Chicago Board of Trade Market News

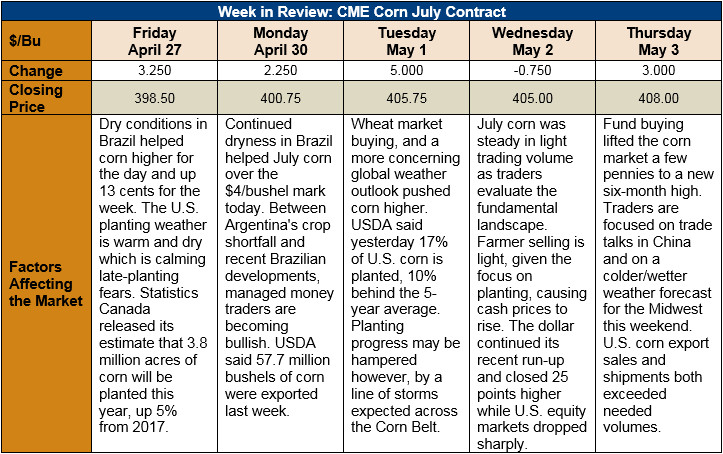

Outlook: Global weather is largely responsible for July corn futures’ 23-cent rally over the past two weeks. Between dryness in Brazil that threatens the safrinha corn crop and drought across the U.S. Southern Plains and Australia causing trouble for the wheat crops, grain bulls now have better fundamentals to justify their position. Granted, the weather is certainly more dire for the wheat crops, and rising wheat futures have created spillover buying in the corn market. While this dynamic is of little importance to fundamental traders, it has created interesting technical developments.

From a technical perspective, July corn is in a short-term uptrend but hitting resistance near the $4.10/bushel range. The contract has traded through and closed above many moving averages (MAs), including the 200-day MA on the weekly chart. This leaves the next upside target as $4.25/bushel once nearby resistance at $4.10 is broken. On the downside, the 10-, 20- and 40-day Mas are in a range between $3.93-$3.97 and will offer key support within this range. Notably, the trend is decidedly more bullish for December corn futures where resistance at $4.18 was breached, leaving $4.30 as the next technical target.

The fundamentals are supportive for corn futures as well. USDA reported 17 percent of the U.S. crop was planted as of Monday, 10 percent behind the 5-year average. Planting delays this early in the crop year correlate poorly to final yields but should planting fall further behind in the coming month, yield prospects could be reduced.

This week’s Export Sales report from was neutral/bullish the corn market with 1.019 MMT of net sales and 1.474 MMT of shipments. YTD bookings (outstanding sales plus shipments) are down only 2 percent from last year while exports are down 17 percent. USDA’s 2017/18 export forecast calls for a 3 percent year-over-year reduction in exports.