Ocean Freight Markets and Spreads

Ocean Freight Comments

The Houthis continue to exert their presence in the Indian Ocean by attacking the M/V MSC Orion container ship, claiming its owner is partly owned by an Israeli businessman. Based on industry sources and various vessel reporting services, the facts do not support the claim and the attack, calling into question the ongoing intent of the Houthis. Meanwhile they continue their attacks in the Red Sea too, targeting one merchant marine vessel and two U.S. destroyers this week. The incessant attacks will continue to drive vessel owners and operators away from the Arabian Peninsula, opting for longer routes and more sea days. There is over capacity among several vessel types that helps keep freight rates subdued, but as conditions change and demand rebounds, the impact will be higher freight rates as vessel utilization rates tighten.

The Port of Baltimore’s temporary navigation channel that accommodates larger vessels is not presently available, however another channel is being prepared. The U.S. Coast Guard, Army Corps of Engineers and the Port of Baltimore are preparing to open an access channel on May 10 with a draft of 45 feet and would be available from 8 pm ET to 7 am ET daily. The goal is to fully reopen the port by the end of May.

Vessel transits at the Panama Canal remain weak but water levels are improving in Gatun Lake. It seems the worst of the dry season is fading away as water levels in Gatun Lake had been steady for several weeks and in the most current week improved to the highest level since late March. Seasonally, the lowest levels are during May. Over the next month the Panama Canal Authority will be adding transit slots, striving to have 32 available by June 1.

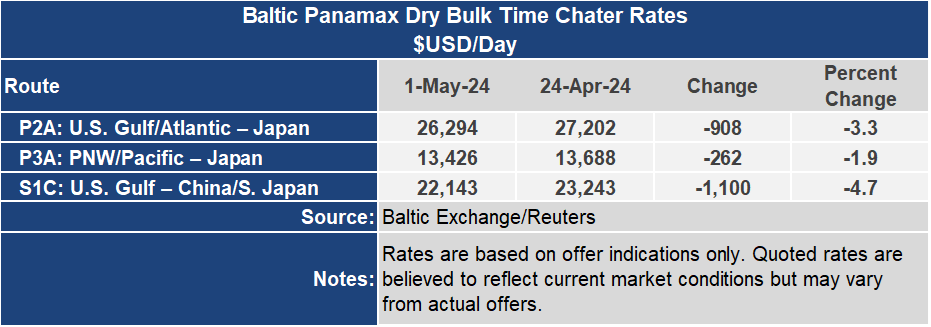

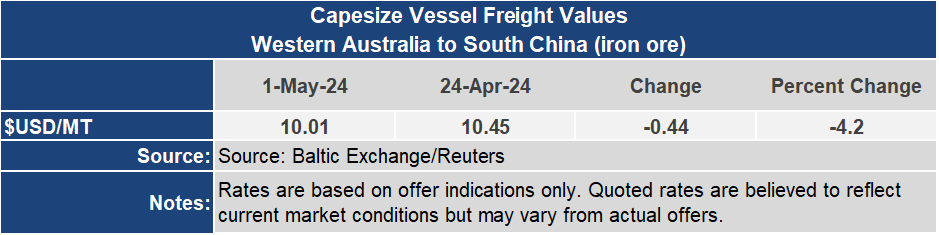

The Baltic Dry Index kept a weak tone this last week, dropping nearly 5% to an index of 1,688. The Capesize sector is pulling the BDI lower, falling 10% on the week to an index of 2,116. The Panamax sector was weaker too, down 3% to an index of 1,847. The Supramax class held its own water this week, up nearly 2% to an index reading of 742. Cargo volumes have been anemic and what is on the horizon looks uncertain. However, the Forward Freight Assessments point to firmness going into the second half of 2024.

