Ocean Freight Markets and Spreads

Ocean Freight Comments

Houthis attacks on merchant vessels plying the Red Sea, Indian Ocean and around the Arabian Peninsula were quiet this week. The U.S. Central Command together with the British Navy has intercepted Houthis anti-ship ballistic missiles and aerial drones. The Houthis are claiming solidarity with Hamas and Palestine, vowing to continue their attacks until a ceasefire from Israel is started or Israel pulls out of Gaza. Ship owners and operators have adjusted their routes, taking an extended route around the Cape of Good Hope between South Asia and Europe, the Mediterranean and elsewhere. The longer distance does increase shipping costs due to more sailing days and fuel consumption, and tightened vessel capacity utilization.

Water levels in Panama’s Gatun Lake remain steady to slightly higher than the previous week. The dry season is expected to end this month with the rainy season to get underway. The low water levels resulted from an extended El Nino that limited rain events. Gatun Lake is used as a reservoir for the Panama Canal locks and municipal water. Because of the low water levels the Panama Canal Authority restricted vessel transits through its two lock systems (Panamax and Neopanamax) and vessel draft levels through the Neopanamax locks the past year. The ACP announced it will be adding transit slots to 32 available by June 1, up from 27 now. When water levels are adequate, transits average about 36 per day. Because the Panama Canal is an important economic machine for Panama, the president-elect Jose Raul Mulino is calling for a law to build larger water reservoirs to assure vessel transits are not hindered as they were during the El Nino induced drought of the previous year.

Meanwhile, Nicaragua repealed a law that gave a Chinese investor a 100-year concession to build and run a canal between the Atlantic and Pacific Oceans. The law was put into effect in 2012 to have a revenue source for the country. However, the investor who originally planned to have the canal built by 2019 lost much of his net worth and did not commit to the project. The cost of the canal was estimated at $50 billion at the time. The repeal removed the concession from the Chinese investor but keeps in place the plan to build the canal.

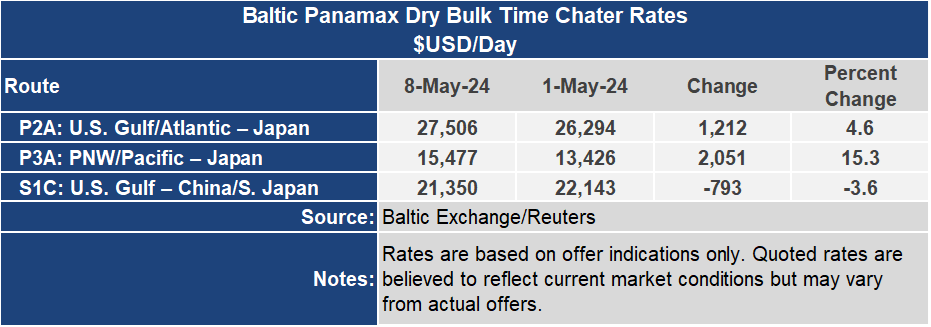

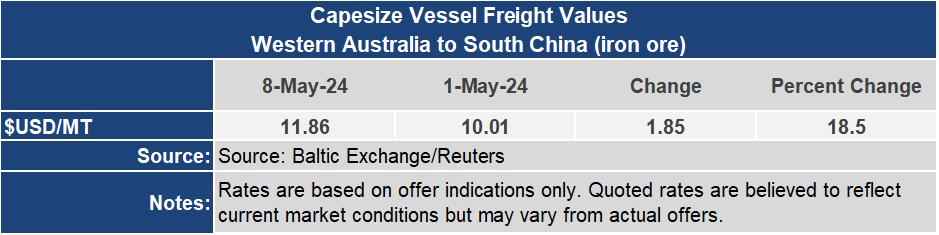

The Baltic dry indices continue to bounce up and down from one week to the next. This week they bounced higher on renewed interest in the Capesize sector, which pulls all the other sectors with it. The Baltic Dry Index finished this week through May 8 up 31% or 515 points to an index of 2,203. This is the highest BDI level since March 21. The Capesize jumped a whopping 67% or 1,425 points on the week to an index of 3,541. The Capsize market found optimism hauling iron ore to China following its Labor Day holiday and demand for steel. The Capesize and Panamax markets could find further strength with India burning more coal for electricity generation during its on-going heatwave. The Panamax market was up 9% for the week to a reading of 2,005 while the Surpramax was essentially unchanged at an index of 711.

