Distiller’s Dried Grains with Solubles (DDGS)

DDGS Comments:

U.S. DDGS prices are down $4/MT this week, trading within their recent, sideways range. Two weeks of strong gains in ethanol production have increased spot DDGS supplies and created modest pressure on prices. Kansas City soymeal prices are down $5/MT this week as the futures market remains weak and a headwind for cash values. The DDGS/Kansas City soymeal ratio sits at 0.57 this week, steady with the prior week and above the three-year average of 0.47. The DDGS/cash corn ratio is higher this week at 1.04, up from 1.02 last week but below the three-year average of 1.09.

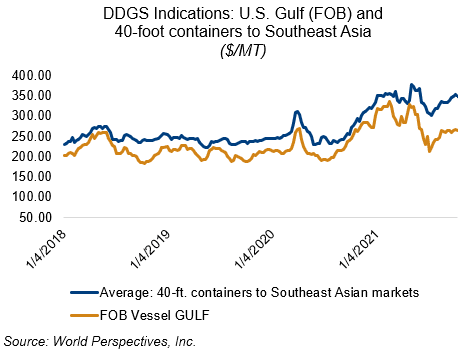

On the export market, DDGS values are slightly lower with Barge CIF NOLA rates down $4-5/MT for Q4 shipment and down $1/MT for January 2022. A gradual weakening of CIF rates has helped CIF Gulf DDGS values ease lower as well. FOB Gulf offers are down $1/MT this week, on average, with the bid-ask spread widening slightly. Container freight rates have leveled off or posted small declines this week, which has allowed offers for 40-foot containers to move some $4/MT lower this week. Brokers say Asian demand remains quiet for containerized DDGS, but it is expected to increase later this fall.

Please note that FOB Gulf markets will likely be more volatile than normal as the industry works to recover full capacity in New Orleans area export facilities. There are significant questions about elevation capacity and availability and the DDGS market will have to compete with other grains as the U.S. new crop harvest approaches. Consequently, both flat prices and spreads versus other markets may see greater than normal volatility.