Ocean Freight Markets and Spreads

Ocean Freight Comments

After three days, the International Longshore Association (ILA) “paused” its strike against the U.S. Maritime Alliance at ports and terminals on the U.S. East and Gulf Coasts. It was reported that the contract between both sides is related to wages. This contract expires in ninety days, essentially on January 15. Work resumed at the ports and terminals on October 4. There remain several outstanding issues, mainly on automation that is a major point of contention. Issues at East and Gulf ports and terminals are far from over.

While the Houthi terrorist organization has not attacked vessels transiting the Red Sea in recent weeks, they continue to attack Israeli ports and terminals. The U.S. led miliary alliance continues to destroy Houthi drones and missiles. In the meantime, vessel owners and operators continue to bypass the Red Sea to minimize attacks and to protect their crews.

Russia attacked three vessels loaded with Ukraine grain in the Black Sea this week. Reportedly, Russia has also attacked Ukraine’s port infrastructure nearly 60 times in the last three months. Vessel owners and operators are avoiding the Black Sea, especially accessing ports in Ukraine. War risk premiums and insurance costs are higher, up about 30% this week for vessels calling on Ukraine ports.

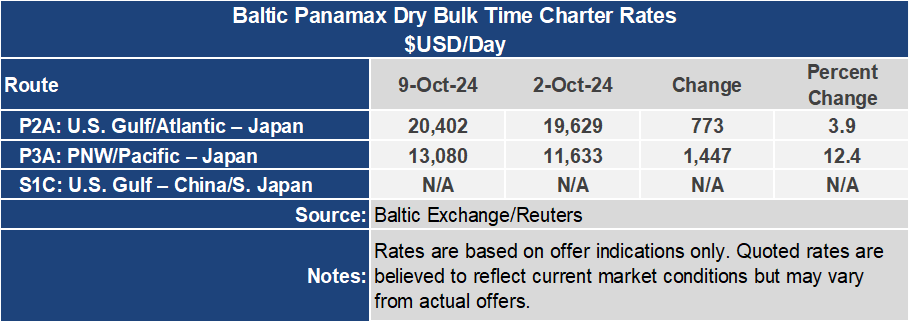

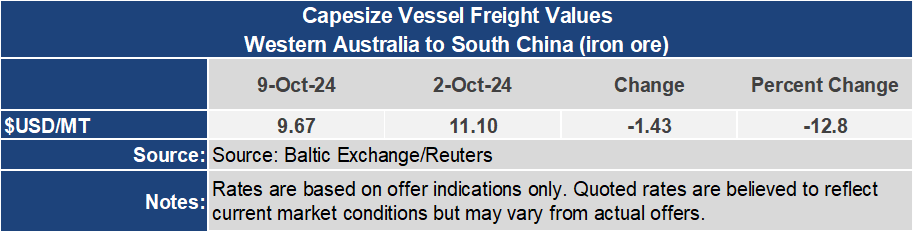

Demand for Capesize vessels has stalled, leading to an 18% or 613-point drop in the Capesize Baltic Index this week to 2,786. This is the lowest level for the Capesize market since late August. Baltic Dry Index lost 9% or 179 points this week to an index of 1,799. The Panamax sector was up 6.8% or 93 points to an index of 1,457. The Baltic Supramax Index was mostly unchanged at 1,270.

