Chicago Board of Trade Market News

Outlook

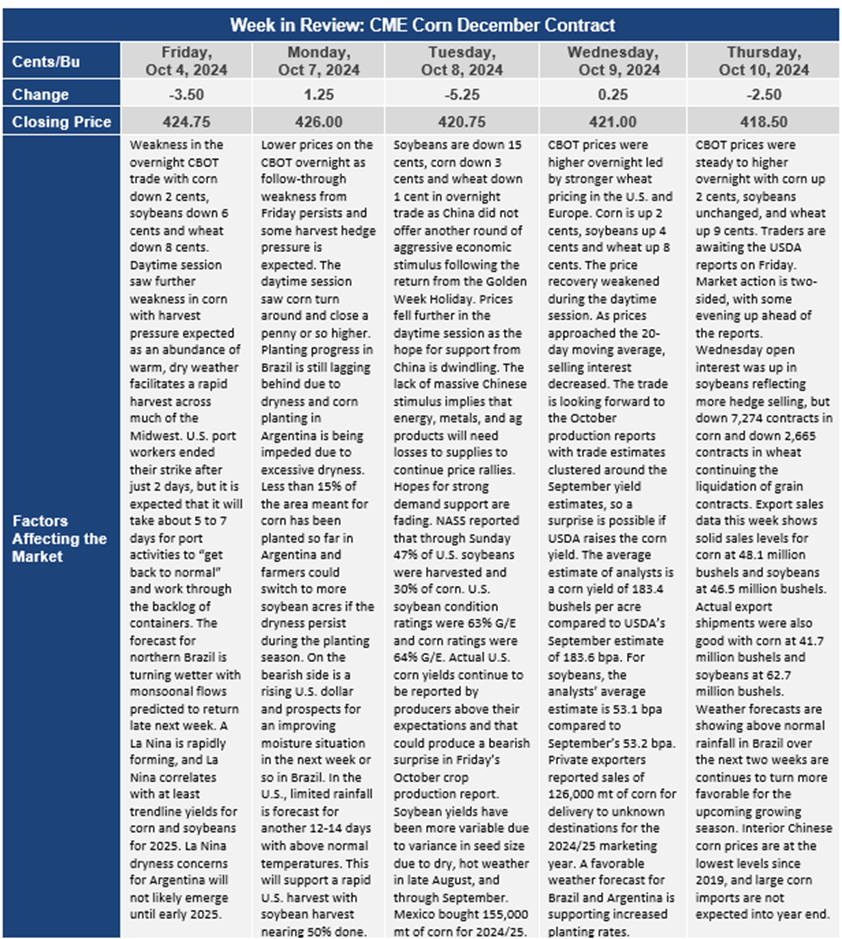

Trade analysts are expecting little change from September in the October crop production reports. The average analysts’ estimates for corn production is 15.155 billion bushels on a national yield of 183.4 bushels per acre. The range of estimates is from 15.0 billion bushels to 15.258 billion bushels of corn. The average estimate would be 31 million bushels less than the September USDA estimate and could set up a bearish surprise if the anecdotal producer reports of better than expected yields is borne out by a higher USDA October estimate. The old adage of “big crops get bigger” could play out this year.

For soybeans, the average of the analysts’ estimates is a U.S. crop of 4.579 billion bushels, down 7 million bushels from the September USDA estimate of 4.586 billion bushels. The range of estimates is from 4.462 billion bushels to 4.66 billion bushels. The estimated yield for soybeans is 53.1 bushels per acre, down 0.1 bushel per acre from the September estimate.

Analysts expect grain stocks for corn to be 1.962 billion bushels which compares to the latest USDA ending stocks estimate of 2.057 billion bushels. The range on corn stocks is 1.835 to 2.100 billion bushels. Soybean stocks are expected to be 549 million bushels, just 1 million bushels less than the current USDA ending stocks estimate of 550 million bushels. The range is 486 million bushels to 660 million bushels.

World corn stocks are estimated to be 306.83 mmt which compares to USDA’s latest estimate of 308.35 mmt. World soybean stocks are expected to be 134.53 mmt, compared to 134.58 mmt in USDA’s latest estimate.

Some of the world’s “dry” grain areas for 2024 are now seeing more moisture. Western Europe gets soaked by tropical storm Kirk with 2 to 4 inches of rain across France and western Germany. An improved Black Sea area forecast and welcomed rain is forecast for the western half of Ukraine and regular chances of rain in eastern Ukraine and southern Russia over the next 10 days. Substantial autumn/winter precipitation will be needed to end the Black Sea drought, but enough rain is being received to accelerate winer crop planting. The South American drought is ending with a substantial moisture boost expected through the end of October and intensifying into the end of the year. Mato Grosso precipitation of 3 inches is expected October 1 through October 21 versus just 1 inch last year. November climate guidance features a relative cooling of temperatures in Brazil and near to above normal rainfall. Equally important is that shower activity will be spread across much of Argentina over the next 10 days.

The recent rally in CBOT corn and soybean prices was driven by shortcovering by commodity funds, expectations of Chinese economic stimulus and fears of delayed rainfall in South America. Shortcovering by funds is likely exhausted, China is stimulating less than many had hoped, and rain clouds are moving across the crop areas of Brazil and Argentina. The U.S. Central Plains are dry and getting drier but with a large harvest rapidly filling the storage in the U.S., corn prices will likely go into a trading range of $4.00 to $4.30 basis the December contract through November. Longer term, corn price will likely gain on soybean price.