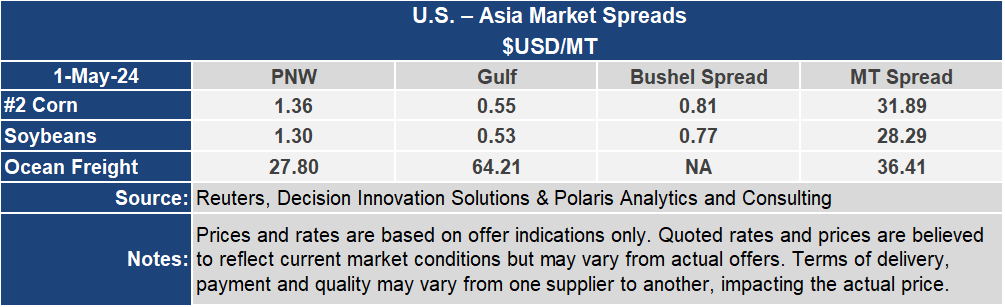

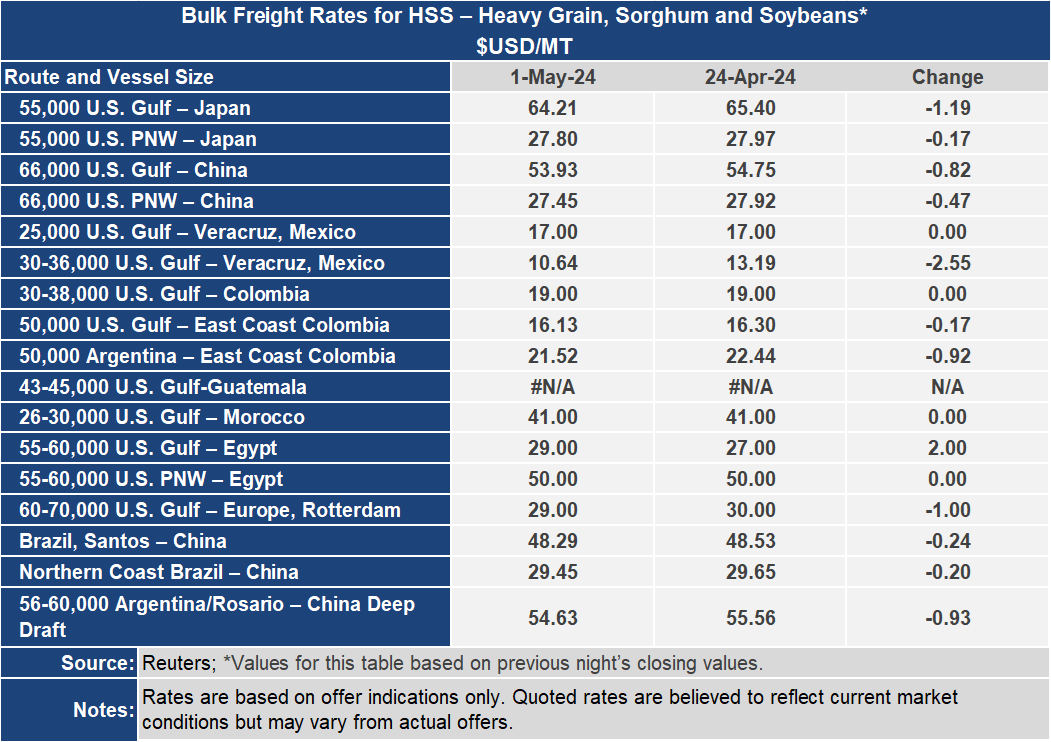

The weakness in the Panamax sector flowed over to the voyage rates. On the U.S. Gulf to Japan grain route, the freight rate ended the week losing 2% or $1.19 per metric ton to $64.21 per metric ton. The route out of the Pacific Northwest to Japan was stagnant, down six-tenths of one percent to $27.80 per metric ton. The spread between these key routes narrowed by about 3% or about $1 per metric ton to $36.41 per metric ton.