Chicago Board of Trade Market News

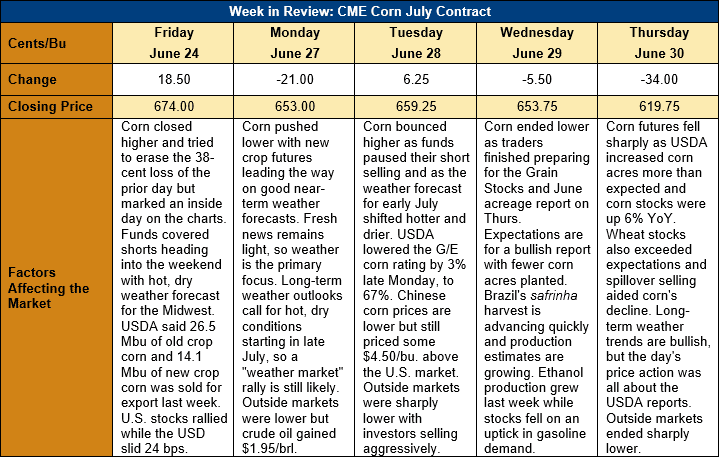

Outlook: December corn futures are down 54 ¼ cents (8.0 percent) this week as markets braced for bearish Grain Stocks and June acreage reports from the USDA and got what they expected. Despite wet weather in the northern Plains, corn plantings exceeded expectations and pressured new crop futures, as did larger than anticipated grain stocks. Long-range weather forecasts continue to predict hot, dry weather for the U.S. Midwest in late July and August, but near-term outlooks remain favorable for crop development. The latter fact is pressuring new crop futures, along with a dose of long position liquidation selling.

The June acreage report from USDA was a surprise for the markets as farmers were able to seed more of the corn crop than expected. Planted corn acres for 2022 totaled 36.41 million hectares (Mha) (89.92 million acres), which was up 0.5 percent from March and fractionally above the average pre-report estimate. Conversely, soybean acres, pegged at 35.76 Mha (88.33 million acres) were down 2.9 percent from the March forecast and 2.3 percent below pre-report expectations, giving the report a bullish interpretation for the oilseed. Finally, sorghum was planted across 2.55 Mha (6.31 million acres) in 2022, up 1.6 percent from USDA’s March estimate but down 13.7 percent from 2021.

The USDA’s June Grain Stocks report also head a strong influence on CBOT futures Thursday and sent corn and wheat prices roughly 4 percent lower. Total corn stocks reached 110.39 MMT (4.346 million bushels) on June 1, up 6 percent from the prior year. Notably, on-farm corn stocks were up 22 percent from last June as farmers have taken a more measured approach to selling this year’s crop. Soybean stocks totaled 26.44 MMT (971 million bushels), up 26 percent from last June with a 51 percent year-over-year increase in on-farm stocks. Finally, sorghum stocks totaled 3.07 MMT, up 195 percent from June 2021 due to a 72 percent increase in on-farm stocks and a 202 percent increase on off-farm stocks. The report was bearish commodity futures as the stocks figures were all on the high end of pre-report expectations.

From a technical standpoint, December corn futures posted a bearish week on the charts but are approaching major, long-term technical support. Specifically, the contract posted Thursday’s lows just 5 cents above the 200-day MA ($6.14), a point that is likely to offer significant resistance for any further downside moves. Moreover, long-term trendline support in place since September 2021 lies at $6.05, which is just above the psychologically-important support level of $6.00. The confluence of these three technical support points indicates the market will likely have a difficult time moving below them and a bounce higher or entry into a sideways trading pattern are likely. Additionally, commercial demand remains strong for corn (as evidenced by the $1.15 inverse in the July-September spread) and end-user buying is likely to increase on this break. Consequently, while recent price action has been bearish, markets are approaching a point where sideways/higher trade is more likely.