Country News

Argentina: The Buenos Aires Grain Exchange reports the corn harvest at 94 percent complete and the FAS attache believes output will be lower than previously expected. (AgriCensus)

Brazil: Celeres forecasts the coming season’s corn production at 111.5 MMT, with planted area at 19.4 million hectares. Datagro believes the 2020/21 corn crop could hit 112.13 MMT, up 8 percent from last year. USDA pegs Brazil’s 2020/21 corn production at 107 MMT and the crop year begins 1 September. Arc Mercosul forecasts the safrinha corn crop at 55 percent harvested versus 71 percent a year ago. Basis is pushing higher as farmers dry down the crop and withhold selling. This prompted the Associação Nacional dos Exportadores de Cereais (ANEC) to lower its estimate of July 2020 corn exports to 5.4 MMT from the previous estimate of 5.65 MMT. (Reuters; AgriCensus)

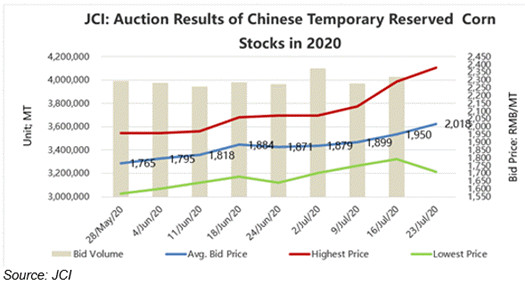

China: This may be the first year ever that the import quota for corn will be fully utilized. According to Chinese customs data, corn imports in June were 881.6 KMT and totaled 3.66 MMT from January to June, or 51 percent of the annual quota set at 7.2 MMT. Third grade corn offered by industrial processing enterprises in Shandong has reached more than RMB2,300/MT ($328.45). Dalian corn futures are at a record high, hitting RMB 2,346/MT ($335.29) before paring back some gains. Open interest for the grain hit its highest level in over three years.

China further tightened the bidding rules with the pre-bid deposits now at $134/MT and individual bidders limited in how much they can buy. Still the ninth auction of government corn reserves was fully bid (3.945 MMT) and hit a new high average price of RMB 2,018/MT ($288.18); the highest bid was up RMB90 from a week earlier. The tenth auction also sold out but at lower prices for longer stored corn. The 2014 corn sold for RMB 1,874/MT ($267.38) and the 2015 corn sold for RMB 2,040/MT ($291.06). At this pace, China’s reserve corn will be depleted in just over a month.

Compounding the situation are grain transport bottlenecks caused by Yangtze River flooding concurrent with production concerns due to overly dry conditions in the main growing region of Northeast China. Corn has hit the key tasseling/pollination period and could be adversely impacted by the heat and drought. (Reuters; AgriCensus; JCI)

EU: The Monitoring Agricultural ResourceS (MARS) report for July says improved weather increased its spring barley output forecast by 6.4 percent, winter barley production by 1.1 percent, and corn crop total by 0.1 percent. FranceAgriMer cut its corn crop rating to 81 percent good/excellent versus 82 percent a week earlier and above a year ago at 67 percent. The Agriculture and Horticulture Development Board says the UK winter barley yield is almost 1 MT/ha below average. (EU JRC; FranceAgriMer; AHDB)

Mexico: Grupo Consultor de Mercados Agricolus reports that first-half 2020 corn imports were up 5 percent year-on-year. Total corn imports were 7.73 MMT corn in FH 2020, up 4.9 percent compared with the same period in 2019. (GCMA)

South Africa: The government’s Crop Estimates Committee forecasts 2019/2020 maize production at 15.545 MMT, up 38 percent from the 11.275 MMT harvested in the 2018/2019 season. This exceeded the amount predicted in a survey of six analysts by Reuters. (Reuters; CEC; AgriCensus; Refinitiv)

Tunisia: The government tendered for 100 KMT of barley for Aug-Oct delivery. (AgriCensus)

Ukraine: According to APK-Inform, 785,300 tons of corn were exported to China in June, accounting for 51 percent of the total exported that month. Overall exports in June were down, with corn exports off by 37 percent month on month, barley exports were also down 37 percent with Saudi Arabia the main buyer.