Chicago Board of Trade Market News

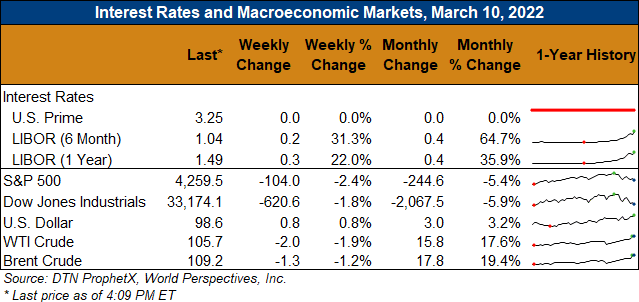

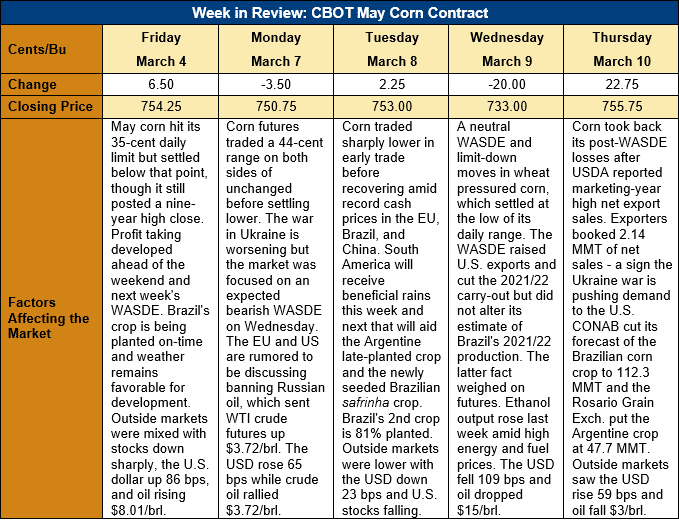

Outlook: May corn futures are 1.5 cents (0.2 percent) higher this week after the market minted a mostly sideways – if volatile – trading range. The market drifted lower heading into the WASDE as traders booked profits and prepared for what was expected to be a neutral/bearish report. The WASDE was in-line with expectations and May futures fell 20 cents. Thursday’s export sales data, which featured a marketing year high net sales number, helped corn futures recover their post-WASDE declines. Going forward, the war in Ukraine, U.S. export potential, and the Brazilian safrinha crop’s development will be the key market drivers.

The March WASDE was evidence of USDA’s careful, measured approach to updating world commodity supply and demand estimates. The agency left Brazil’s 2021/22 corn production forecast unchanged at 114 MMT as a timely planting of the safrinha crop and favorable weather forecasts offer optimism for the crop’s yield potential. USDA did cut Argentina’s corn production by 1 MMT to 53 MMT, which would still be a record crop if realized.

The USDA began the process of adjusting world corn demand and supply availability in light of the war in Ukraine. The WASDE cut Ukraine’s 2021/22 corn export forecast 6 MMT to 27.5 MMT and cut world exports by 3.7 MMT while lowering global imports 2.5 MMT. Global corn production rose 0.8 MMT as cuts to South African and Argentine production were largely offset by increases from Russia and India. World ending stocks fell 1.2 MMT to 300.9 MMT, which was in-line with pre-report expectations.

In the U.S., USDA’s adjustments to the corn balance sheet were in-line with expectations. The agency increased ethanol use of corn by 0.635 MMT (25 million bushels) and increased U.S. corn exports by 1.905 MMT (75 million bushels) in response to the loss of Ukraine’s exports. U.S. ending stocks fell 2.54 MMT (100 million bushels) to 36.578 (1.440 billion bushels), leaving a 9.6 percent ending stocks-to-use ratio. The USDA increased its season-average price for corn by $7.87/MT ($0.20/bushel) to $222.43/MT ($5.65/bushel).

The weekly Export Sales report showed a marketing-year high of 2.14 MMT of net sales, which were up 342 percent from the prior week. Exports rose 14 percent to 1.763 MMT and put YTD exports at 27.53 MMT, down 1 percent. YTD bookings currently total 50.02 MMT, down 16 percent.

From a technical standpoint, May corn futures have turned sideways with support at $7.30 and resistance at the contract high ($7.82 ¾). Corn futures have so far remained insulated from the wheat market’s dramatic rise and current fall and funds have been steady corn buyers amid the rally. May futures are technical overbought, which makes them vulnerable to a correction. Strong global fundamentals and rallies in broader grain/feedstuff markets, however, suggest pullbacks will likely be viewed as buying opportunities.