Chicago Board of Trade Market News

Outlook

Recent frosts in eastern, northern, and central Ukraine didn’t cause significant damage to grain and oilseed crops according to a state weather forecaster in Ukraine. Some damage to early seedlings of corn and sunflower has been seen but in relatively localized areas. Wheat and other frost-tolerant cereals should be able to pass through minor frosts, but final assessments won’t be known until harvest time. The situation in Ukraine was much better than in Russia, where frost damaged significant crop areas.

IKAR cut its forecast for Russia’s wheat crop another 2.5 MMT to 83.5 MMT after a “more exact assessment of frost damage and dryness across the south.” Total grain production is now forecast at 132 MMT, down 3 MMT from its prior outlook. The ag consultancy lowered its 2024-25 Russian wheat export projection by 2 MMT to 45 MMT. Total grain exports are now forecast at 57 MMT, down 2.5 MMT.

South American crop consultant Dr. Cordonnier left his Argentine crop estimates at 47 MMT for corn and 50 MMT for soybeans though he thinks the estimates may decline further as harvest progresses. For Brazil, Cordonnier left his crop forecasts at 112 MMT for corn and 147 MMT for soybeans with a neutral bias toward both.

In the U.S., excessive moisture is slowing planting progress in the Midwest and leading to poor crop conditions for crops in the Gulf states. River bottoms in many areas of Iowa are seeing flooding after recent heavy rains. Corn futures are adding risk premium as the odds of a reduction in U.S. corn acres are increasing while drought deepens and expands in Mexico. Mexico has become the U.S.’s largest market for corn and is rapidly becoming one of the largest markets for imported corn in the world. Adverse weather is capping Mexican corn production and the expected carryover supplies are dwindling to about 16 days of consumption. Any loss of production in Mexico is likely to be met with a similar increase in imports, a vast majority of which will be sourced from the U.S.

China will offer nationwide full-cost, planting income insurance policies for rice, wheat and corn. The policies are aimed at improving crop insurance protection, stabilizing farmers’ income, supporting the revitalization of rural areas and better safeguarding food security. This action should be supportive of plantings for these staples both this year and in the future.

Private exporters reported sales activities of 113,050 metric tons of corn for delivery to Mexico. Of the total, 56,525 metric tons are for delivery during the 2023/2024 marketing year and 56,525 metric tons are for delivery during the 2024/2025 marketing year. Sales of 110,000 metric tons of corn for delivery to Spain during the 2023/2024 marketing year were also reported.

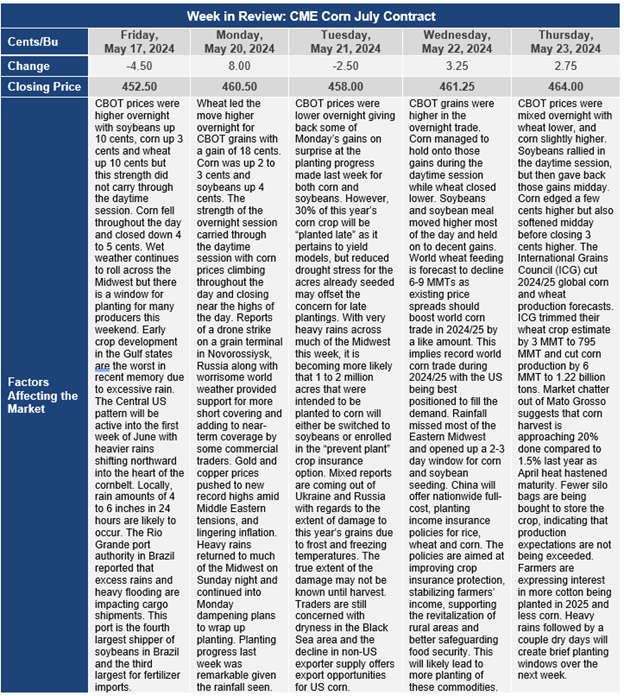

On Monday, with the corn market rising 8 cents per bushel, funds were net buyers of 10,000 contracts of corn, 9,000 of soybeans, 4,000 of soybean meal and 5,000 of soybean oil and 13,000 of wheat. It is

now estimated that the funds are short 23,000 contracts of Chicago wheat, 75,000 of corn, 30,000 of soybeans and 56,000 of soybean oil, and long 99,000 of soybean meal. The funds’ net short position was reduced to 85,000 contracts.