Chicago Board of Trade Market News

Outlook

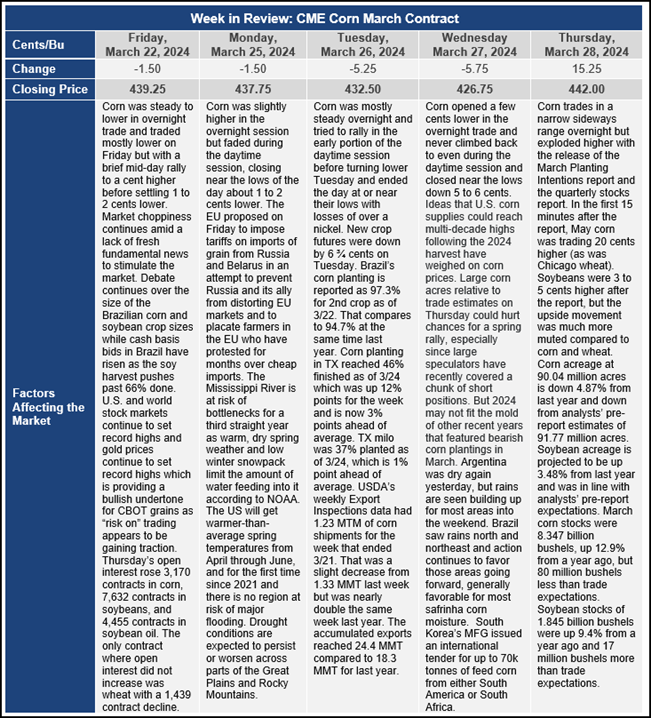

The lack of fresh fundamental market news contributed to the choppiness in the market in the early part of the week. On Thursday, the U.S. Department of Agriculture released its quarterly stocks report. March corn stocks were estimated at 8.347 billion bushels, up 12.9% from a year ago. This was 80 million bushels less than the average trade estimate for March 1 corn stocks, at 8.427 billion bushels, but still represents a five-year high. For wheat, the USDA March stocks were 1.087 billion bushels, up 16% from a year ago and 43 million bushels higher than the average trade estimate of 1.044 billion bushels and represents a 3-year high for March wheat stocks. For barley, March stocks in all positions were estimated at 112 million bushels, 20% higher than a year ago. For soybeans, USDA’s estimate of March stocks was 1.845 billion bushels, up 9.4% from a year ago and 17 million bushels higher than the trade expectations prior to the report.

The U.S. planting intentions report was also released on Thursday, March 28th. Corn planting intentions are estimated at 90. 036 million acres, down 4.87% from a year ago and below the trade’s average pre-report estimate of 91.77 million acres. Soybean planting intentions were 86.51 million acres, up 3.48% from a year ago and in line with trade expectations. For 2024, 37.8% of corn acres are expected to be east of the Mississippi River and 62.2% of corn acres are expected to be west of the Mississippi River. States east of the Mississippi River are expected to see a 5.2% drop in planted corn acres, on average with the primary states dropping 2.68% (IL) to 8.33% (OH). In total, the states east of the Mississippi River are expected to plant 1.825 million acres less corn than last year. For states west of the Mississippi River, total corn acres are expected to drop 2.78 million acres, from 58.79 million acres to 56.01 million acres. This would be a 5.73% drop in corn acreage west of the Mississippi River. The largest percentage drop in corn acres west of the Mississippi River is expected to be in Missouri (-9.09%) followed by Minnesota (-8.14%), North Dakota (-6.17%), and South Dakota (-4.76%). Iowa, the largest corn producing state, is expected to have 2.29% less corn acres in 2024. The sharp drop in prospective corn planting acres in the upper Midwest (west of the Mississippi River) was not expected by the trade. Low corn prices, and higher than expected operating costs are likely contributors to the shift to a lower-cost crop (soybeans) in this region.

Producers indicate they intend to plant 86.51 million acres to soybeans in 2024, up 2.91 million acres (3.48%) from last year. Of those farmers who plan to shift acres, 59% of respondents will increase soybean plantings. Soybean plantings are expected to broadly increase in the Corn Belt, with every state in the Midwest, except Kansas, showing an increase in soybean acres. With high cattle prices, Kansas is expected to drop corn, soybean, and wheat acreage with an increase in land devoted to cattle production.

Planting intentions for barley are 2.566 million acres, down 17% from a year ago. Major reductions are expected for the two largest barley states, Montana (-240,000 acres) and North Dakota (-220,000 acres).