Ocean Freight Comments

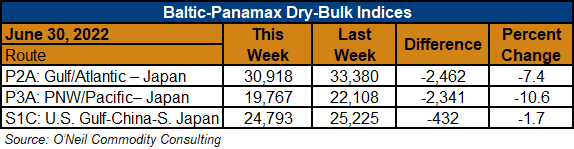

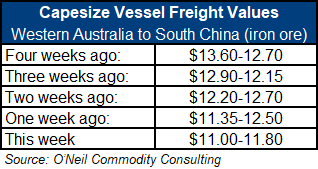

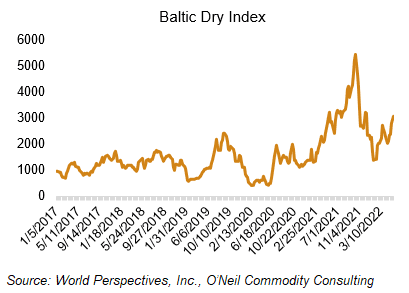

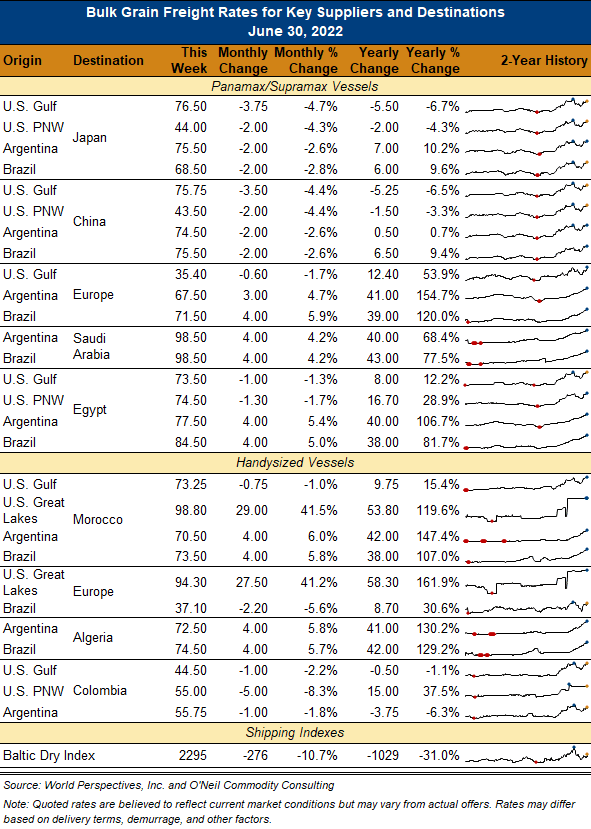

Transportation and Export Report: Jay O’Neil, O’Neil Commodity Consulting: Dry-bulk markets continued to slide for most of the week but appeared to hit a bottom and bounced up a little at the week’s end. Volatility is obviously a constant in the markets these days. It was the Capesize sector that led markets down and then rebounded slightly due to paper short covering and some newfound, price-induced cargo demand. Freight markets are pinning their future hopes on improved Chinese commodity buying and increased grain cargo needs from South America. Q3 Panamax daily hire rates ended the day at $22,250/day versus $22,575/day last week.

Spot container rates remain on the defensive as front haul rates for consumer products from Asia to the West Coast of North America dropped to $7,800 per TEU. This is down substantially from the $15,000 plus spot rates recorded earlier in the year. Contract rates, however, are higher as shipping lines have some charterers locked in for 2-3 year periods.

The U.S. West Coast ILWU labor contract expires tomorrow. Negotiations are ongoing with no sign of an agreement soon. Both sides state that a labor strike is not planned, at least not at this time.