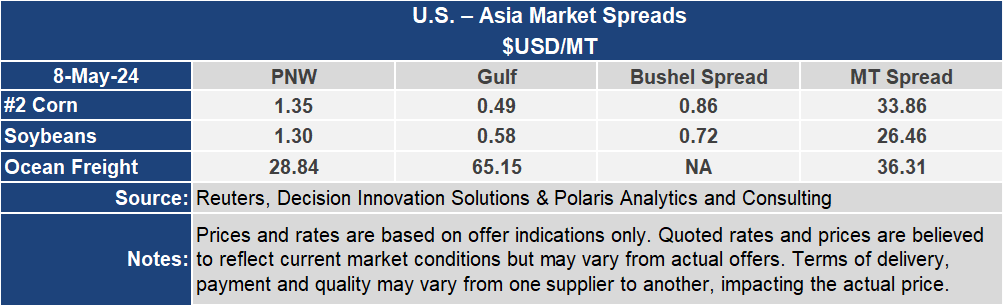

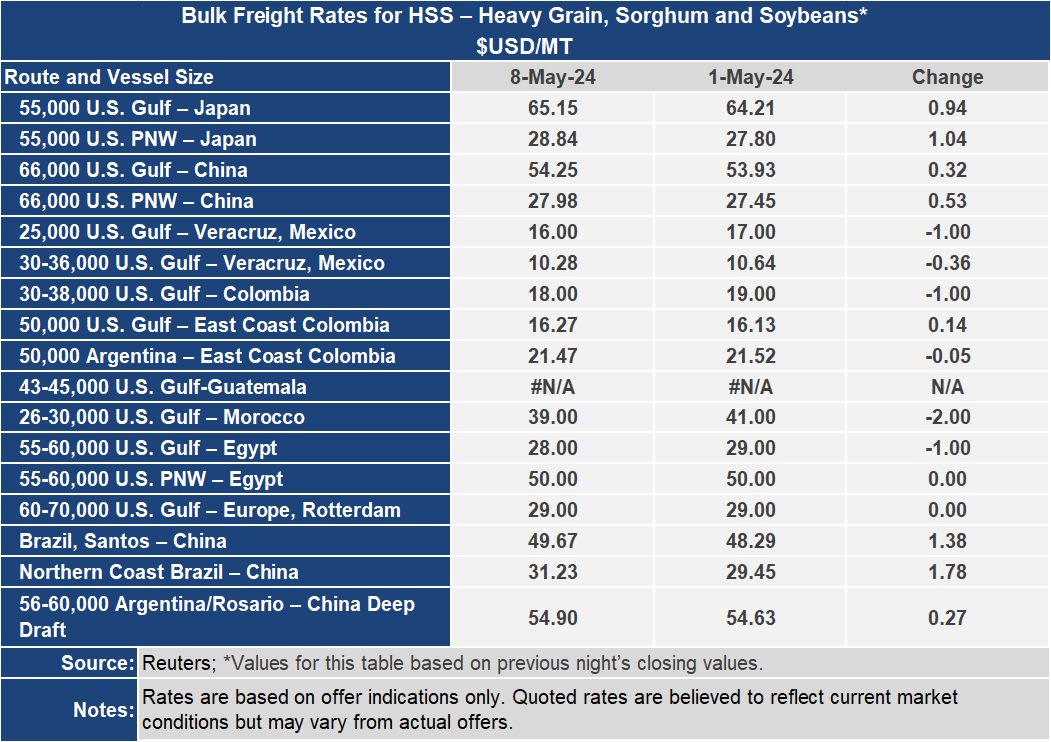

Voyage freight rates followed the Baltic indices higher except to certain Latin American and North Africa markets. On the U.S. Gulf to Japan grain route the rate was up nearly one dollar per metric ton for the week to $65.15 while the route of the Pacific Northwest was up more than one dollar to $28.84. The spread between these key grain routes narrowed slightly for the week to $36.31 per metric ton. To Latin American rates were down on the smaller vessel sizes.