Chicago Board of Trade Market News

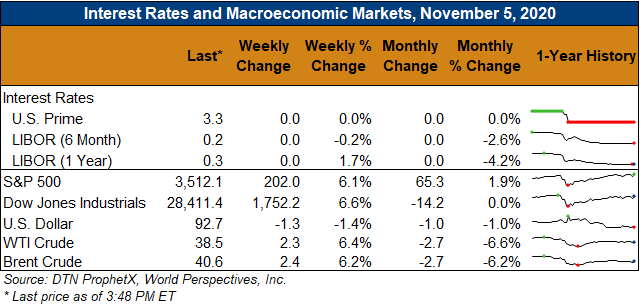

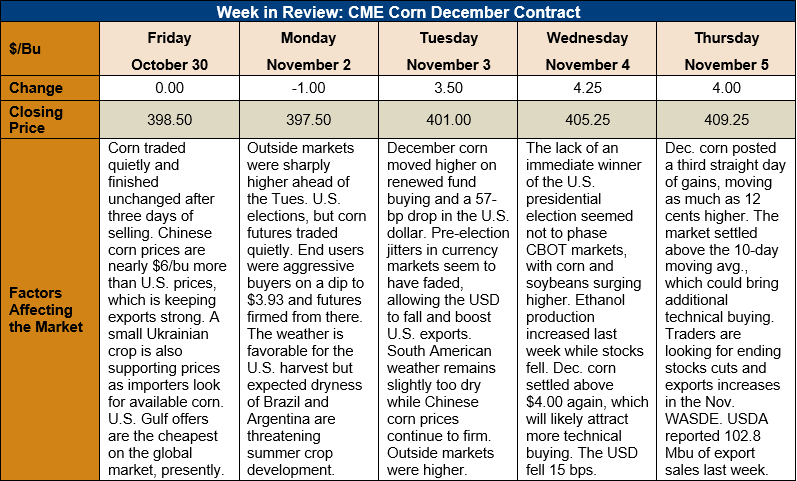

Outlook: December corn futures are 10 ¾ cents (2.7 percent) higher this week as last week’s pullback found strong end-user and technical support. That support allowed prices to rally this week and push towards their October highs once again. The weather in South America remains supportive for CBOT trade, with a dry pattern setting up for Brazil and Argentina. Strong U.S. exports and signs of ample feed demand around the world are further fueling bullish sentiments.

Thursday’s Export Sales report from USDA showed 2.61 MMT of net export sales for the week ending October 29, up 16 percent from the prior week. Weaker corn futures during that week prompted importers to become aggressive procuring U.S. corn. FOB Gulf is the cheapest origin presently, which should continue to boost U.S. export sales.

Weekly corn exports totaled 728,800 MT, down 1 percent from the prior week but enough to put YTD shipments at 6.853 MMT. YTD exports are up 74 percent. Total export bookings (exports plus unshipped sales) stand at 33.189 MMT, up 179 percent.

Sorghum exports totaled 94,900 MT last week, up 68 percent from the prior week and enough to keep YTD shipments at 614,800 MT. YTD sorghum exports are up 1,231 percent while YTD bookings total 3.641 MMT, up 576 percent.

The 2020 U.S. corn harvest is entering its final phase with USDA reporting 82 percent was harvested as of Sunday night. U.S. farmers have made quick, early progress this year and harvest is above the average completion rate of 69 percent. Weather has been favorable this week for continued field work and next week’s Crop Progress report should show another large gain in harvest completion.

Despite the strong harvest pace, U.S. cash corn and basis levels have shown few signs of harvest pressure. The U.S.-average corn price is up 2 percent this week at $150.05/MT ($3.86/bushel) and basis levels have firmed to 19 cents under December futures (-19Z). This time last year the average basis was -39Z, which highlights how the aggressive export program is prompting commercial grain firms to be similarly aggressive procuring grain to keep the export pipeline full.

From a technical standpoint, last week’s hook reversal and subsequent selloff look to have been stopped by strong end-user buying. December futures found support at $3.93, just a few cents above long-term trendline support, and have since rallied and posted three consecutive closes above $4.00. This price action shows the underlying strength of the bull market, which is prompting funds to once again extend their long corn positions. Traders and analysts are looking for USDA to increase the U.S. corn export program and further tighten 2020/21 ending stocks. That outlook is also keeping prices moving higher.