Ocean Freight Comments

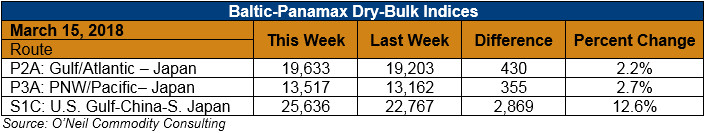

Transportation and Export Report: Jay O’Neil, O’Neil Commodity Consulting: Dry-bulk freight rates maintained their slow, gradual movement upward this week but appear to be running out of momentum at week’s end. From a rate or daily hire rate perspective, there really is no big news in global freight markets. Owners are feeling better knowing that the worst is behind them and that things ought to get gradually better. Of course, this is contingent on the continued growth in the global economy and the hope that a true trade war does not break out. The other requirement to a healthier dry-bulk market is the expectation that vessel owners do not get greedy and start another growth spurt in new vessel orders.

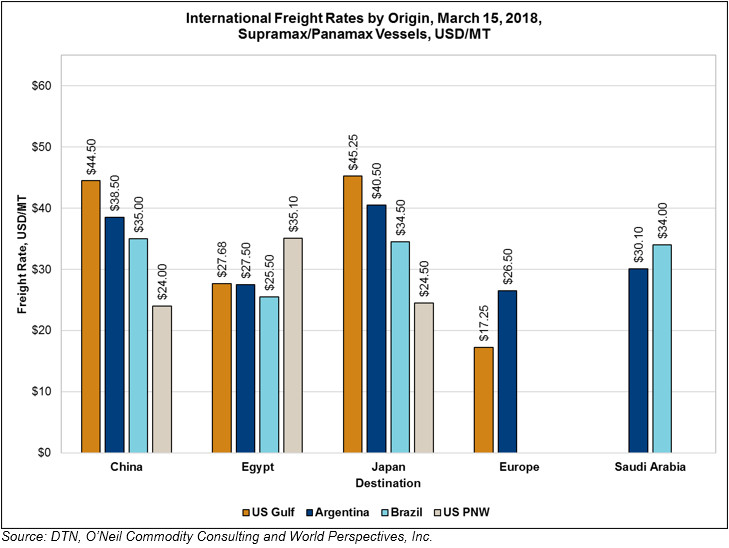

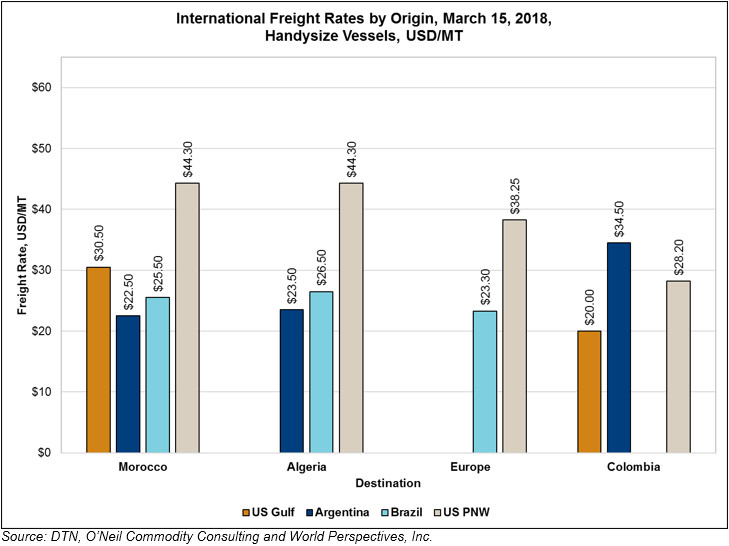

For those who buy freight, or buy commodities on a CIF basis, you will need to budget for slightly higher freight as we move into Q3 and Q4 of 2018. I am not as optimistic about the potential upward movement on containerized grain freight rates. Container shipping lines are still expanding capacity.

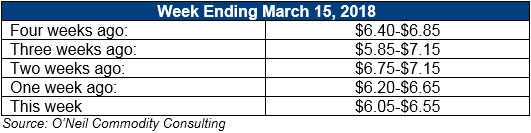

Below is a recent history of freight values for Capesize vessels of iron ore from Western Australia to South China:

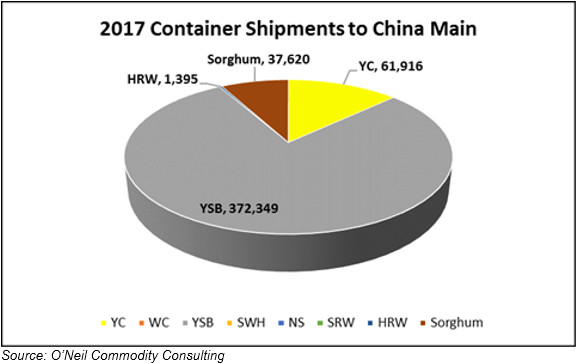

The charts below represent 2017 annual totals versus 2016 annual totals for container shipments to China.