Chicago Board of Trade Market News

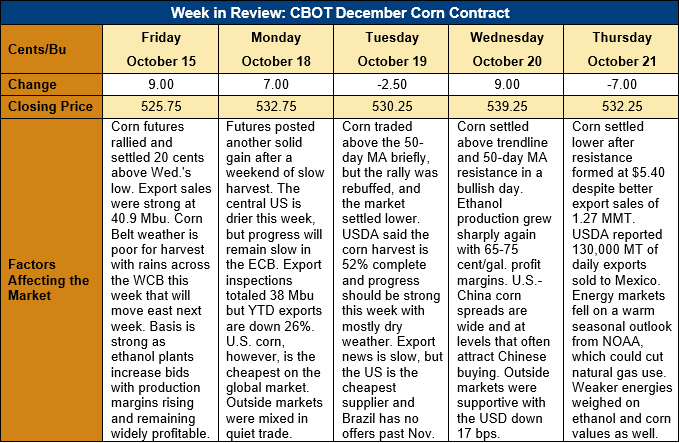

Outlook: December corn futures are 6.5 cents (1.2 percent) higher this week as the market recovered from its October WASDE selloff due to stronger export sales and firming Midwest basis. The market remains in a sideways trading pattern as funds are neither chasing rallies nor selling breaks and U.S. farmers are storing grain, rather than marketing it immediately after harvest. Market fundamentals remain supportive, however, with demand for U.S. corn starting to trend higher.

Ethanol production has increased by 5 percent or more in each of the past three weeks, with average daily output reaching 1.096 million barrels for the week ending October 15, 2021. That production figure was up 20 percent from the same week in 2020 and the estimated 2021/22 cumulative corn grind (17.461 MT or 687.4 Mbu) is up 6 percent YTD. Ethanol production margins have hit multi-year highs due to rising energy prices and steady new crop corn prices. Positive ethanol margins are prompting firms to increase their bids for cash corn, pushing basis levels higher.

Across the Midwest, basis was steady at -17Z (17 cents below December futures) last week and above the -22Z recorded this time last year. Typically, basis decreases as harvest progress advances, but an uptick in export sales plus the increase in ethanol run rates is keeping basis firm this year.

A bout of cold, rainy weather last week (including snow for parts of North Dakota) stalled some of the U.S. corn harvest, with USDA reporting 52 percent of the crop harvested as of Sunday night. That is above the average pace of 41 percent completion but was below analysts’ pre-report expectations. This week’s weather is favorable for harvest and next week’s Crop Progress report should feature a large weekly gain.

U.S. corn is the lowest cost origin on the world export market currently and that was reflected in the weekly Export Sales report. USDA reported 1.273 MMT of net export sales for the week ending October 14, which was up 22 percent from the prior week. Weekly exports totaled 1.041 MMT and were up 13 percent. YTD exports are down 17 percent due primarily to the Hurricane Ida-induced slowdown in U.S. Gulf export activity, but YTD bookings (exports plus unshipped sales) are up 2 percent. Brokers report they expect U.S. sales and shipments to increase further in the coming weeks due to the discount U.S. corn holds to competing origins.

From a technical standpoint, December corn futures posted a near-term low on October 13, the day after the October WASDE, and have since recovered all of the post-WASDE losses. The contract is trading a $5.06 to 5.48 ½ range and broke short-term trendline resistance at $5.30 ½ on Wednesday. The market is now facing resistance at $5.40, which stalled rallies both Wednesday and Thursday this week. The market is decidedly in a range-bound pattern, but the seasonal tendency is for corn to grind higher following harvest. That trend, combined with rising ethanol corn consumption and stronger export demand, suggests corn futures will continue to find support on breaks and gradually grind higher.