Chicago Board of Trade Market News

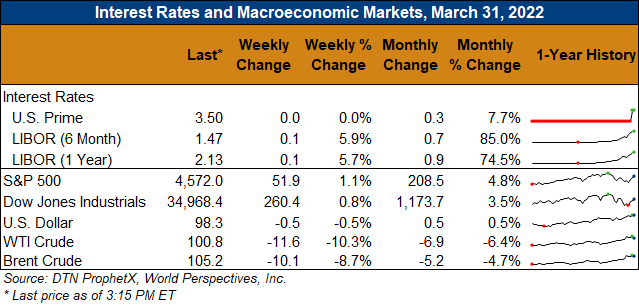

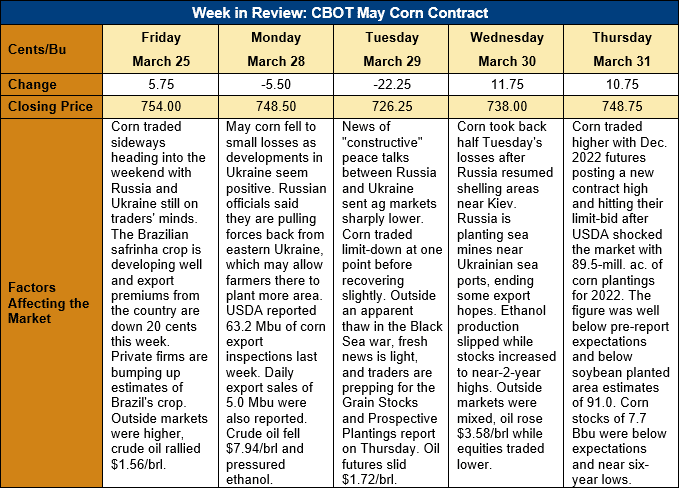

Outlook: May corn futures are 5.25 cents (0.7 percent) lower this week after early-week peace talks between Russia and Ukraine pressured the market, but USDA’s Grain Stocks report offered late-week support. Ag and energy markets remain sensitive to developments in the Russia-Ukraine war and “headline risk” persists. The corn market received strong fundamental input from this week’s USDA reports and the agency’s data will help give direction to both old and new crop markets.

USDA surprised the market with its Prospective Plantings report that showed, for just the second time since 1984, soybean acres will likely exceed those of corn in 2022. USDA estimated that U.S. farmers will seed 36.22 million hectares (89.5 million acres) to corn this year and 36.81 million hectares (90.95 million acres) to soybeans. The corn acreage estimate is down 4 percent from 2021 while the soybean planted area forecast is up 4 percent. The 0.6-million-hectare (1.46-million-acre) difference in soybean versus corn acres is the largest in history. USDA noted that corn planted area is forecast to be lower in 43 of the 48 states included in the survey. Notably, of states that are projected to see 2022 corn acres change by 20,200 hectares (50,000 acres) or more, only Colorado saw a net increase in corn acres.

Despite high prices during the past two years, U.S. sorghum area is projected to fall 15 percent to 2.51 million hectares (6.2 million acres). Of the six major producing states (Kansas, Texas, South Dakota, Nebraska, Colorado, and Oklahoma), all saw net acreage decreases from 2021.

While the Prospective Plantings report was primarily influential for new crop futures, USDA also released data relevant for old crop demand estimates, namely the quarterly Grain Stocks report. USDA estimated there were 195.6 MMT (7.7 billion bushels) of corn in storage as of 1 March, up 2 percent from the prior year. The figure was within the range of pre-report estimates but on the low end. Interestingly, on-farm corn stocks were up 1 percent from the prior year versus a 3 percent increase in off-farm stocks, which may indicate farmers are more current on marketings this year. Of note from the stocks report is the calculation that feed/residual use during the second quarter of the 2021/22 marketing year totaled 35.18 MMT (1.385 billion bushels), down 3 percent from the prior year.

Sorghum stocks as of 1 March totaled 3.48 MMT (136.9 million bushels), up 51 percent from the same period in 2021. On-farm stocks were more than double last March’s figures at 0.301 MMT (11.85 million bushels) while off-farm stocks were up 49 percent.

U.S. corn export sales fell from last week with exporters reporting 0.637 MMT of net sales (down 35 percent week-over-week). Despite a slower sales pace, weekly exports rose 26 percent to 1.882 MMT, putting YTD exports at 32.18 MMT, down 5 percent. YTD corn export bookings (exports plus unshipped sales) are down 18 percent at 53.65 MMT but account for 84.5 percent of UDSA’s current forecast with five months left in the 2021/22 marketing year. The weekly Export Sales report also featured 0.339 MMT of sorghum exports, which were up 33 percent from the prior week but put YTD bookings at 6.76 MMT, up 6 percent.

From a technical standpoint, May corn futures are drifting sideways/lower but maintained trendline support at $7.13 in the early-week selloff. Despite weakening technical conditions, funds continue to hold a large net-long position in corn and are unlikely to give this up with old crop corn exports rising. The Prospective Plantings report created bear spreading between old crop/new crop futures and that trend could continue heading into planting season. Notably, the December 2022 corn futures contract posted fresh contract highs on Thursday and reached its limit-bid at $6.91 and posted its highest settlement to date in heavy trading volume.