Ocean Freight Markets and Spreads

Ocean Freight Comments

This week’s collision of the MV Dali with the Francis Scott Key Bridge in Baltimore, MD is a major and tragic event that will impact commodity and product trade flows into and out of the United States. The greatest impact will be on coal exports since Baltimore is the second largest handler of coal leaving the United States. Coal exports could be diverted to nearby Norfolk, VA, the largest handler of coal departing the United States, or there could be coal barged down the Mississippi River System for export through the New Orleans and Mobile Customs Districts in the Center Gulf, together the third largest handlers of coal export volume. If coal exports are diverted toward the Center Gulf, barge rates could be pressured higher for increased demand of inland towboat services.

For agricultural commodities and products, Baltimore is the seventeenth largest port handling 2% of U.S. containerized agricultural exports and the tenth largest port handling 4% of U.S. agricultural imports. Of the agricultural commodities and products exported by container through Baltimore, animal feed, grocery items, dextrose, beer, poultry, soybeans, bitters, meat, dairy products, and rice starch represent about 80% of the volume. However, there will be minimal to no impact on bulk grain and soybean and agricultural products from the bridge collapse since most of those cargoes are exported through the U.S. Center Gulf and Pacific Northwest grain elevators and facilities.

The situation through the Red Sea continues with no meaningful changes taking place this week. The Houthis continue to call for a ceasefire and for Israel to pull out of Gaza. Until those conditions are met, the Houthis vow to attack vessels that have seeming solidarity with Israel. The commodity and product supply chains continue to adjust to bypass the Red Sea and the Suez Canal as a result.

Water levels in Panama’s Gatun Lake were unchanged for a second week at 80.5 feet, keeping the variable freshwater surcharge unchanged at 2.89% as of March 28. That water levels are unchanged for two consecutive weeks is good news and should be reassuring that the worst of the low water conditions are nearly done, even though the seasonal dry period across Panama extends through May. The better news is that water levels in Gatun Lake are not expected to fall as much as anticipated and by the end of May are expected to recover after falling slightly.

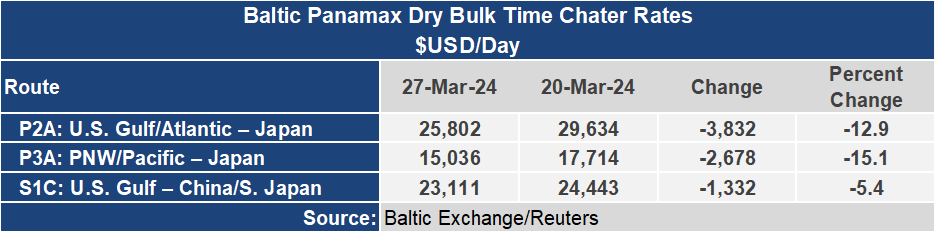

The sea-sawing action of ocean freight continues, with the Baltic Dry Index plunging 19% this week to 1,845, which is the lowest level in more than one month. The index was brought down by uncertainty in the Capesize market that ended the week down nearly 30% to an index of 2,638 while the Panamax sector was down 14% to 1,941. The Baltic Supramax Index was down slightly by 1% to 1,353. Economic uncertainty in China is trickling down to the freight markets, especially for iron ore purchases that move predominantly in Capesize and Panamax vessels.

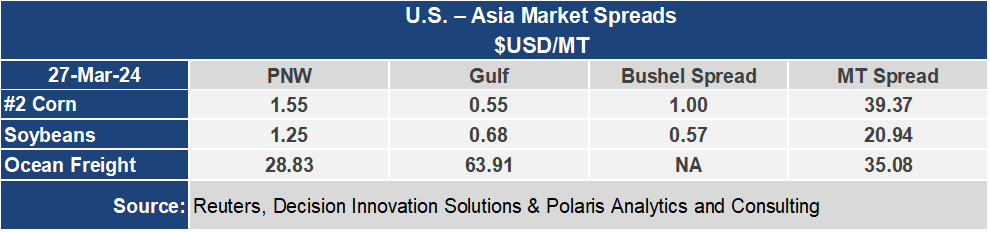

The weakness in the indices bled over to the voyage markets with freight rates for grain shipments from the U.S. Gulf to Japan down 7% or $4.86 per metric ton for the current week to $63.91 per metric ton. Out of the Pacific Northwest the rate to Japan was down 6% or $1.85 per metric ton to $28.83 per metric ton. The spread between these routes narrowed by 8% or about $3.00 per metric ton to $35.08 per metric ton.