Ocean Freight Markets and Spreads

Ocean Freight Comments

The Unified Command leading recovery efforts of the m/v Dali, Francis Scott Key Bridge and navigational channels successfully moved Dali from the main channel this week. Navigation can resume a 50-foot draft on a 400-foot-horizontal clearance. The full horizontal clearance should be available by the end of May. However, this channel reopening essentially brings full and immediate relief to access the Port of Baltimore. There will be intermittent restrictions while recovery efforts continue.

Attacks by the Houthis terrorist group continue, but with little success this week. Since they started targeting vessels plying the Red Sea in October 2023, many vessel owners and operators have altered their sailing schedules to avoid the Red Sea and Arabian Peninsula. Vessels are being diverted on longer routes around the Cape of Good Hope, which adds costs and leads to higher freight rates. The U.S. Central Command continues to destroy the Houthis drones and inbound anti-ship ballistic missiles.

Water levels in Panama’s Gatun Lake are slowly rising, pegging 80.9 feet as of May 23, the highest level since February 22. The conditions are expected to improve further as Panama is entering its rainy season that will bring much relief to the drought experienced over the past year. Vessel transits are firming. The Panama Canal Authority will be increasing daily vessel transits to 32 starting June 1, up from 31 at present. The number of daily transits through Panama Canal average about 36.

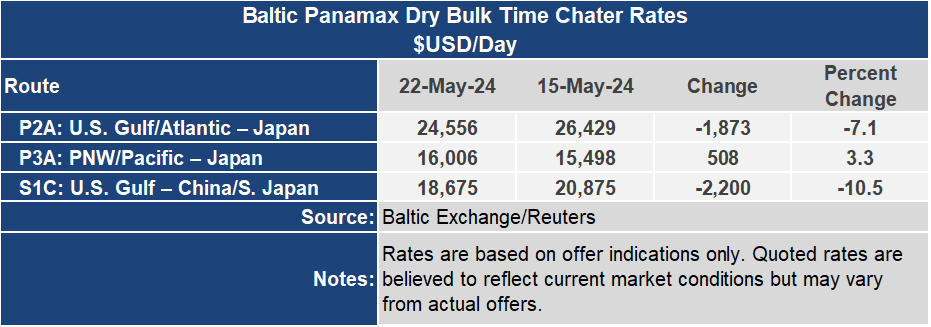

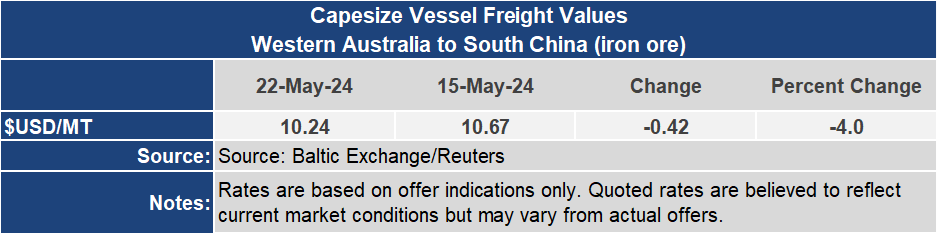

This week the Baltic dry indices remained negative with the Baltic Dry Index, the basket index for dry bulk cargo vessels of all sizes, dropped 4.5% to an index of 1,804. The Capesize sector was down 4.3% to an index of 2,584, and is a major component of the BDI, greatly influencing it. The Panamax market ended the week down 4% to an index of 1,831 and the Supramax sector was 5.6% lower to an index of 686.

