Chicago Board of Trade Market News

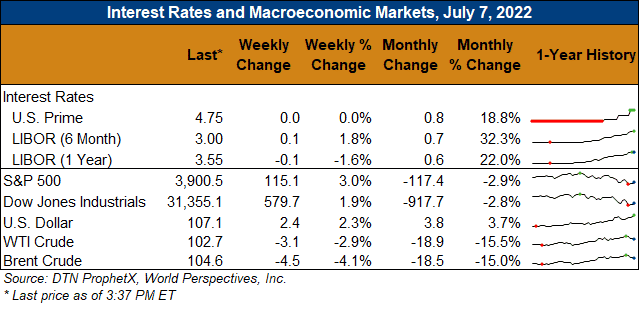

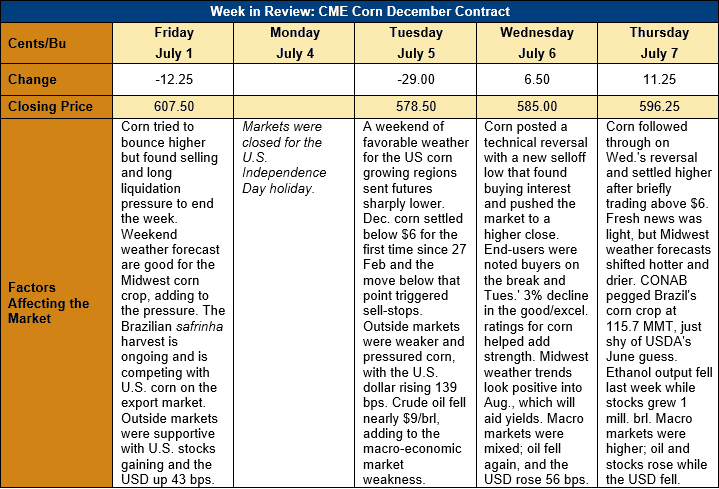

Outlook: December corn futures are down 11 ¼ cents (1.9 percent) this week as fund selling and long liquidation continued following last week’s Grain Stocks and June acreage reports. While the reports may not have been as bearish as the futures market’s reaction, weak outside markets and steady liquidation trade kept prices on the defensive. Moreover, favorable Midwest weather forecasts boosted 2022 yield expectations despite a 3 percent decrease in the corn crop’s good/excellent rating. Futures traders are also preparing for next week’s July WASDE report, to be released on Tuesday, with the grain stocks and acreage data shifting the market’s mindset to a more amply supply scenario.

Analysts are generally expecting USDA to keep the 2022 corn yield unchanged or slightly above the June estimate of 11.116 MT/ha (177 bushels/acre). Combined with the June acreage data (36.382 million hectares or 89.9 million acres), analysts are looking for a 2022 U.S. corn crop of 368.827 MMT (14.52 billion bushels), up from the June forecast but below 2021 levels. The higher production is expected to bolster U.S. ending stocks, with the average pre-report estimate indicating a 37.873-MMT (1.491 billion bushel) carry-out for 2022/23.

The U.S. corn crop is developing under generally favorable weather conditions across the Midwest, with forecasts for late-July and early-August switching to favor more precipitation than predicted earlier this year. That will aid the crop’s pollination and kernel fill potential as this year’s later planting means the late-July weather will have greater-than-normal importance for yields. So far, 7 percent of the crop is silking, down from the 5-year average of 11 percent.

From a technical standpoint, December corn futures posted a bearish week on the charts but likely forged a near-term low on Wednesday. Wednesday’s trade took futures to a new selloff low ($5.66 ½) but the market rallied through the afternoon and settled higher to form a bullish reversal on the charts. Thursday’s trade saw some follow through buying and short covering that carried the market above the $6.00 level again. There is a growing sense that new crop corn futures are technically oversold (as also indicated by the Relative Strength Index at 25.6) and undervalued below $6.00/bushel, which could create additional support heading into next week’s WASDE report.