Chicago Board of Trade Market News

Outlook: The corn market has essentially traded sideways over the past week, neither adding additional risk premium nor taking a bearish view of the fundamentals. Funds hold a sizeable long position in corn and are not relinquishing this position with global supply factors remaining bullish. Cash market values around the world are finding support, from FOB NOLA to the Black Sea, as buyers seek to mitigate some procurement risk.

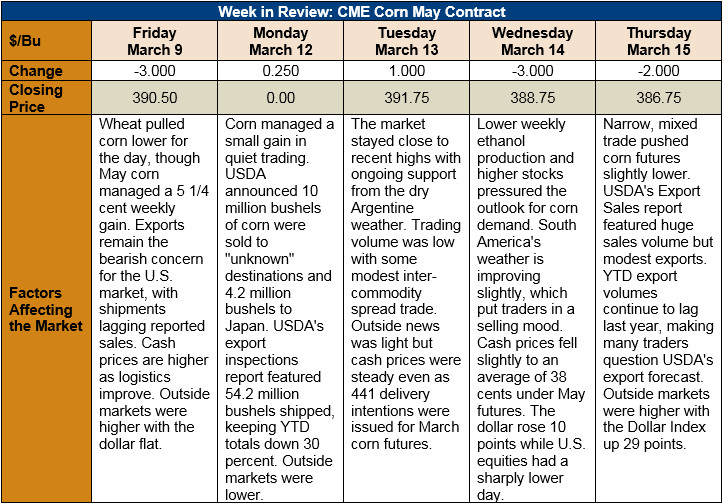

U.S. exports continue to be a bearish argument in the market’s debate. USDA’s Export Sales today featured a continuation of the recent huge sales volumes (98.6 million bushels) but small export volumes (55.4 million bushels). While both were above the values needed this week to keep pace with USDA’s projections, YTD exports are down 27 percent.

Argentina’s corn crop continues to deteriorate and, with the weather trending drier in the long-term outlook, the worst-cast scenario is becoming the most-likely scenario. The Rosario Grain Exchange in Argentina lowered its corn production forecast by 3 MMT to 32 MMT today, which is less than USDA’s projection of 36 MMT. As such, selloffs are likely to be short-lived and even higher prices are likely.

From a technical standpoint, May corn is still trending higher. The short-term trendline from mid-January to present stands to offer support at $3.83 ¼. A close below this point will likely signal the end of the early 2018 rally while continued support at the trendline will keep open the possibility of higher prices. Notably, both May and December futures contracts closed below their 10-day moving average, the first time since early February they have done so. Going forward, sideways/higher trading is expected as the Argentine drought and firmer cash prices support the bullish cause. However, slow exports from the U.S. will keep a damper on rallies.