Chicago Board of Trade Market News

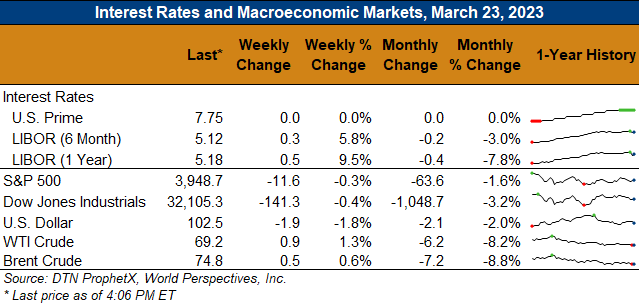

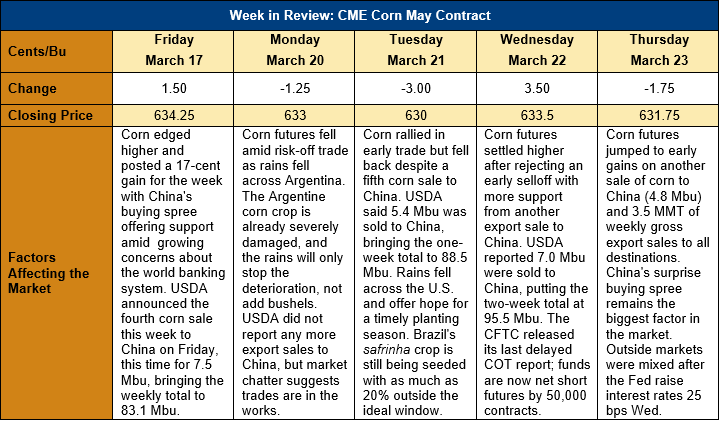

Outlook: May corn futures are 2 ½ cents (0.4 percent) lower this week as the market has remained largely range-bound despite somewhat volatile trade. Recent corn export purchases by China surprised the market and led to a firmer tone through the week. Beyond those purchases, however, fresh news has been light with Brazil’s safrinha crop still being seeded and the U.S. crop still a few away from being planted. Drought remains a major threat to the Argentine crop, but the implications of the country’s 36-MMT crop are already priced into markets. Outside of agricultural markets, ongoing concerns about the world banking industry have created additional volatility in markets across the world and influenced trade at the CBOT as well.

Over the past two weeks, China has booked 2.37 MMT (93.3 million bushels) in sales required to be reported under the daily export sales reporting program. This is the largest suite of corn purchases by China in over a year. Additionally, this week’s Export Sales report feature net sales of 3.548 MMT, with the largest buyer, China, accounting for 2.245 MMT. Corn exports last week hit a marketing year high of 1.381 MMT with the top destinations being Mexico, Japan, and China. YTD exports now total 18.586 MMT (down 39 percent) while YTD bookings (exports plus unshipped sales) total 34.941 MMT (down 34 percent). U.S. corn exports tend to increase seasonally in the spring and that trend may be accentuated this year amid the damage to the Argentine crop and the slow planning of the Brazilian safrinha crop.

As much as 20 percent of the Brazilian safrinha corn crop may have missed its ideal planting window, as early rains delayed planting progress. Now, a seemingly early end to the rainy season is allowing sowing to progress more quickly (estimates indicate and additional 10 percent was seeded this week) but is bringing concerns about a transition to a possible dry weather pattern or emerging drought. The world grain balance sheets are increasingly sensitive and dependent upon Brazil’s projected 126-MMT crop, so weather or production concerns there could spark rallies in world grain markets.

From a technical perspective, May corn remains range-bound with long-term support at the mid-March lows at $6.06 ¾ and more recently has moved into a higher range with support near $6.25. The upper end of the new trading range has yet to be fully defined but resistance emerged Thursday afternoon just below $6.45. Notably, the most recent Commitments of Traders report from the Commodity Futures Trading Commission, the publishing of which was previously delayed by a cyberattack, showed that managed money funds have fully liquidated their net long position and are now slightly short corn futures. That makes the market vulnerable to short covering on surprises and suggests funds have ample room to expand long positions should the fundamentals turn more aggressively bullish.