Chicago Board of Trade Market News

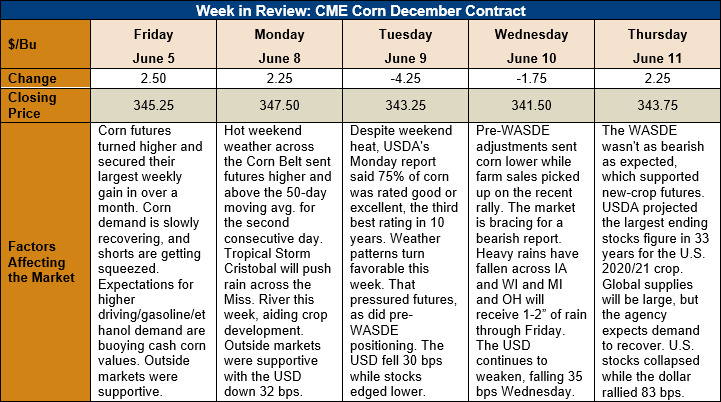

Outlook: December corn futures are 1.5 cents (0.4 percent) lower this week as funds were net sellers heading into what was expected to be a bearish June WASDE. Last week’s rally attracted old crop cash sales and 2020 hedges while commercial and international buyers did not chase prices higher. International demand remains solid, but buyers are proving patient so far. The June WASDE was not as bearish as expected but also offered little reason for funds to liquidate their large short position. The market is cautiously searching for any signs of a weather event, but favorable U.S. and global conditions so far have reduced any perceptions of supply risks.

The June WASDE was slightly bearish corn despite the fact USDA’s downward revision to 2019/20 production. The agency cut that estimate by 1.27 MMT (45 million bushels) due to a re-survey of production in North Dakota/the Upper Midwest. That, however, was offset by a nearly equal reduction on 2019 ethanol consumption. USDA forecast 2019/20 U.S. ending stocks at 53.419 MMT (2.103 billion bushels), which is slightly higher than the agency’s May estimate.

For the coming 2020/21 crop year, USDA forecast U.S. production at 406.294 MMT (15.995 billion bushels), leaving yield and planted area forecasts unchanged from the May report. USDA left its demand-side estimates unchanged as well, with the only substantial change being that ending stocks increased due to higher carry-in stocks. 2020/21 ending stocks are now forecast 0.127 MMT (5 million bushels) higher at 84.409 MMT (3.323 billion bushels). The ending stocks estimate is the largest such projection in 33 years and could grow if 2020 yields are above trendline forecasts.

The June WASDE confirmed large global corn supplies for 2020/21. World production was revised 3.2 MMT higher to 1,188 MMT. The increased production was due the large expected U.S. crop, a record-large Ukrainian corn cop (39 MMT) and large Brazilian production still forecast at 101 MMT. 2020/21 global ending stocks are forecast at 338 MMT, down 2 MMT from prior estimates but is up 25 MMT from 2019/20 ending stocks.

Beyond the U.S. corn crop, USDA lowered its estimate of 2019/20 sorghum ending stocks but left its 2020/21 projections for the crop unchanged. USDA made no adjustments to the 2020/21 U.S. barley supply/demand sheet, but increased EU production based on a larger UK crop. Barley production was also increased for Australia, but cuts were issued to the crop in Russia, Ukraine, and India.

The weekly Export Sales report featured net corn sales of 660,700 MT, which was up 4 percent from the prior week. Exports reached 1.241 MMT, down 8 percent from the prior week but above the market’s expectation. The recent shipments put YTD exports at 30.25 MMT (down 27 percent) while YTD bookings (exports plus unshipped sales) stand at 41.132 MMT (down 15 percent). The report also featured 69,700 MT of net sorghum sales and 230,300 MT of sorghum exports. YTD sorghum exports are up 143 percent as international demand has remained exceptionally strong.

The U.S. corn crop is 97 percent planted as of Monday’s USDA report, which is well above last year’s pace (78 percent by the same day) and the five-year average (94 percent). Sorghum planting is 64 percent completed while the barley crop is 97 percent planted. Seventy-five percent of the U.S. corn crop is rated in good/excellent condition, as is 55 percent of U.S. sorghum and 79 percent of barley. Corn conditions are remaining steady due to favorable weather while sorghum ratings declined from the prior week due to heat in the Southern Plains.

From a technical standpoint, December corn futures rallied to key psychological resistance at $3.50/bushel last week, pulled back, and appear poised to challenge resistance again after Thursday’s higher close. The 50-day moving average has turned into support and heavy trading volume after the WASDE’s release suggests this support will hold going forward. Funds are heavily short heading into the summer – a time when weather scares develop suddenly – and any liquidation of this position could spark a rally.