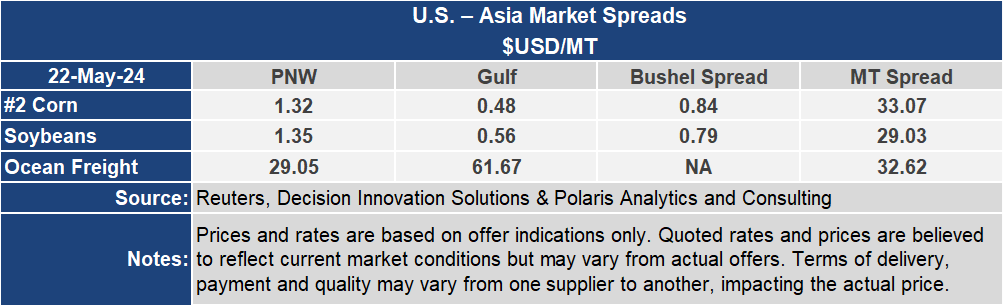

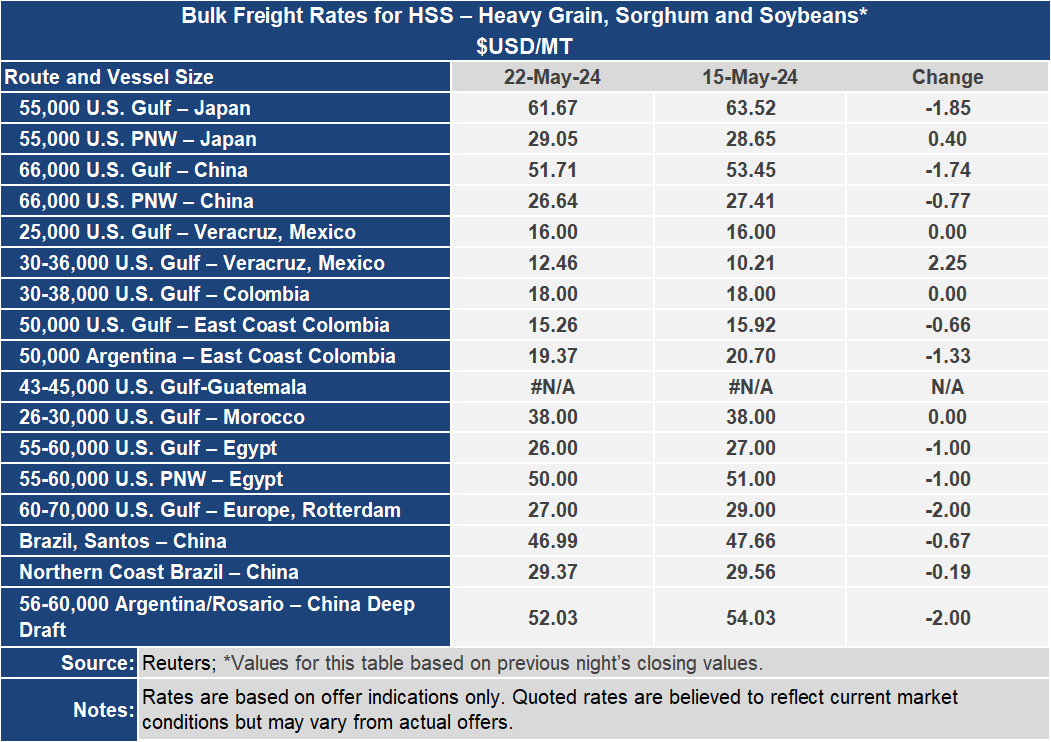

Despite the on-going weakness of the Baltic indices, voyage rates were mixed this week. The rate from the U.S. Gulf to Japan dropped 3% or $1.85 per metric ton to $61.67, its lowest level since April 11. On the Pacific Northwest to Japan route, it firmed up 1.4% or $0.40 per metric ton to $29.05. The spread between these venerable routes narrowed 6.5% or $2.25 per metric ton to $32.62. On the routes to China rates were lower from both the Gulf, down 3.3% to $51.71 per metric ton while the PNW rate declined 2.8% to $26.64. The freight spread to China narrowed 3.7% to $25.07 per metric ton.

Container rates to the United States West Coast from Asia Far East have been rising, hitting an index of 4,025 for a forty-foot equivalent container, the highest level since March 11, but below the recent peak of 4,777 on February 15. On the westbound routes from the U.S. to the Far East, the rate from the West Coast, its index has dropped 10% from a recent high of 800 in early May to 723 most recently. From the East Coast, the rate has risen 9% from its low in early April to an index of 465. With container carriers diverting vessels away from the Red Sea, slowing vessel speeds and experiencing some improved demand, vessel capacity utilization has tightened.