Chicago Board of Trade Market News

Outlook

Weather is the current focal point of traders with regards to price determination for corn and other grains on the CBOT. Currently, the Midsouth, much of the Midwest and Eastern Plains states are wet and getting wetter over the next 10 – 14 days. However, great variability exists in the amount of precipitation that actually falls on any specific location. A few miles can make the difference between receiving half an inch of rain from a shower to as much as 4 inches from a shower passing through. Above normal rainfall is forecast to cover most of the corn/soybean production areas over the next two weeks. There will be less tolerance by the marketplace for additional rainfall beyond May 12th if planting progress is slowed down as expected from the current wetness.

Black Sea area weather is also in the spotlight as dryness has been prevalent in that region. The EU/GFS models are in general agreement with respect to the week’s rain event in southwest Russia. A small portion of Southwest Russia may receive 0.5 to 1.5 inches of rain in the coming days, the majority of the Black Sea winter wheat belt stays arid. A major pattern change is not indicated prior to May 14th. Assuming this forecast holds for the next 10 days, April 1st to May 9th rainfall in most of the Eastern Ukraine and Southwester Russia area will see just 17-60% of normal precipitation.

The Biden Administration announced a set of rules for participation of corn-based ethanol as a feedstock for alcohol-to-jet sustainable aviation fuel (SAF) with adjustments to the GREET model for calculating the carbon intensity of SAF from ethanol and HEFA-type oils such as soybean oil, canola oil, used cooking oil and animal fats. The rules which only apply to SAF produced under the 40B tax credit which is scheduled to be replaced by the 45Z tax credits in 2025, also provide a mechanism for corn produced under specific Carbon-Smart Agriculture provisions to further reduce the carbon intensity of SAF by 10 points. This announcement will have little practical impact on corn currently in the bin and likely will have little impact on the corn market for new crop corn, but it does provide some insight into what the administration is thinking with regards to the implementation of the 45Z program which is now scheduled be in effect during 2025 through 2027.

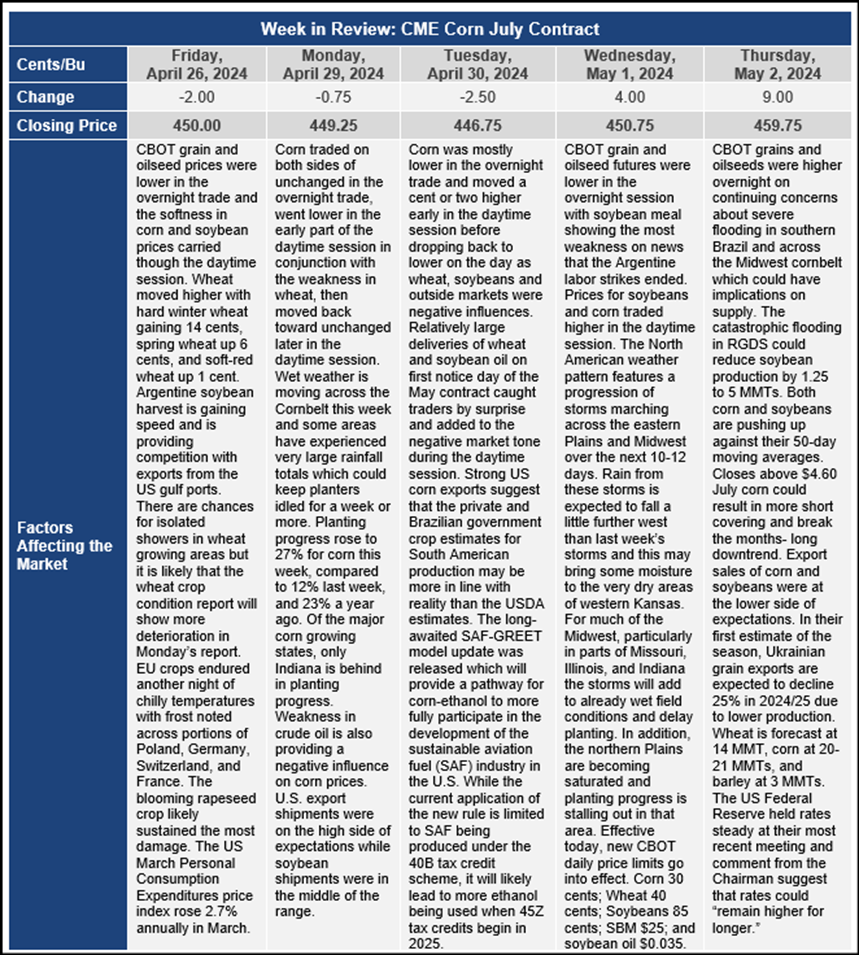

New CBOT daily price limits… Effective May 1st, the Chicago Board of Trade will reset daily price limits for grain and oilseed futures. Price limits for each product are reset twice per year – on the first trade date in May and the first trade date in November. The new limits are:

- Corn: 30 cents; 45 cents for days with expanded limits.

- SRW and HRW wheat: 40 cents; 60 cents for days with expanded limits.

- Soybeans: 85 cents; $1.30 for days with expanded limits.

- Soymeal: $25; $40 for days with expanded limits.

- Soyoil: $0.035; $0.055 for days with expanded limits.

This week, a noted market analyst lowered his Argentine corn crop estimate by 1 MMT to 49MMT citing variable yields and impacts from corn stunt disease which is showing up in even greater amounts in later-harvested field. He kept his estimate of the Brazilian corn crop at 112 MMT.