Chicago Board of Trade Market News

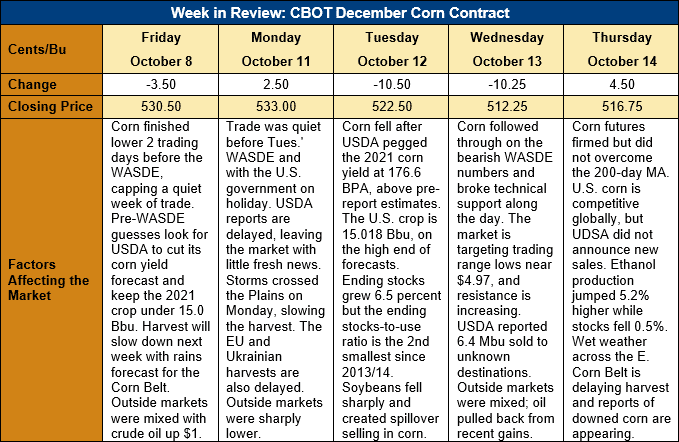

Outlook: December corn futures are 13.75 cents (2.6 percent) lower this week after the October WASDE report featured bearish numbers for the U.S. balance sheet. USDA increased its yield and ending stocks forecasts for the 2021 U.S. corn crop, which has since pressured futures. Notably, however, the record-large U.S. soybean crop created a larger selloff in that market, with spillover selling further pressuring corn futures.

USDA estimated the 2021 U.S. corn yield at 11.079 MT/ha (176.6 bushels/acre) a slight increase from the September WASDE and the opposite of analysts’ pre-report expectations. USDA left its harvested area estimate unchanged, which meant 2021 corn production increased to 381.489 MMT (15.018 billion bushels). The production estimate was on the high end of analysts’ pre-report estimates and helped foster a bearish interpretation. Total U.S. supplies for 2021/22 increased by 1.829 MMT (72 million bushels) as USDA increased beginning stocks based on the September 30 Grain Stocks report figures.

On the demand side, USDA increased the U.S. export forecast by 0.635 MMT (25 million bushels) due to “reduced competition from other major exporters”. If correct, that number would be the third largest export program in U.S. history. USDA cut feed and residual use based on the disappearance indicated in the recent Grain Stocks report.

In total, USDA added 2.337 MMT (92 million bushels or 6.5 percent) to the 2021/22 U.S. ending stocks estimate. The ending stocks-to-use ratio (10.1 percent), however, while greater than 2020/21 levels, is still the second smallest since 2013/14, reflecting continued tightness in the U.S. balance sheet.

Outside the U.S., the October WASDE reflects USDA’s expectation for world corn supplies to increase in the coming year. World corn production was increased 0.448 MMT and world ending stocks increased 4.1 MMT due to larger carry-out estimates for the U.S. and China. World corn ending stocks are up from 2020/21 levels but the second smallest since 2014/15.

The U.S. corn harvest continues to make strong progress under generally favorable weather conditions. Some recent rains across the Upper Midwest and Eastern Corn Belt have delayed progress, but other regions have seen dry, warm conditions. On Tuesday, the USDA said 94 percent of the U.S. corn crop was mature, 8 percent ahead of the normal pace, while 41 percent was harvested. The harvest rate is 10 percent ahead of the five-year average pace.

Despite the quick harvest progress, basis levels have firmed in recent weeks, thanks to stronger exports from the U.S. Gulf. The average Midwest basis was -16Z this week (16 cents under December futures), up from -18Z last week and above the -24Z record this time last year.

From a technical standpoint, December corn futures exited their pre-WASDE trading range to the downside and found support (temporarily, at least) at $5.06 on Wednesday. The market is now trying to find another trading range and major technical support at the 10 September daily low ($4.97 ½) will likely form that range’s floor. On the high side, the 30 September daily high ($5.48) will likely form the trading range ceiling, though short-term trendline resistance lies between Thursday’s close and that level.

The market is in an interesting technical position as downward pressure is increasing but cash and commercial buying interest is robust on breaks. A large round of fund liquidation was noted Tuesday and Wednesday, but much of that selling came from weak longs whose positions were newly underwater. There are plenty of old, strong longs still left in the market, which may keep corn futures protected from liquidation selling.