Ocean Freight Comments

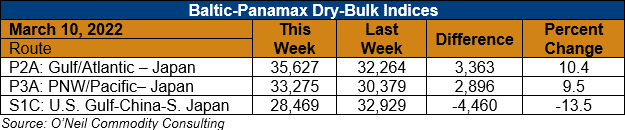

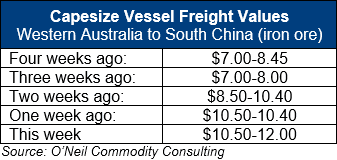

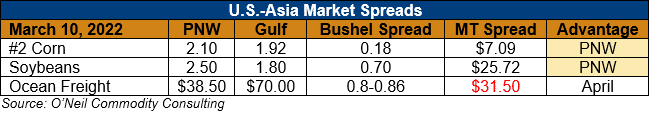

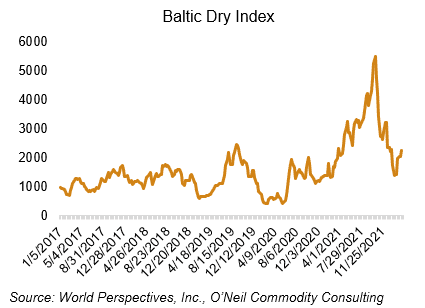

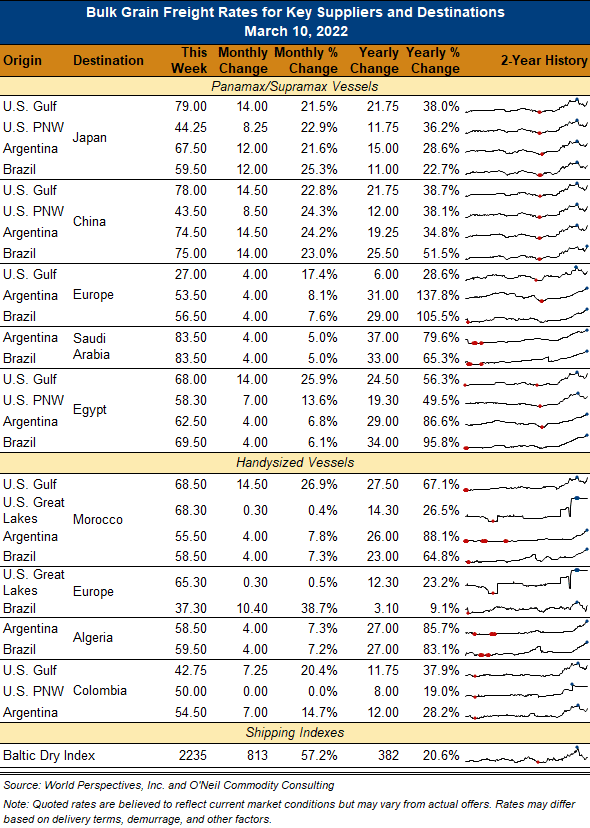

Transportation and Export Report: Jay O’Neil, O’Neil Commodity Consulting: Freight and commodity markets still have a lot to digest and resolve. War in the Black Sea region is the common, and biggest, issue driving markets. The large jump in crude oil, and therefore in fuel prices, has significantly elevated freight cost and is going to keep transportation costs relatively high for weeks and months to come. This week, dry-bulk ocean freight is acting like last week’s CBOT May wheat futures contract – going straight up in the air. It is probably moving up too much too fast for the moment?

While volatility remains, one constant is that the wild price swings are occurring at higher levels than just two months ago. The net result is simply higher values and serious challenges for buyers of commodities and freight.

On the bright side, due to increased dredging, vessel drafts in the port of New Orleans have been increased to 48-49 feet (14.6-14.9 meters). This will allow for 2,000-5,000 additional MT of grain to be loaded on outbound ships where desired.

Container markets continue to show some improvement, meaning slightly lower rates and improvements in logistics. There is still the risk of a global economic downturn.