Ocean Freight Comments

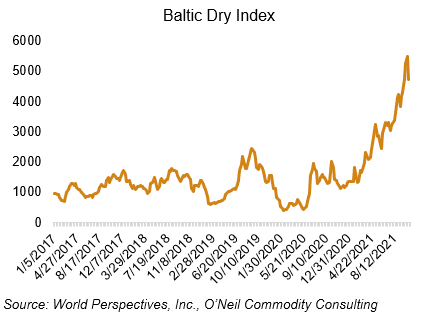

Transportation and Export Report: Jay O’Neil, O’Neil Commodity Consulting: Volatility is the one constant in dry-bulk markets, and I have no doubts about it continuing through the next year or more. The global fleet is insufficient to meet growing market needs – especially those of China – and it will take 2 to 3 years to balance this supply and demand dynamic. It is therefore very likely the industry will ride roller coaster markets for many months to come. Best hold on to your hat.

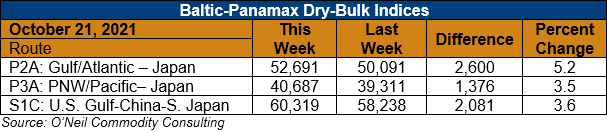

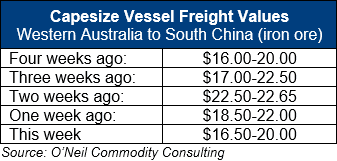

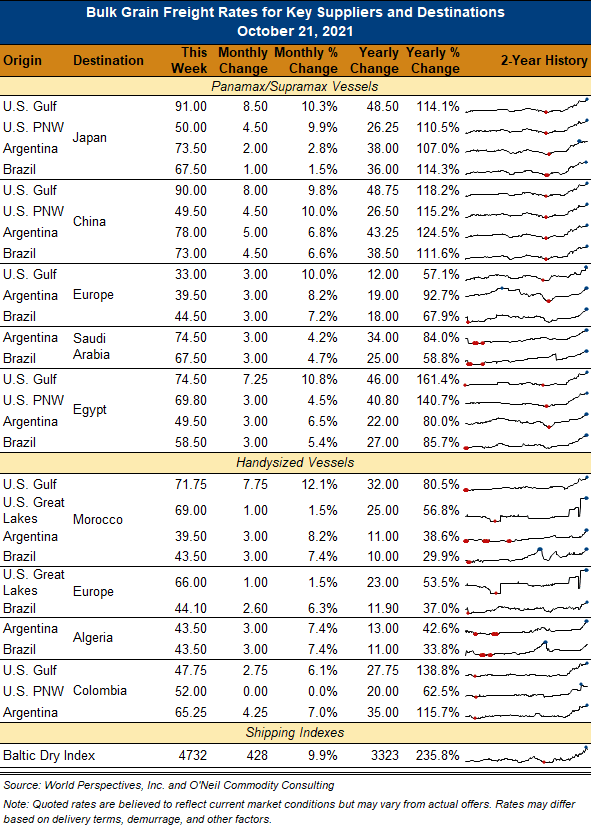

This week, Capesize paper markets experienced a substantial decline as paper sellers took profits. Daily hire rates slipped from $85,000/day down to $50,000/day. Panamax and Supramax markets showed better support and ended the week at $38,000/day. I view this as more of a technical correction than a turn to bearish conditions. The overall trend in physical markets still seems to be moving upward. Notably, available of freight from the U.S. Gulf to the Caribbean and East Coast Central America is very tight and rates are higher for the week.

Container rates remain steady but the backlog of waiting ships off the U.S. west coast continues to grow and logistics remain a mess.