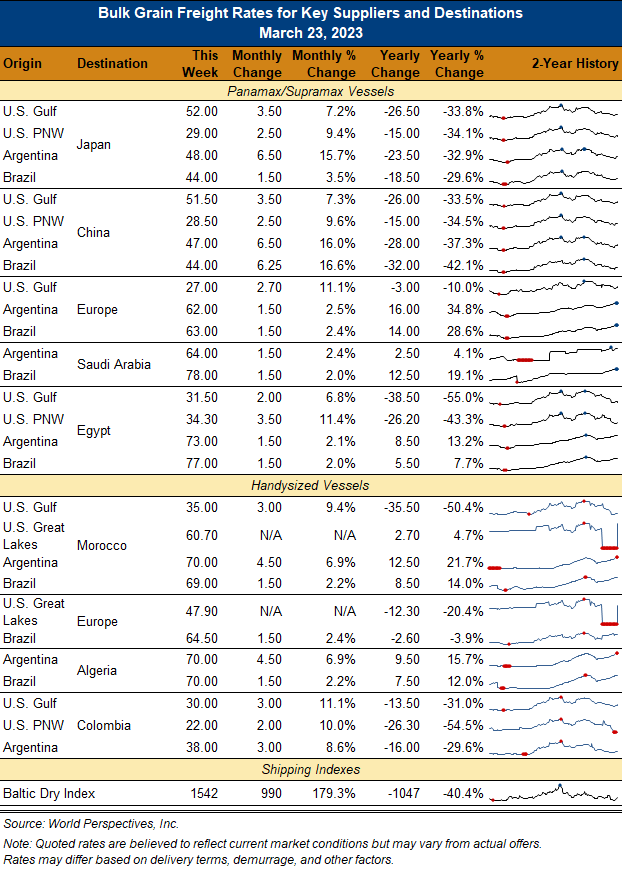

Ocean Freight Comments

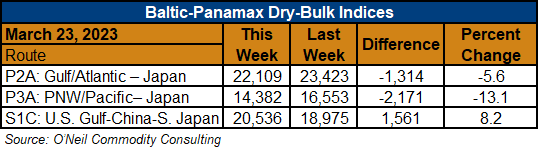

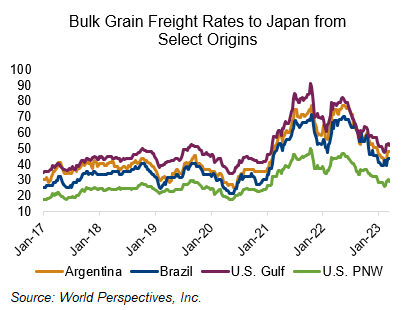

Transportation and Export Report: Jay O’Neil, O’Neil Commodity Consulting: It was another mixed week for dry-bulk freight markets, one industry writer described the market volatility as “mood swings” but I cannot disagree with that description. Vessel owners and FFA paper Traders remain optimistic and bullish but physical markets still need to see a sustained uptick in cargo demand; and that is not yet evident. Markets are now better balanced between players than they were just one month ago and will therefore continue to see up and down swings until cargo demand provides better motivation for a clear direction. China demand will continue to be the key focus. Panamax FFA paper for Q2 dipped to $15,100/day, with Q3 trading at $15,900/day.