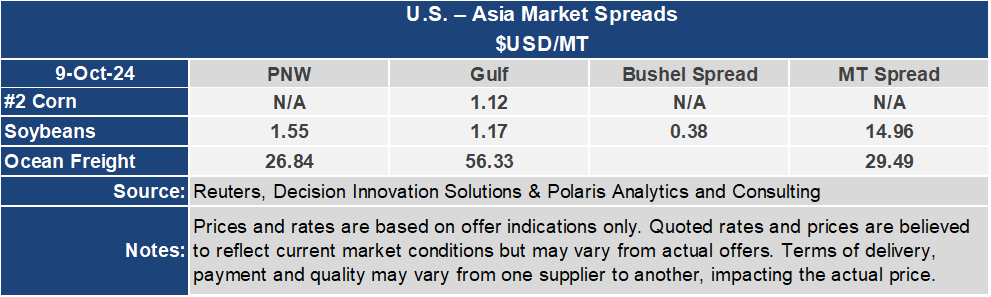

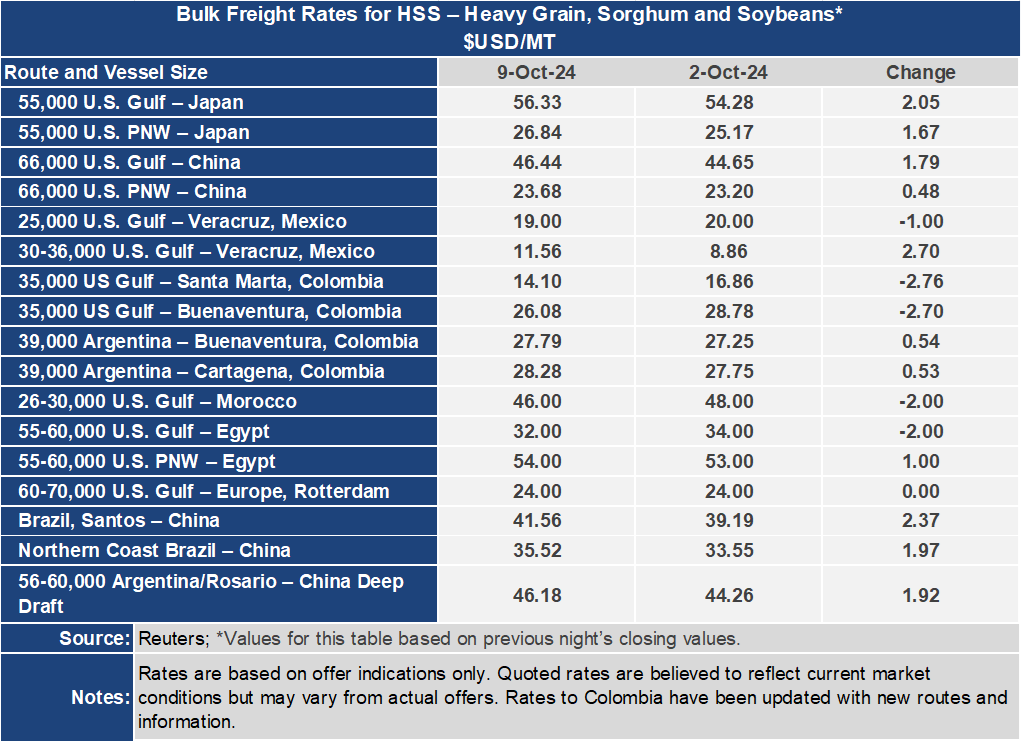

Voyage grain rates were mostly higher this week. The U.S. Gulf to Japan freight rate was up $2.05 per metric ton or 3.8% for the week to $56.33 per metric ton. From the Pacific Northwest the rate gained 4% or $1.79 per metric ton at $26.84 per metric ton. The spread between these key grain routes widened 1.3% or $0.38 per metric ton to $29.49 per metric ton. Both routes are quoted using vessels loaded with 55,000 metric tons.

To China the rate from the U.S. Gulf was $46.44 per metric ton for the week, gaining $1.79 per metric ton or 4%. From the PNW, the rate increased $0.48 per metric ton or 2.1% to $23.68 per metric ton this week. The spread on this route widened by 6.1% or $1.31 per metric ton to $22.76 per metric ton. Both routes to China are quoted using vessels loaded with 66,000 metric tons.

Despite firmness to Asia from the U.S. Gulf, ocean rates to Central and Latin America, and North Africa were weaker for the week.

Container freight rates for forty-foot equivalent containers from the U.S. West Coast to the Far East jumped 13% on the first day of the ILA strike, to an index of 738 on October 1. By October 7 the rate retreated 4.5% to an index of 705. The rate on this route had been in a long steady decline since its last peak in May. Container availability plummeted in Long Beach as shippers shifted cargo through the Southern California ports.

The rate for forty-foot equivalent containers from the U.S. East Coast to the Far East was stronger as well, up 5.5% on the first day of the strike to an index of 593, and as of October 7 eased to 570 points.