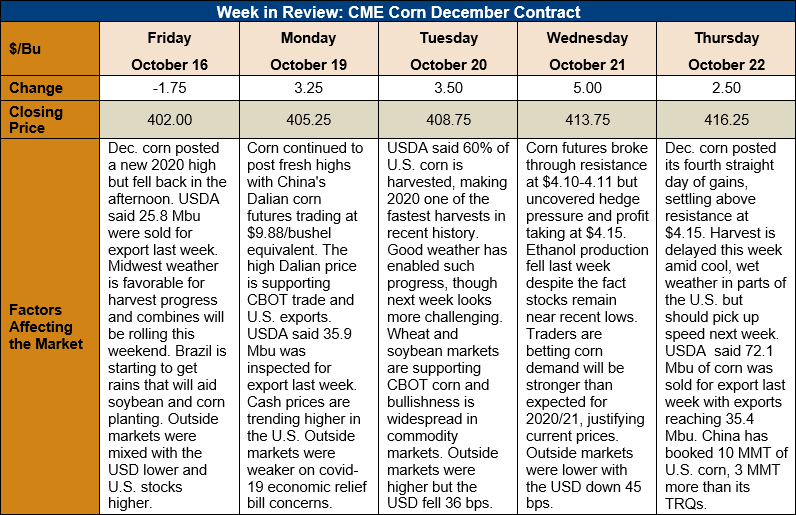

Outlook: December corn futures are 14.25 cents (3.5 percent) higher this week and trading at 18-month highs. Strong export sales and modest harvest delays due to areas of cold, wet weather and snowfall in the Midwest supported the market this week. Funds remain net buyers and have continued to extend their large long position.

The USDA’s weekly Export Sales report showed 1.8 MMT of net sales (up 180 percent from last week) and weekly exports of 898,000 MT (up 10 percent). YTD exports total 5.39 MMT, up 72 percent while YTD bookings (exports plus unshipped sales) stand at 28.334 MMT (up 161 percent). USDA’s data show U.S. exports to China cumulatively total 1.735 MMT so far for the 2020/21 marketing year, while China’s bookings of U.S. corn total 10.549 MMT.

Sorghum exports remain robust as well, with another 280,000 MT of net sales reported this week with 70,100 MT of exports. YTD bookings for sorghum total 3.216 MMT (up 1,109 percent) with China accounting for 2.216 MMT of those commitments.

The 2020 U.S. corn harvest continues to make excellent progress, advancing 17 percent last week to total 60 percent complete as of Monday’s USDA report. The harvest, so far, has been among the fastest in the past decade and favorable weather has facilitated field work. Progress has been slowed this week, however, by cool, wet weather across the Northern Plains and Upper Midwest with snow falling across parts of the Northern Plains. That will slow the rate of drying for corn still in fields and delay field work as well. Still, the weather disruptions are not expected to pose a serious threat to 2020 supplies.

From a technical standpoint, December corn futures continue to trend higher with successive days of higher highs and higher lows. The market made quick work of resistance at $4.10-4.11 and on Thursday overcame selling pressure that developed Wednesday at $4.15. The next upside target is the July 2019 high of $4.23 ½ with the contract high above that. Cash corn prices continue to firm around the U.S., though basis levels are weakening sightly, while world FOB offers continue to rally sharply. With buyers continually revising pricing ideas higher, the bullish outlook for futures remains.